Global Market and Economic Perspective

Global Economic Commentary

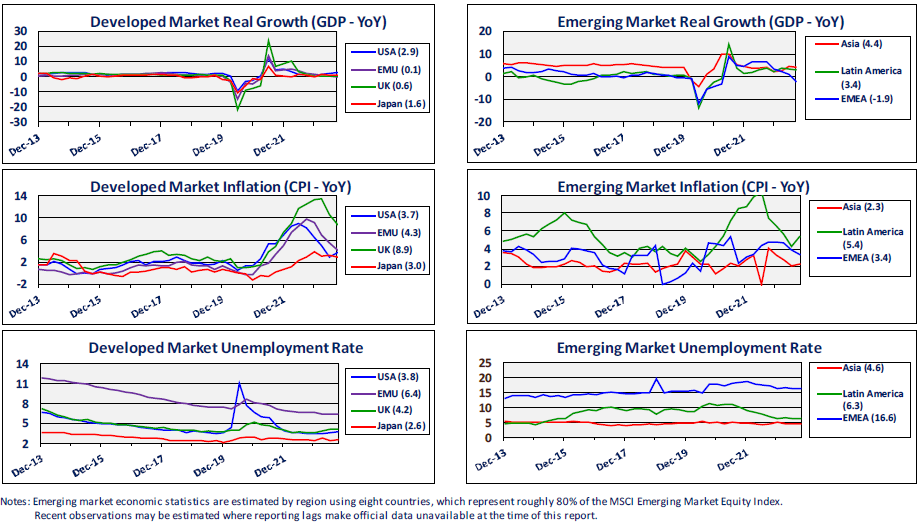

- Third-quarter economic conditions differed substantially across the world. In the US, real GDP growth was strong, as consumers and government continued to spend. On the business side, investment spending was also very good, but much of the gain came from additions to inventories. This is not likely to be sustained in the final quarter of 2023. The housing market remained bifurcated, with robust new home sales but very weak turnover of existing homes. Homeowners with low-rate mortgages are reluctant to sell and move, taking on a new mortgage with a substantially higher interest rate.

- Eurozone GDP was essentially flat in the third quarter, as decent growth in 2022 has weakened throughout 2023. The region continues to suffer from the effects of elevated energy prices caused by Russia’s ongoing war in Ukraine. In addition to its expensive energy, Germany has seen weak demand from China, as that country’s economy remains soft due to the ongoing real estate troubles and a pullback by foreign investors over a riskier political environment.

- Inflation in most countries has been on a downtrend, as central banks responded to 40-year high inflation by aggressively raising interest rates. In the US, the consumer price index ticked up in the third quarter. Core inflation, which is well above the Fed’s 2% target, remains problematic as both housing and non-housing services prices show little sign of easing.

Stairway Partners is an SEC-registered Investment Advisor providing comprehensive investment advice and industry-leading portfolio management solutions. Our firm was created to provide institutions and individual investors with transparent and cost-effective stewardship of their assets. Our sophisticated investment capabilities and a steadfast commitment to the industry’s best practices have allowed us to serve as a valued advisor and trusted fiduciary to clients throughout the United States. For more information, please call (630) 371-2626 or email us at stairwaypartners@stairwaypartners.com.

Global Equity and Currency Commentary

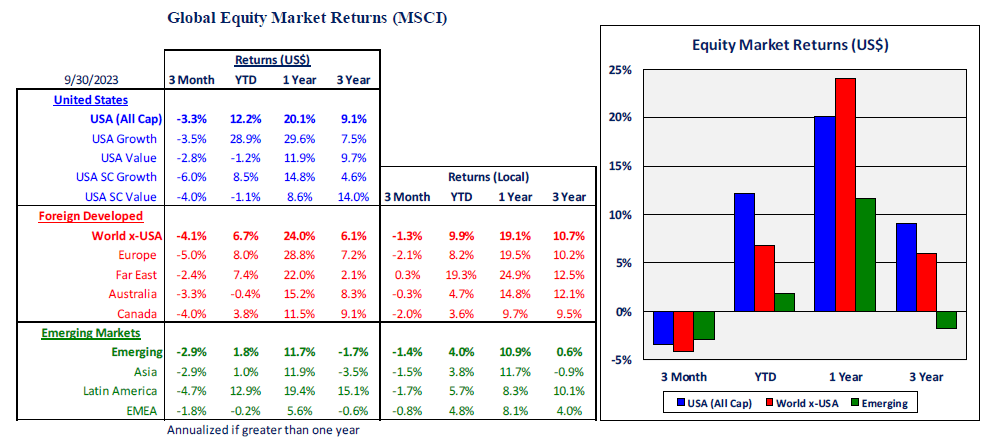

- After the first six months of 2023 when equity returns in most markets were largely positive, the third quarter produced losses. Higher interest rates led to an increase in investors’ discount rates and to profit pressures as some companies had to borrow at much higher rates to replace maturing low-cost debt.

- Profit trends were flat to down in many markets. In the US, per share operating earnings in 2023 have been coming in well below the high levels of 2022. Profits in emerging markets companies have also been declining during the year. The picture was marginally better recently in the Eurozone, where earnings exhibited a modest upward trend after many years of stagnation.

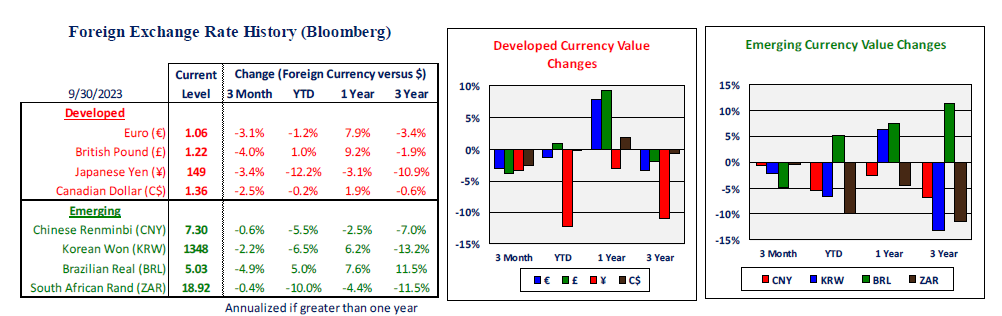

- A stronger US dollar hurt returns in non-US equities. In local currency terms, non-US market returns – both developed and emerging – were better than returns in US equities, although they were still negative by a small amount. Including the negative currency effects, US and non-US equities performed similarly.

- Some of the dollar strength can be attributed to the more aggressive interest rate increases from the Federal Reserve. Other central banks have been more cautious and refrained from hiking their rates as high. The higher yields on US fixed income investments make them more attractive and tend to draw capital inflows, which increases demand for dollars.

US Fixed Income and Fed Commentary

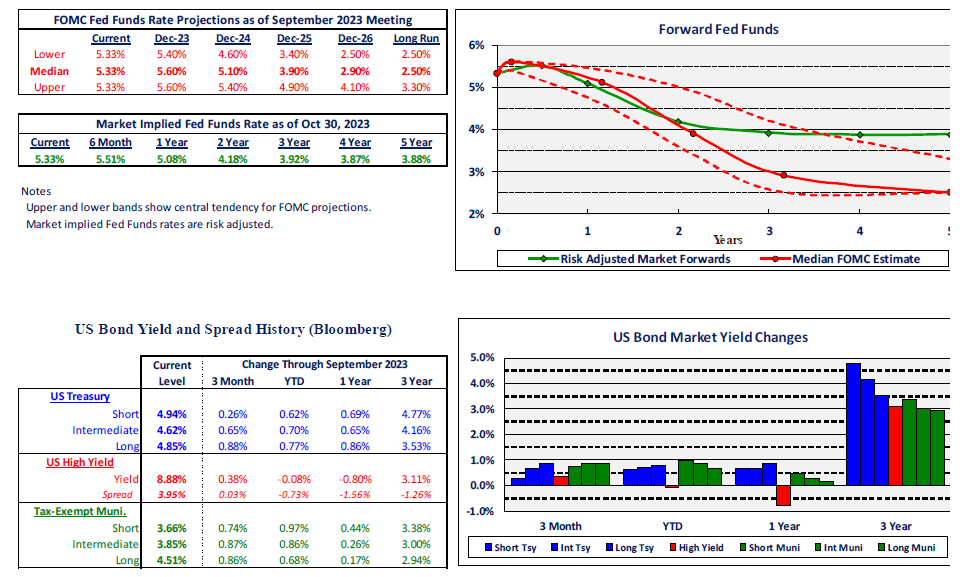

- Bond yields rose sharply during the third quarter, with corresponding capital losses in bond prices. This contrasted with the bond market in the first six months of the year, when intermediate and long-term bond yields remained generally stable and fixed income returns were relatively good.

- The Q3 rise in yields for the credit sectors was almost entirely the result of the increased Treasury curve, as spreads were largely unchanged. Interestingly, credit spreads – even in high yield – were stable despite negative returns in equities and the prospect of pressure on profits in upcoming quarters as companies look to refinance low-rate debt at much higher interest rates.

- In July, the Federal Reserve’s monetary policy body (FOMC) raised the Fed funds rate another 25 basis points to a range of 5.25%-5.50%. However, at the second meeting of the quarter in September, the FOMC decided to pause their rate hiking effort, leaving the policy range unchanged.

- The market’s expectations of Fed policy have changed dramatically over the past year. The long-run Fed funds rate implied by the market was just over 1% at the beginning of 2022, just before the FOMC began raising rates in March of that year. Now that the Fed funds rate has been increased by over 5%, the market expectation for the long-run rate has risen to nearly 4%. The Fed’s longer-term forecast has remained 2.5% since the middle of 2019.

Stairway Partners, LLC © 2023

This material is based upon information that we believe to be reliable, but no representation is being made that it is accurate or complete, and it should not be relied upon as such. This material is based upon our assumptions, opinions and estimates as of the date the material was prepared. Changes to assumptions, opinions and estimates are subject to change without notice. Past performance is not indicative of future results, and no representation is being made that any returns indicated will be achieved. This material has been prepared for information purposes and does not constitute investment advice. This material does not take into account particular investment objectives or financial situations. Strategies and financial instruments described in this material may not be suitable for all investors. Readers should not act upon the information without seeking professional advice. This material is not a recommendation or an offer or solicitation for the purchase or sale of any security or other financial instrument.

You must be logged in to post a comment.