Global Market and Economic Perspective

Global Economic Commentary

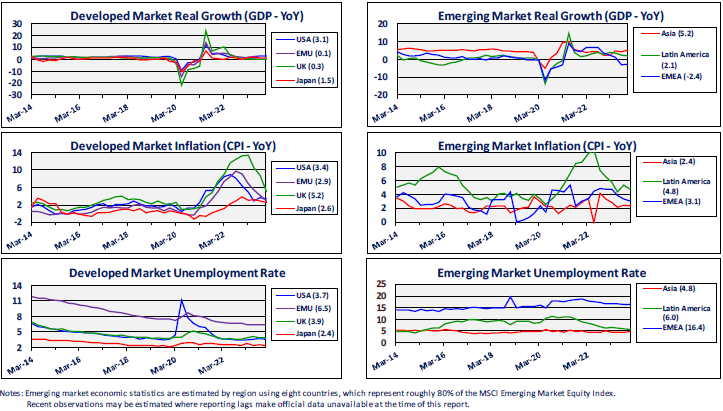

- In the fourth quarter, US economic growth strengthened further from a moderate third-quarter rate as a result of solid consumer spending and continued growth in government spending. The quickening growth throughout 2023 stood in stark contrast to consensus expectations at the beginning of the year. Most analysts and market participants expected the US to tip into recession in 2023, as growth had slowed during 2022 and the Fed was continuing to hike interest rates. The strong economy kept joblessness low, with the unemployment rate remaining fairly stable around 3.7% during the quarter.

- The US picture was nearly unique. Real GDP growth in both the Eurozone and UK economies was barely positive in the fourth quarter. Germany experienced a minor contraction, which followed essentially zero growth in the third quarter. The outlook in Germany, a main driver of the EU economy, remained poor, with the Ifo survey of sentiment pointing toward further weakness. Much of Europe continued to suffer from high energy costs and anemic export demand from China. This lack of economic vigor in Europe and the UK did result in sharper declines in consumer price inflation than in the US.

- As in Europe, the last quarter of 2023 did not provide a respite for China’s economy. Factory activity, as measured by the PMI (Purchasing Managers Index), declined for three straight months. In addition, the authorities in Beijing failed to take strong action to stem the problems in the real estate sector.

Stairway Partners is an SEC-registered Investment Advisor providing comprehensive investment advice and industry-leading portfolio management solutions. Our firm was created to provide institutions and individual investors with transparent and cost-effective stewardship of their assets. Our sophisticated investment capabilities and a steadfast commitment to the industry’s best practices have allowed us to serve as a valued advisor and trusted fiduciary to clients throughout the United States. For more information, please call (630) 371-2626 or email us at stairwaypartners@stairwaypartners.com.

Global Equity and Currency Commentary

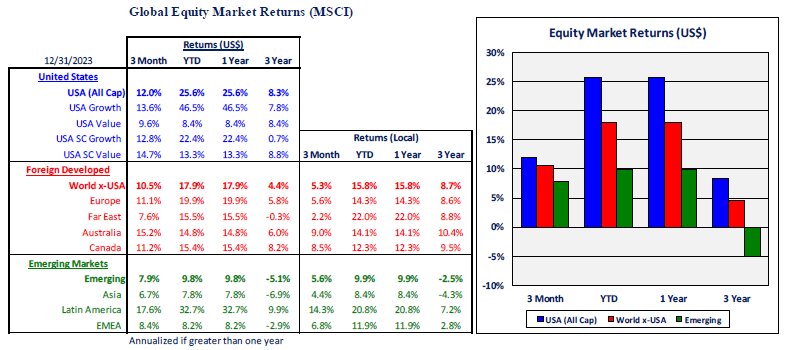

- The large-cap growth sector of the US equity market continued to produce outstanding returns in the fourth quarter, adding to strong returns in the first three quarters of 2023. Some of this can be attributed to the “Magnificent Seven” names – Alphabet (Google), Amazon, Apple, Meta, Microsoft, NVIDIA, and Tesla – that benefitted from investor enthusiasm for artificial intelligence-related stocks. But, unlike earlier in the year, stocks other than the Seven also contributed to market gains.

- Given expectations of recession at the start of the year, unexpectedly strong economic growth in 2023 helped keep the earnings outlook positive.

- Interestingly, small cap value stocks also performed well during the quarter, after having gone essentially nowhere for the first three quarters. The decline in interest rates during Q4 provided some relief to value-oriented companies that tend to be more highly leveraged.

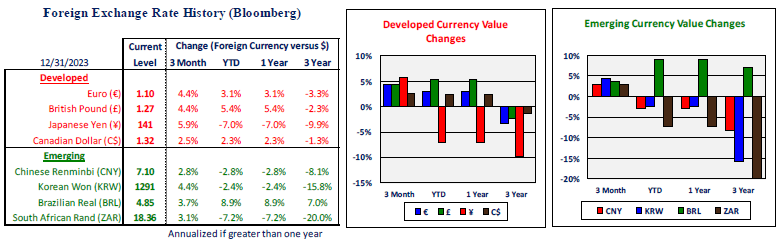

- Equity market returns outside the US – both in emerging and developed markets – mostly lagged the US market’s performance. In local currencies, developed and emerging market indexes for the quarter produced returns of 5%-6%. However, when translated into US dollars, foreign equity returns were boosted by dollar weakness that resulted in gains of 8%-11% for US investors. The decline in the value of the dollar reversed the impact of dollar strength that we saw in the first three quarters.

US Fixed Income and Fed Commentary

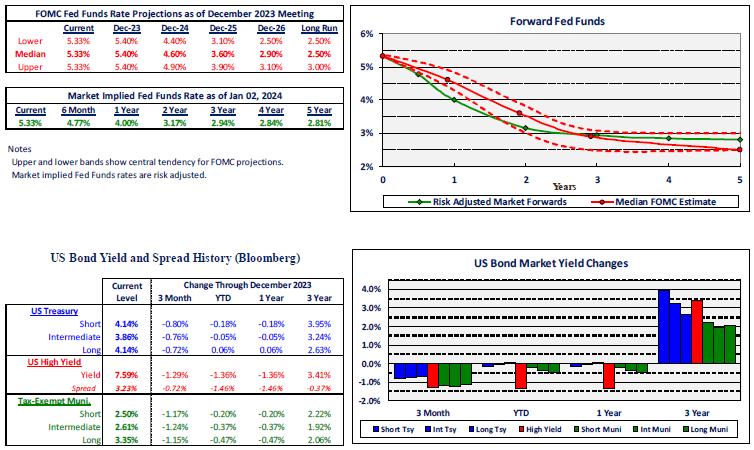

- After three quarters in which the Federal Reserve raised the policy Fed Funds interest rate, the Fed paused in the fourth quarter and left the policy range unchanged at 5.25%-5.50% at both the November and December meetings. The FOMC modified their message slightly toward a wait-and-see attitude, stating that inflation “has eased…but remains elevated” relative to their 2% target.

- The bond market responded dramatically to the change in stance, with investors suddenly assuming that the Fed would be cutting interest rates in 2024 much earlier and by more than the Fed had indicated. The yield on the 10-year Treasury, which had started the fourth quarter at 4.6% and peaked in mid-October just slightly below 5.0%, plummeted to a low of around 3.8% in late December. The 10-year finished the year slightly higher, at around 3.9%.

- Given strong economic growth and sharply falling interest rates in the fourth quarter, bond returns were significantly positive. The magnitude of the price gains meant that returns in investment-grade bonds for the full year were positive rather than close to zero or negative.

- In credit sectors, the decline in the underlying Treasury yield curve was augmented by narrowing of credit spreads. The combination of a stronger equity market and easing of refinancing pressure led to yields on investment grade and high yield corporate bonds falling even more sharply than Treasury yields did.

Stairway Partners, LLC © 2023

This material is based upon information that we believe to be reliable, but no representation is being made that it is accurate or complete, and it should not be relied upon as such. This material is based upon our assumptions, opinions and estimates as of the date the material was prepared. Changes to assumptions, opinions and estimates are subject to change without notice. Past performance is not indicative of future results, and no representation is being made that any returns indicated will be achieved. This material has been prepared for information purposes and does not constitute investment advice. This material does not take into account particular investment objectives or financial situations. Strategies and financial instruments described in this material may not be suitable for all investors. Readers should not act upon the information without seeking professional advice. This material is not a recommendation or an offer or solicitation for the purchase or sale of any security or other financial instrument.

You must be logged in to post a comment.