Global Market and Economic Perspective

Global Economic Commentary

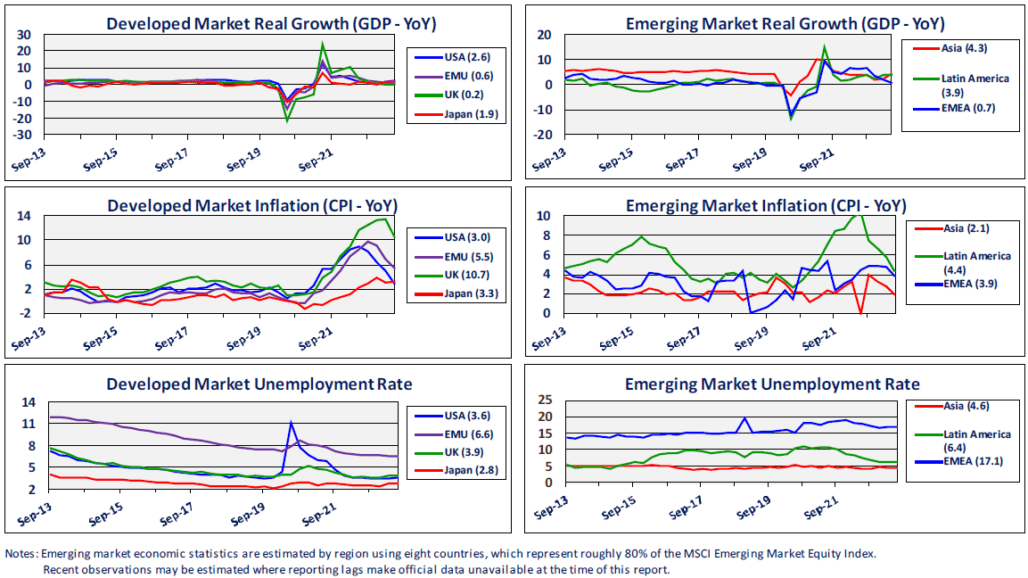

- After a narrowly averted banking crisis at the end of the first quarter this year, there was considerable uncertainty over the direction that the US economy would take in the second quarter. Rather than being pushed into a recession by financial problems, the economy strengthened, with real GDP growing more rapidly than it had in more than a year. Although household consumption softened a bit, higher levels of fixed investment spending buoyed GDP. Unemployment remained low despite continued strength in labor compensation gains, which would typically lead to restrained hiring.

- Outside the US the economic picture was not as rosy. In Europe, growth remained more subdued, although lower energy and food prices helped support spending. China’s output continued to grow, but was not strong enough to alleviate some of the more persistent economic problems. Specifically, unemployment for young people remains high, in part due to the inability of university graduates to find lucrative jobs in the tech and financial sectors. Chinese property and home sales have also been weak, which has put pressure on real estate developers and local governments.

- In many countries, consumer price inflation, which had reached four-decade highs last year, continued to moderate. The US CPI fell from 9% last summer to 3% at the end of the second quarter. The Eurozone saw its CPI inflation rate halve, from a peak of nearly 11%. Unfortunately, many countries have not experienced similar declines in their core (ex-food and energy) inflation rates, as services prices remain elevated due to labor costs that have not moderated.

Stairway Partners is an SEC-registered Investment Advisor providing comprehensive investment advice and industry-leading portfolio management solutions. Our firm was created to provide institutions and individual investors with transparent and cost-effective stewardship of their assets. Our sophisticated investment capabilities and a steadfast commitment to the industry’s best practices have allowed us to serve as a valued advisor and trusted fiduciary to clients throughout the United States. For more information, please call (630) 371-2626 or email us at stairwaypartners@stairwaypartners.com.

Global Equity and Currency Commentary

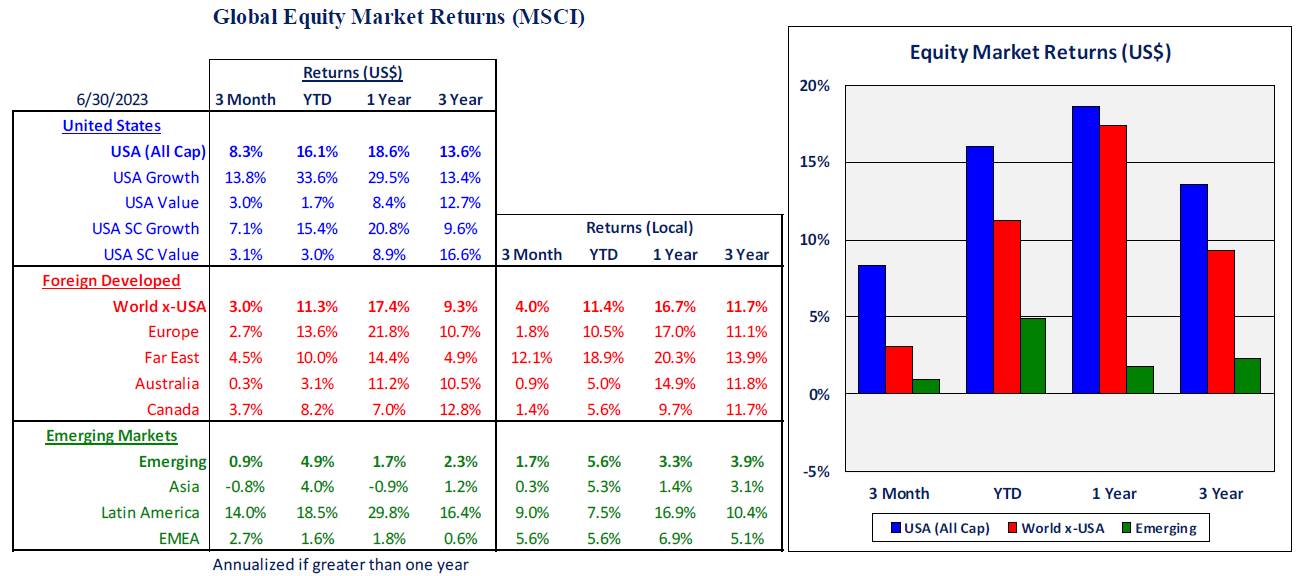

- US equities had a strong second quarter, returning over 8%. Much of the performance can be attributed to the continued outperformance of growth stocks, particularly the large-cap tech companies that shined in the first quarter. However, this should be taken with a grain of salt, as the price gains were largely a result of rising valuations (e.g. rising P/E ratios) rather than improvements in fundamentals, such as earnings or dividend payouts.

- Non-US equity markets had weaker second quarter performance. In developed markets, year-to-date performance has been very good, as low single-digit returns built on a strong first quarter. Developed markets in the Asia/Far East region performed best. This was perhaps attributable to investor interest shifting away from Chinese equities, which suffered from the country’s ongoing economic and financial problems. Performance in another emerging equity market, South Africa, was hurt by that country’s poor governance and increasingly chaotic public order, most clearly seen in its electricity company’s inability to keep the power on consistently.

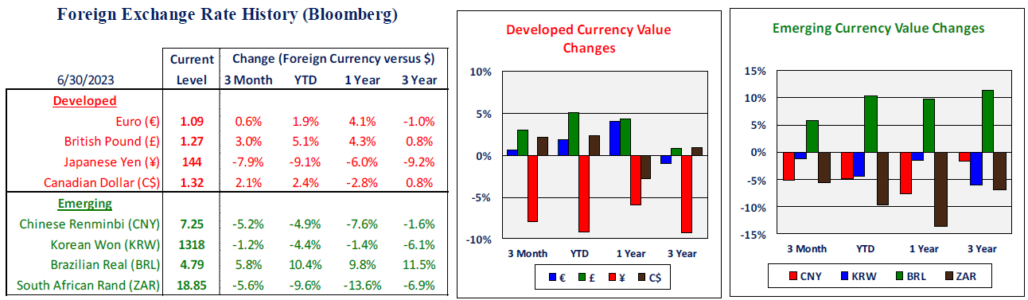

- US dollar strength was a small detractor from non-US equity returns for US-based investors. The Federal Reserve has been more aggressive in raising interest rates than have most other central banks, making dollar-denominated bonds relatively more attractive than foreign fixed income yields.

US Fixed Income and Fed Commentary

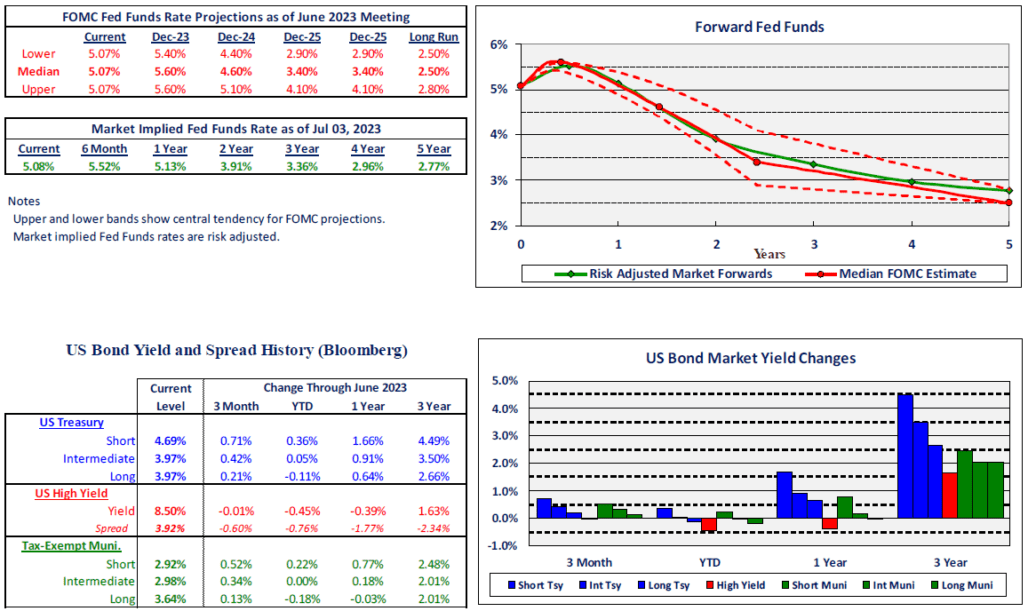

- After hiking interest rates in each of its first two meetings in the first quarter of 2023, the Federal Reserve (FOMC) only raised its policy rate in the first meeting of the second quarter on May 2. That 25 bps increase took the rate to a range of 5.00%-5.25%. At its second meeting, on June 14, the Fed took no action, a “pause” that was widely anticipated. In its statement, the FOMC highlighted the decline in inflation over the last year, but also expressed continued concern over the stickiness of core inflation and the tight labor market.

- Subsequent to the end of June, the FOMC raised rates again by 25 bps at its July 26 meeting. This move was also widely expected, although the uncertainty over future rate hikes appears to have increased. Higher interest rates have had a substantial impact on the housing market, as homeowners with low mortgage rates are largely unwilling to sell, and house prices not yet declining sufficiently to reflect the reduced affordability at new, doubled mortgage rates.

- As short-term interest rates were being moved higher during the quarter, yields rose on default-free Treasuries at all maturities. The increasing interest rates led to declining prices for investment-grade bonds, which meant a modest negative return for the broad investment-grade index for the year’s second quarter. However, the negative return was not large enough to offset the first quarter gain.

- Yields on emerging markets fixed income and high-yield bonds were either stable or increased only slightly. As a result of tightening spreads vs. Treasuries, these sectors produced relatively good positive returns for the quarter.

Stairway Partners, LLC © 2023

This material is based upon information that we believe to be reliable, but no representation is being made that it is accurate or complete, and it should not be relied upon as such. This material is based upon our assumptions, opinions and estimates as of the date the material was prepared. Changes to assumptions, opinions and estimates are subject to change without notice. Past performance is not indicative of future results, and no representation is being made that any returns indicated will be achieved. This material has been prepared for information purposes and does not constitute investment advice. This material does not take into account particular investment objectives or financial situations. Strategies and financial instruments described in this material may not be suitable for all investors. Readers should not act upon the information without seeking professional advice. This material is not a recommendation or an offer or solicitation for the purchase or sale of any security or other financial instrument.

You must be logged in to post a comment.