Global Market and Economic Perspective

Global Economic Commentary

- The biggest news during the first quarter of 2023 revolved around the failures of two banks: Silicon Valley and Signature. Losses on longer-term bonds due to higher interest rates, coupled with substantial deposits in excess of the FDIC-insured limit, led to a classic bank run. As depositors fled, these banks needed to generate liquid funds to make payments, but their assets were insufficient to satisfy the withdrawals. The Fed, FDIC, and Treasury stepped in to make all depositors whole, regardless of the amount of their uninsured deposits.

- In addition, several other regional banks came under pressure due to problems in their commercial real estate lending. The was a result of a combination of low occupancy from “work from home” and building owners’ needing to refinance mortgages at higher interest rates.

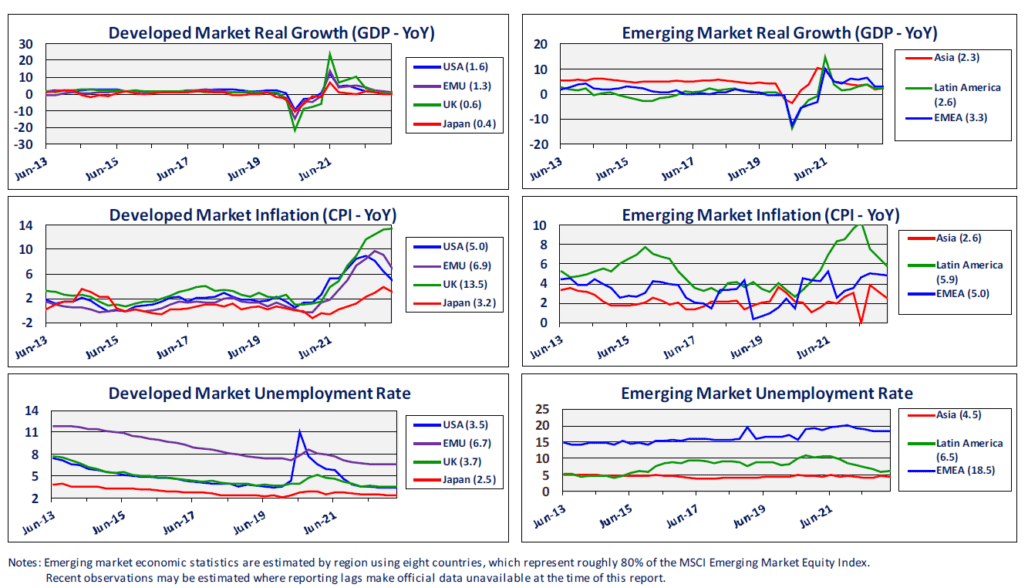

- Real GDP growth in the US slowed from its 2022 pace, with annualized growth well under 2.0%. Although retail spending declined in February and March, the consumption component of GDP remained strong, due to resilient spending on durable goods and on services. Investment spending was weak, with declines in residential investment and equipment purchases.

- Growth elsewhere was a mixed picture, with GDP barely growing in the Eurozone, but China experiencing a rebound in excess of 4%.

Stairway Partners is an SEC-registered Investment Advisor providing comprehensive investment advice and industry-leading portfolio management solutions. Our firm was created to provide institutions and individual investors with transparent and cost-effective stewardship of their assets. Our sophisticated investment capabilities and a steadfast commitment to the industry’s best practices have allowed us to serve as a valued advisor and trusted fiduciary to clients throughout the United States. For more information, please call (630) 371-2626 or email us at stairwaypartners@stairwaypartners.com.

Global Equity and Currency Commentary

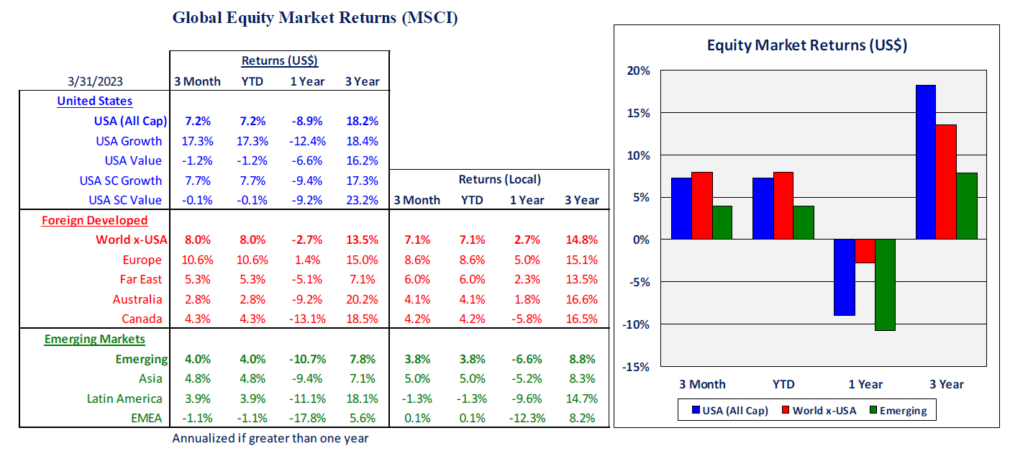

- In the first quarter, US and non-US developed equity markets produced similar strong returns, despite expectations in many markets that interest rates were likely to continue rising and, as a result, economies were likely to weaken.

- Returns in emerging market equities were weaker although still positive. Many of these markets had positive returns, but returns in several of the larger ones, including Brazil and India, were negative during the quarter.

- Large-cap growth stocks in the US turned in an outstanding performance in the first quarter, as shares in many of the big tech companies reversed some of the ground they gave up last year.

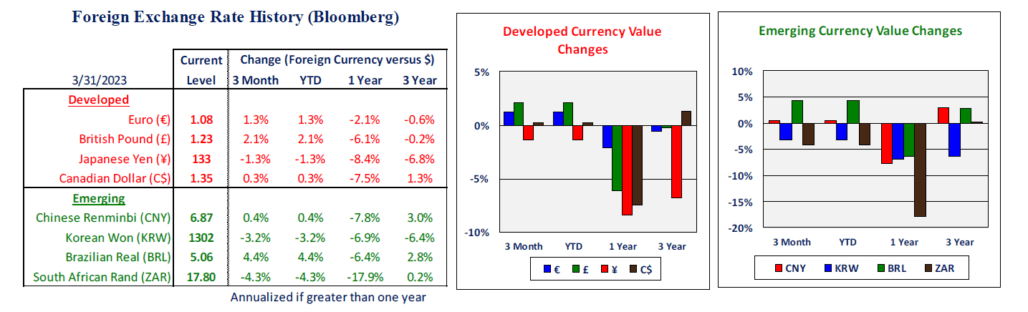

- Moderate weakness in the US dollar against many currencies boosted returns to non-US equities slightly. This was a turnaround from 2022, when dollar strength compounded the losses in non-US equity markets.

US Fixed Income and Fed Commentary

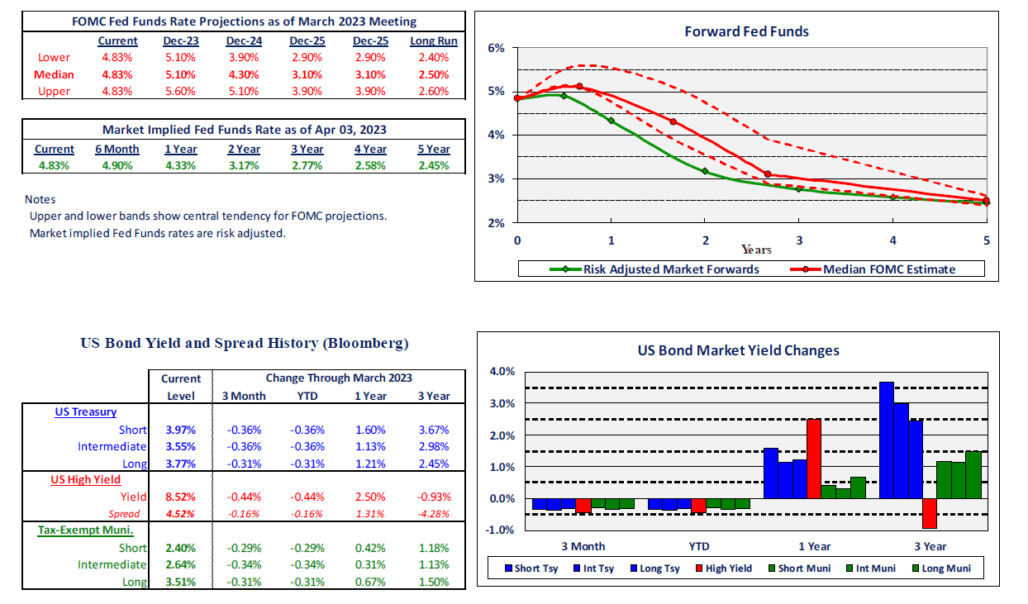

- In response to the failures of Silicon Valley Bank and Signature Bank, the Fed provided substantial liquidity to the banking system. By early March, the Fed’s balance sheet had shrunk by 7% from its peak of nearly $9 trillion a year earlier; however, the additional liquidity led to its assets expanding once again, by nearly $400 million in a matter of a few days.

- Despite bank stresses and the increased provision of funds, the Fed continued to raise the Fed funds policy interest rate. However, the two increases in the first quarter (in February and March) were only 25 basis points each. This stood in stark contrast with the six previous increases, which were 50 and 75 bps each.

- Bond investors took these smaller increases as a positive sign – that the Fed is nearing the end of the rate-hike cycle. As expectations grew more optimistic regarding the path of rates, Treasury yields declined for most maturities and credit spreads narrowed for most sectors. Falling yields meant that bonds enjoyed strong returns during the first quarter, although the gains were insufficient to offset negative returns experienced in 2022. Fears of a debt-limit crisis appeared to have little or no effect on Treasury bond yields during the quarter.

- The increases in short-term interest rates also kept the yield curve inverted, with short rates above rates on longer-term fixed income instruments. In the past, an inverted curve has often been a signal of impending recession, although this could be a case of “predicting nine of the last five recessions” (to paraphrase Paul Samuelson).

Stairway Partners, LLC © 2023

This material is based upon information that we believe to be reliable, but no representation is being made that it is accurate or complete, and it should not be relied upon as such. This material is based upon our assumptions, opinions and estimates as of the date the material was prepared. Changes to assumptions, opinions and estimates are subject to change without notice. Past performance is not indicative of future results, and no representation is being made that any returns indicated will be achieved. This material has been prepared for information purposes and does not constitute investment advice. This material does not take into account particular investment objectives or financial situations. Strategies and financial instruments described in this material may not be suitable for all investors. Readers should not act upon the information without seeking professional advice. This material is not a recommendation or an offer or solicitation for the purchase or sale of any security or other financial instrument.

You must be logged in to post a comment.