Global Market and Economic Perspective

Global Economic Commentary

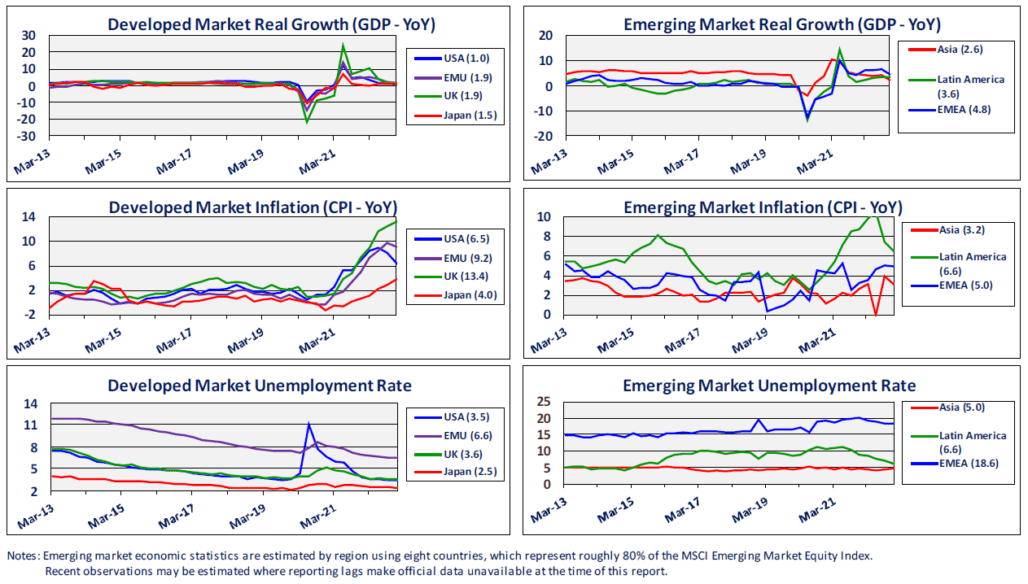

- In the final quarter of 2022, fears of a global recession abated somewhat, as the economic data coming out of many countries was not as weak as expected earlier in the year. GDP growth in the US was positive, reversing the small decline in GDP in the first two quarters of the year. Despite the positive number, several sectors of the economy, such as autos and housing, continued to suffer. Higher mortgage interest rates, combined with elevated house prices, led to a sharp drop in home sales. The labor market stayed strong, with the unemployment rate remaining low and job openings high.

- Surprisingly, economic growth in continental Europe and the UK was more rapid than in the US. The improved situation in Europe can be attributed in part to mild winter weather, which led to energy prices falling from the highs reached earlier in the year due to Russia’s invasion of Ukraine.

- Price pressures remained elevated in most countries, with year-over-year consumer price rises in October hitting multi-decade highs in the UK and Eurozone (above 11% and 10½%, respectively). Although headline inflation abated somewhat in a number of countries, core inflation in many was still heading in the wrong direction. In the US, while goods price inflation moderated, inflation in services continued to be problematic due to wage pressures resulting from the tight labor market.

Stairway Partners is an SEC-registered Investment Advisor providing comprehensive investment advice and industry-leading portfolio management solutions. Our firm was created to provide institutions and individual investors with transparent and cost-effective stewardship of their assets. Our sophisticated investment capabilities and a steadfast commitment to the industry’s best practices have allowed us to serve as a valued advisor and trusted fiduciary to clients throughout the United States. For more information, please call (630) 371-2626 or email us at stairwaypartners@stairwaypartners.com.

Global Equity and Currency Commentary

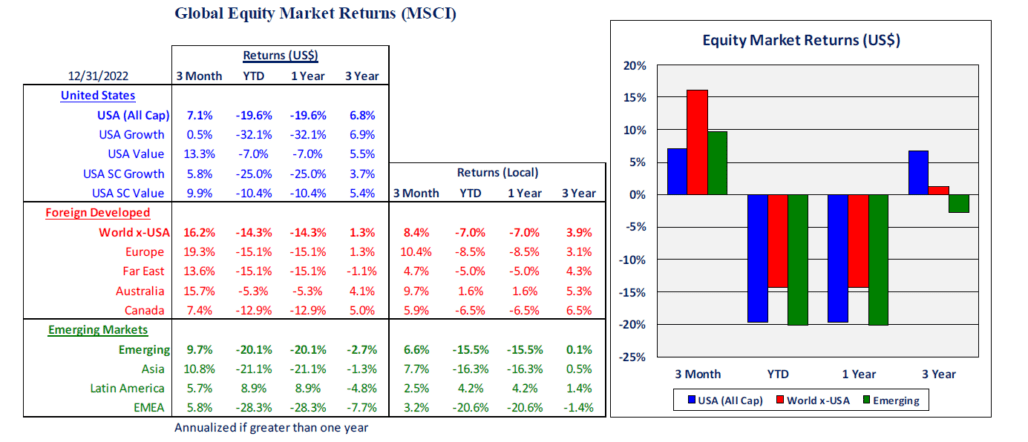

- Equity markets globally produced good returns in the fourth quarter, although the positive performance fell far short of offsetting the enormous declines from earlier in 2022. As economic growth outperformed expectations of recession, earnings growth continued to defy expectations earlier in the year of a sharp slowdown.

- Within US equities, value stocks continued their run of strong performance relative to growth, especially in larger capitalization shares. The large tech companies had outperformed for many years prior to last year’s reversal of fortunes when equity discount rates increased as the Fed raised cash rates.

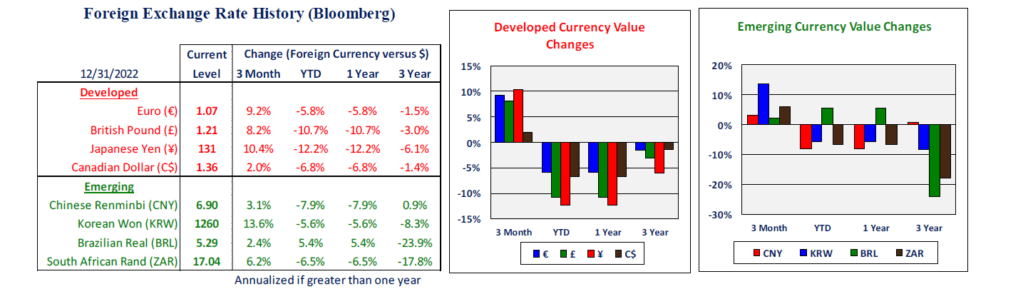

- Returns in non-US equities, particularly in developed markets, were better than in the US in the fourth quarter. This was largely due to a weakening of the US dollar against foreign currencies, which boosted the returns for US investors in foreign equity markets. The dollar, which had been very strong earlier in 2022 due to rising US interest rates, reversed course as investors anticipated that the Fed was likely to moderate the pace and magnitude of future interest rate hikes. At the same time, foreign central banks were still much earlier on their path of rate increases, indicating that the US dollar’s interest differential would be narrowing over time.

US Fixed Income and Fed Commentary

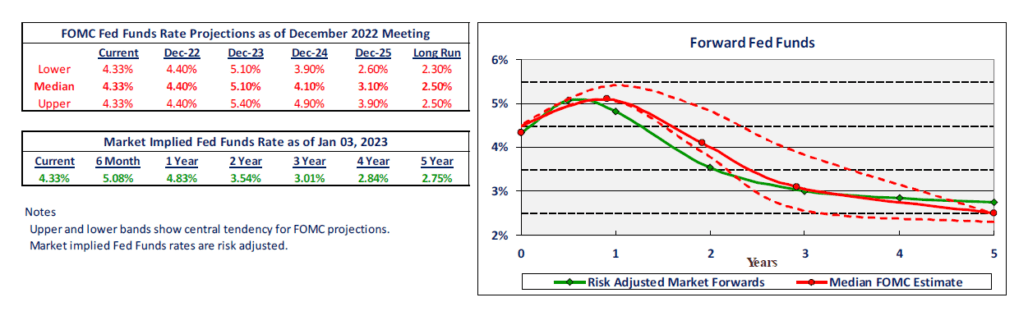

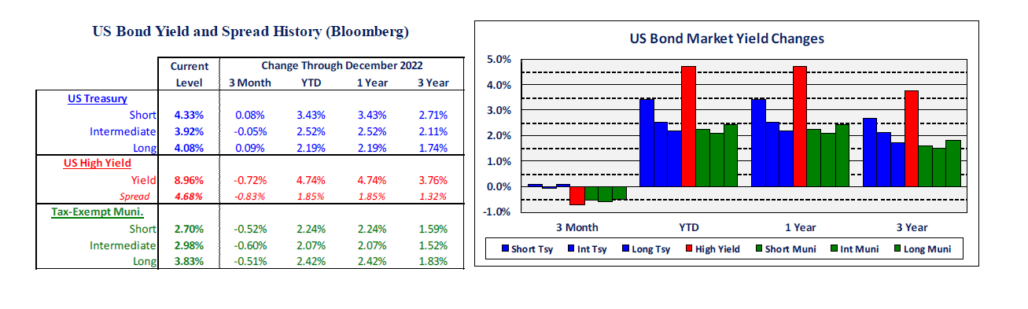

- During the fourth quarter of 2022, the Federal Reserve continued raising their policy Fed funds interest rate. At the early November FOMC meeting, they hiked another three-quarters of a percentage point, which was the fourth 75 basis point increase in a row. The Fed raised rates again at their December meeting, but only by 50 basis points. The latest increase resulted in a Fed funds policy range of 4.25% to 4.50%, a substantial increase from the 0% to 0.25% range at the start of 2022. The smaller increase in December indicated that the pace and size of future rate hikes would be diminishing, and led some investors to anticipate that the Fed will actually start cutting rates in 2023.

- In contrast to earlier in the year, the fourth-quarter increases in the Fed funds rate did not result in widespread increases in bond yields. In fact, many fixed income sectors – munis, investment-grade credit, and high yield – experienced falling rather than rising credit spreads and yields.

- Declining yields in these sectors produced higher bond prices, and thus strong returns. However, the good performance of the fourth quarter was nowhere near sufficient to offset the substantial losses that fixed income produced in the first three quarters of the year.

Stairway Partners, LLC © 2022

This material is based upon information that we believe to be reliable, but no representation is being made that it is accurate or complete, and it should not be relied upon as such. This material is based upon our assumptions, opinions and estimates as of the date the material was prepared. Changes to assumptions, opinions and estimates are subject to change without notice. Past performance is not indicative of future results, and no representation is being made that any returns indicated will be achieved. This material has been prepared for information purposes and does not constitute investment advice. This material does not take into account particular investment objectives or financial situations. Strategies and financial instruments described in this material may not be suitable for all investors. Readers should not act upon the information without seeking professional advice. This material is not a recommendation or an offer or solicitation for the purchase or sale of any security or other financial instrument.

You must be logged in to post a comment.