Global Market and Economic Perspective

Global Economic Commentary

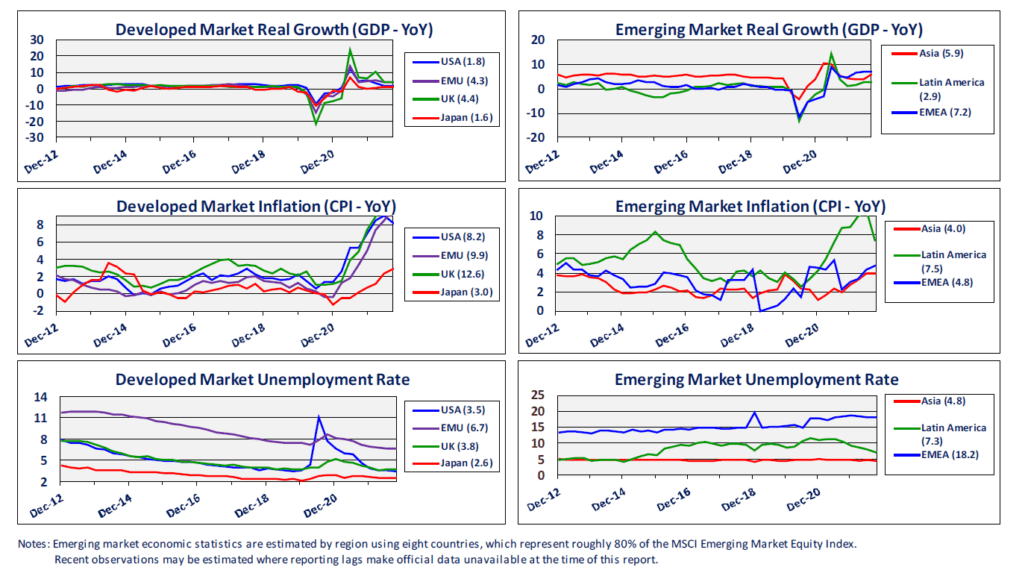

- The third quarter of 2022 saw weak GDP growth in many countries, including the US, China, and Germany. Although growth was anemic, in most cases it was above consensus expectations.

- Growth in the US was enough to offset the declines in the first two quarters of the year. Unfortunately, consumer spending was weak and private sector investment decreased sharply. Government spending and exports were the bright spots, although the strong dollar should dampen exports in the future.

- Inflation remained elevated globally, with Japan being a notable exception to the trend. Although headline CPI in the US fell slightly from its high in June due to a decline in fuel prices, core CPI (ex-food and energy) continued its upward trend, due to the important and heavily weighted housing component. The UK and countries in much of continental Europe continued to suffer from very high inflation, due to the ongoing effects on food and energy markets resulting from Russia’s invasion of Ukraine.

- The US unemployment rate during the third quarter remained near historic lows around 3.5%, and the number of employed persons finally reached pre-Covid employment levels. However, the labor force participation rate was still well below previous highs, as early retirees and discouraged workers remained out of the labor force.

Stairway Partners is an SEC-registered Investment Advisor providing comprehensive investment advice and industry-leading portfolio management solutions. Our firm was created to provide institutions and individual investors with transparent and cost-effective stewardship of their assets. Our sophisticated investment capabilities and a steadfast commitment to the industry’s best practices have allowed us to serve as a valued advisor and trusted fiduciary to clients throughout the United States. For more information, please call (630) 371-2626 or email us at stairwaypartners@stairwaypartners.com.

Global Equity and Currency Commentary

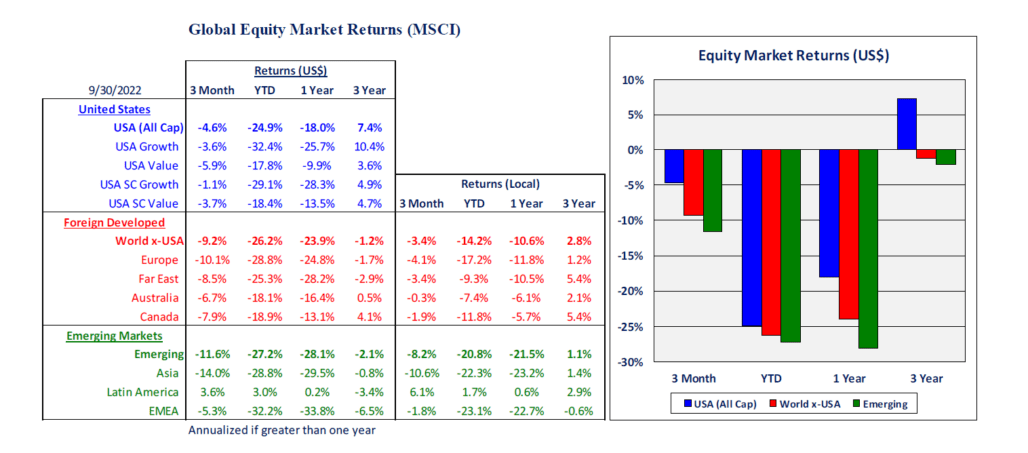

- Most developed and emerging equity markets produced losses during the third quarter. Several factors were responsible for the poor performance, including aggressive interest rate hikes by a number of central banks to address persistently high inflation. An increase in core interest rates hurts equity values by effectively raising the discount rates used to determine the present value of future earnings.

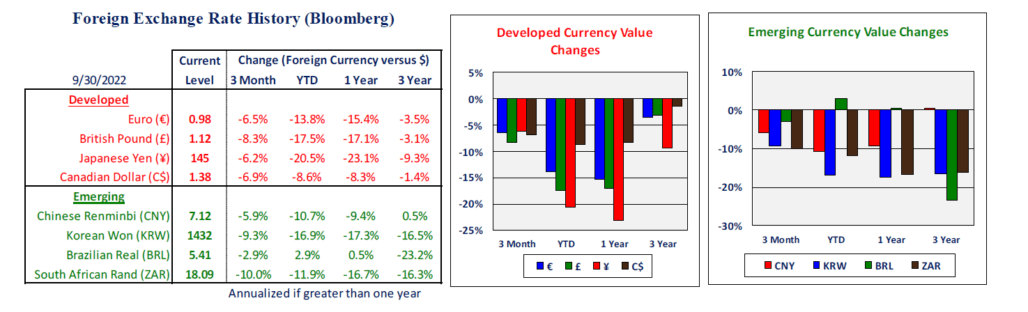

- In contrast to the first half of the year, growth-oriented stocks did not fare as poorly as value stocks in the third quarter. Small-cap stocks in the US performed slightly better than large and mid-cap stocks, likely as a result of their lower exposure to foreign income. The strong dollar has had a negative effect on US companies’ non-US revenues and earnings.

- Developed non-US equity markets performed better than US equities in the third quarter, whereas emerging markets fell by more than the US market. The aforementioned strength of the US dollar detracted from both foreign developed and emerging markets, which helped US equities in relative terms.

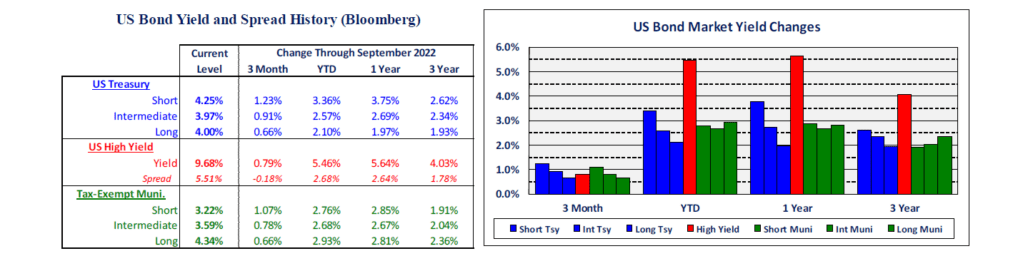

US Fixed Income and Fed Commentary

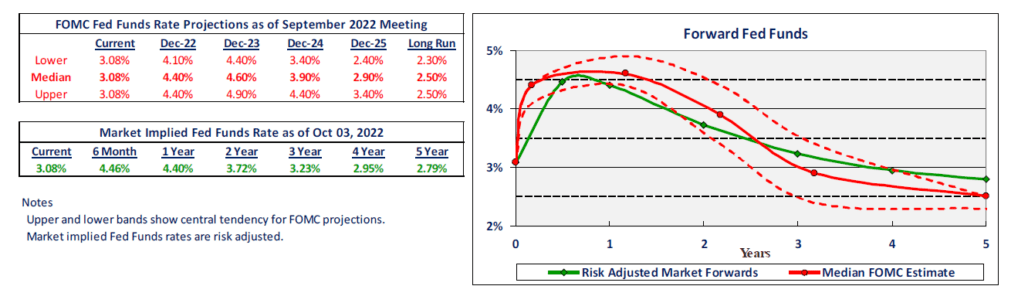

- During the third quarter, the Federal Reserve continued on their path of tightening monetary policy to address the elevated inflation that US consumers are experiencing. At both the July and September FOMC meetings, the Fed raised their policy interest rate, the Fed Funds rate, by 0.75%. At the end of the third quarter, the Fed’s target for the Fed Funds rate was 3.0% to 3.25%, which is well above the range of 0.0%-0.25% in the first quarter.

- The Fed’s aggressive increases in short-term interest rates caused rates along the entire yield curve to rise sharply. Investment grade bonds have turned in one of their worst returns in history, as capital losses due to price declines have overwhelmed the low yields that investors started the year earning. During the third quarter alone, the investment grade bond index lost over 4.5%, which brought the loss since the start of the year to more than 14.5%, which is a number that is more typical for equities than it is for high quality bonds.

- Higher yields were also reflected in mortgages, with the average interest rate on a 30-year fixed-rate mortgage more than doubling from its late-2021 level around 3%. As a result, affordability declined and home prices began falling in a number of cities in the third quarter. The weakening housing market was reflected in pending home sales, which have fallen for 11 of the 12 months through September of this year.

Stairway Partners, LLC © 2022

This material is based upon information that we believe to be reliable, but no representation is being made that it is accurate or complete, and it should not be relied upon as such. This material is based upon our assumptions, opinions and estimates as of the date the material was prepared. Changes to assumptions, opinions and estimates are subject to change without notice. Past performance is not indicative of future results, and no representation is being made that any returns indicated will be achieved. This material has been prepared for information purposes and does not constitute investment advice. This material does not take into account particular investment objectives or financial situations. Strategies and financial instruments described in this material may not be suitable for all investors. Readers should not act upon the information without seeking professional advice. This material is not a recommendation or an offer or solicitation for the purchase or sale of any security or other financial instrument.

You must be logged in to post a comment.