Global Market and Economic Perspective

Global Economic Commentary

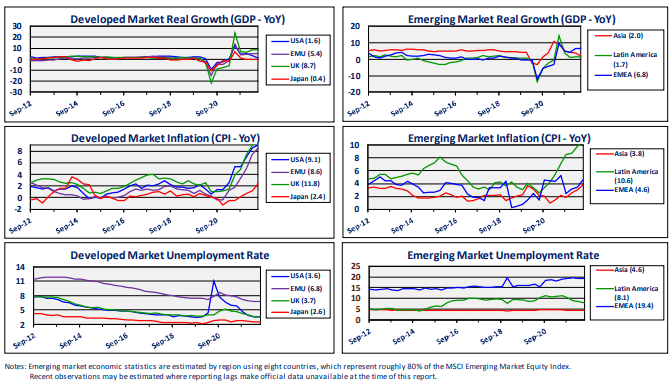

- During the second quarter of 2022, higher inflation and lower real economic growth continued to worsen throughout developed and emerging countries around the world.

- Headline CPI inflation again hit multi-decade highs in the US, UK, Germany, and a number of other countries. In Europe and emerging market countries, inflation was largely driven by increases in energy and food costs, as the invasion of Ukraine continued to restrict supplies of natural gas, oil, and grain. In the US, consumer price pressures were more broad-based, as pandemic-related financial support and supply problems exacerbated global energy and food price pressures.

- Real GDP growth in the US was negative for the second quarter in a row, bringing the economy into what many economists consider a recession. Personal consumption expenditures, the largest component of GDP, showed very weak growth, as spending on goods declined. Investment spending and government expenditures also both detracted from real growth.

- Growth in China remained subdued, due to the continued lockdowns that are required by the government’s zero-Covid policy. A number of other emerging market countries suffered from higher costs to import energy and food, with some drawing close to financial crisis (e.g., Sri Lanka, Pakistan).

Stairway Partners is an SEC-registered Investment Advisor providing comprehensive investment advice and industry-leading portfolio management solutions. Our firm was created to provide institutions and individual investors with transparent and cost-effective stewardship of their assets. Our sophisticated investment capabilities and a steadfast commitment to the industry’s best practices have allowed us to serve as a valued advisor and trusted fiduciary to clients throughout the United States. For more information, please call (630) 371-2626 or email us at stairwaypartners@stairwaypartners.com.

Global Equity and Currency Commentary

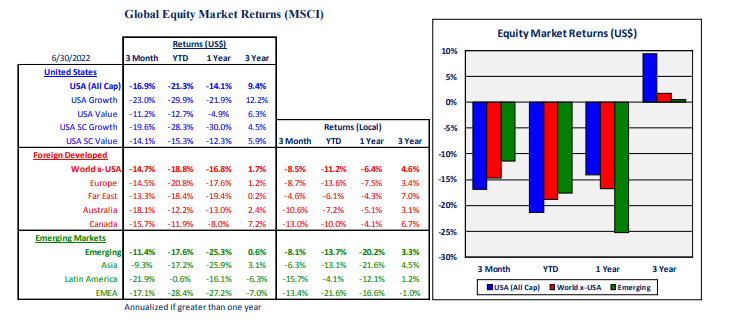

- With very few exceptions, equity markets across the globe delivered substantial losses during the second quarter. When coupled with the market declines in the first quarter, the result was one of the worst first halves in many years. Investors’ negative sentiment was largely the result of increased inflation, policy interest rate increases from central banks, and anticipated future economic weakness.

- Value-oriented stocks in the US again outperformed growth stocks in the second quarter. Because value stocks tend to have higher dividends, their cash flows are received sooner and rising interest rates have less of a negative impact.

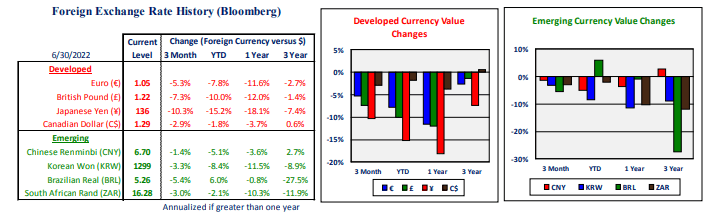

- Outside the US, returns in developed and emerging equity markets were much better than in the US market, although they were still negative. However, the strength of the US dollar significantly reduced foreign equity market returns to US investors. In total, developed foreign markets produced US-like returns, whereas emerging markets outperformed in the second quarter. Dollar strength was likely the result of rising domestic interest rates, which make US cash and fixed income investments more attractive relative to non-US alternatives.

US Fixed Income and Fed Commentary

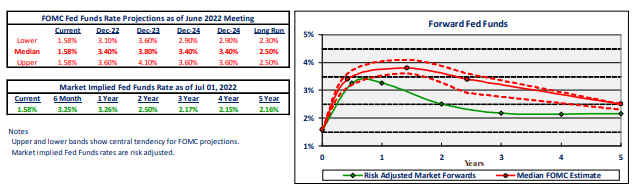

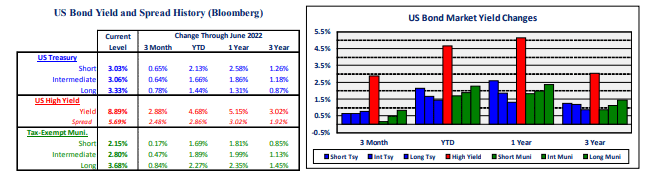

- After cutting their policy interest rate to near zero in March of 2020, the Federal Reserve raised rates at an aggressive pace in the first half of 2022. During the second quarter, after admitting that inflation was not going to be transitory, the Fed began to raise rates in larger and more frequent moves: 50 bps in May and another 75 bps in June, which was the largest increase in nearly 30 years. Forward projections indicate that more tightening is likely in the second half of 2022 and beyond.

- Bond market participants sent fixed income prices sharply lower again in the quarter. Similar to the equity market’s poor performance in the first half of the year, bond market returns were negative for Treasuries, municipal bonds, and both investment-grade and high yield corporate bonds.

- Even at the short-term end of the Treasury market where interest rate sensitivity is low, the yield increase was sufficiently large to produce losses. As a result of low starting yields and large yield increases, the overall Treasury market lost almost 3.8% in the second quarter, which brought the sector’s loss to more than 9.1% for the first six months of the year.

- Credit spreads in the investment-grade and high yield bond markets widened in the second quarter. The combination of higher underlying Treasury rates and wider spreads caused significant losses in corporate bonds in the quarter: more than 7.2% and 9.8% for investment grade and high yield, respectively.

Stairway Partners, LLC © 2022

This material is based upon information that we believe to be reliable, but no representation is being made that it is accurate or complete, and it should not be relied upon as such. This material is based upon our assumptions, opinions and estimates as of the date the material was prepared. Changes to assumptions, opinions and estimates are subject to change without notice. Past performance is not indicative of future results, and no representation is being made that any returns indicated will be achieved. This material has been prepared for information purposes and does not constitute investment advice. This material does not take into account particular investment objectives or financial situations. Strategies and financial instruments described in this material may not be suitable for all investors. Readers should not act upon the information without seeking professional advice. This material is not a recommendation or an offer or solicitation for the purchase or sale of any security or other financial instrument.

You must be logged in to post a comment.