Global Market and Economic Perspective

Global Economic Commentary

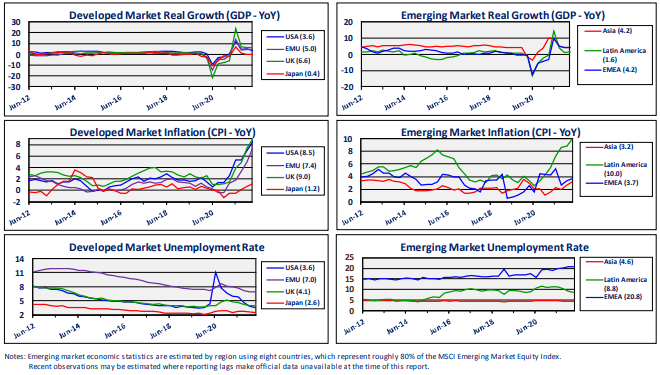

- Financial markets were hit hard when Russia invaded Ukraine in late February. The war, and the Western sanctions that followed, exacerbated food and energy supply problems. As Russian energy exports were threatened with restrictions, prices jumped and already-high inflation accelerated.

- In the US, inflation hit 40-year highs, regardless of which index was being used to measure prices – CPI, core CPI, PCE deflator, etc. Consumers especially took note of gasoline prices rising to $5 and $6 per gallon in parts of the country.

- Real GDP in the US declined slightly in the first quarter, which was the first decline since the lockdowns at the beginning of the Covid crisis. However, the fall was not due to weak personal consumption or investment spending. It was instead driven by inventory drawdowns due to continued supply chain issues, and by weak exports.

- European economies were hit harder by the energy and production problems, due to their proximity to the Ukrainian conflict. Germany in particular imports a substantial amount of its oil and natural gas from Russia.

- In China, Covid-related lockdowns continued to roll through economy, which caused disruptions to manufacturing and exports. In addition, the financial condition of real estate developers deteriorated.

Stairway Partners is an SEC-registered Investment Advisor providing comprehensive investment advice and industry-leading portfolio management solutions. Our firm was created to provide institutions and individual investors with transparent and cost-effective stewardship of their assets. Our sophisticated investment capabilities and a steadfast commitment to the industry’s best practices have allowed us to serve as a valued advisor and trusted fiduciary to clients throughout the United States. For more information, please call (630) 371-2626 or email us at stairwaypartners@stairwaypartners.com.

Global Equity and Currency Commentary

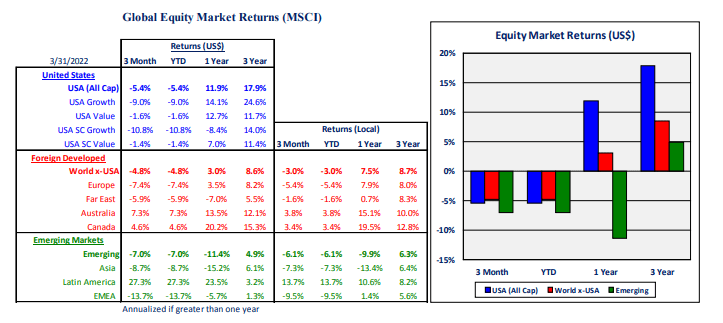

- Equities produced losses across the board – US, non-US developed, and emerging. In the US market, tech-related and other growth stocks were hit especially hard. This can be attributed in part to lofty valuations and rising interest rates. Higher interest rates increase the discount rate used to put a current value on future cash flows. Because growth stocks generally pay less out in the form of dividends, their cash flows are much further in future, and therefore their values tend to fall more sharply as the discount rate rises.

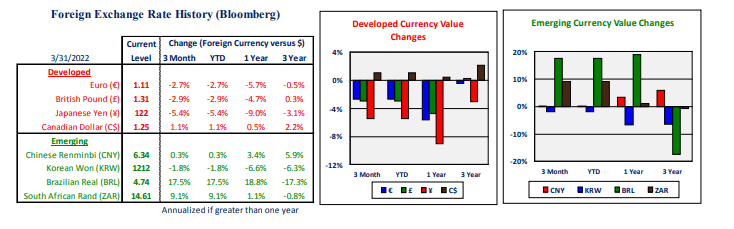

- Returns in non-US equities were negative, due to both declining share prices and a stronger US dollar. The dollar strengthened as expectations grew that the Fed would be more aggressive than many other central banks in raising interest rates. This improvement in the prospective return to holding dollars caused the currency to move higher.

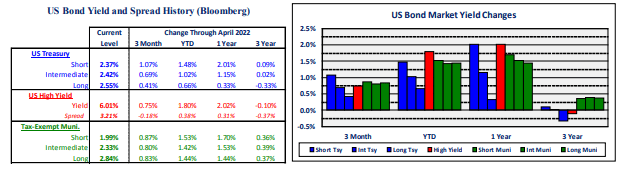

US Fixed Income and Fed Commentary

- Because higher inflation and rising cash rates negatively impact both stocks and bonds, we have seen a return to a positive correlation between stock and bond market returns. This correlation was fairly high in the 1970s and 1980s; bond prices fell and stocks did not perform well during the stagflation of the ‘70s. Then, bonds and stocks both provided outstanding returns in the ‘80s, as inflation and yields fell sharply.

- There was nowhere to hide in the bond market during the quarter. Even “low-risk” US Treasury securities showed negative returns; corporate bonds performed even worse, due to the stock market’s weakness; and, more surprisingly, cash returns fell below zero as the low level of income was insufficient to overcome the small price declines from rising short-term interest rates.

- The carnage in the bond market was due in part to investors finally recognizing that the inflation acceleration that started a year ago is likely to be neither “transitory” nor short-lived.

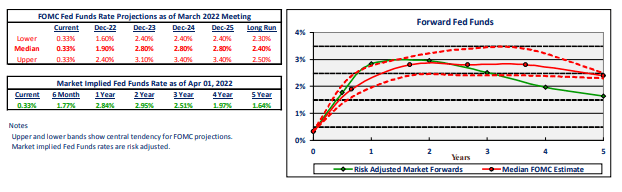

- The Fed signaled that their policy was changing in order to more aggressively address the threat of continued high inflation. Market expectations moved sharply higher toward multiple 50 basis point increases in 2022. The Fed also announced the removal of their massive bond buying program that has been in place for several years. This program continued to quietly grow, despite public comments that suggested that the Fed was already decreasing the size of their balance sheet.

Stairway Partners, LLC © 2022

This material is based upon information that we believe to be reliable, but no representation is being made that it is accurate or complete, and it should not be relied upon as such. This material is based upon our assumptions, opinions and estimates as of the date the material was prepared. Changes to assumptions, opinions and estimates are subject to change without notice. Past performance is not indicative of future results, and no representation is being made that any returns indicated will be achieved. This material has been prepared for information purposes and does not constitute investment advice. This material does not take into account particular investment objectives or financial situations. Strategies and financial instruments described in this material may not be suitable for all investors. Readers should not act upon the information without seeking professional advice. This material is not a recommendation or an offer or solicitation for the purchase or sale of any security or other financial instrument.

You must be logged in to post a comment.