Global Market and Economic Perspective

Global Economic Commentary

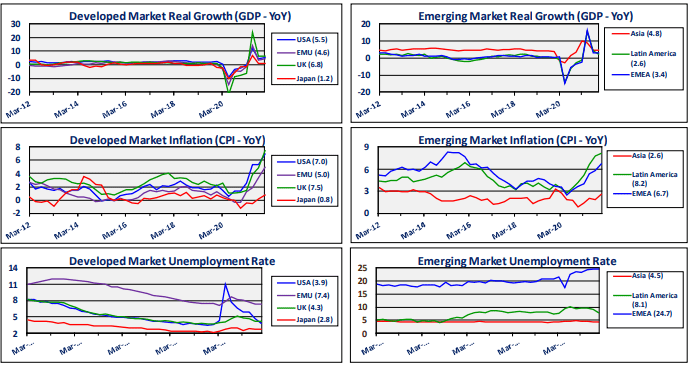

- The big story during the fourth quarter of 2021 was the resurgence in inflation across countries worldwide. US inflation was higher than in most other countries, with some measures showing price gains at a pace not seen in nearly 40 years. There was no single category or sector of the economy that was responsible for the increase, as inflation pressure showed up in a broad array of goods and services.

- The underlying drivers of inflation included supply chain problems, which hit many manufacturers in the US and elsewhere, and massive transfers of fiscal resources to consumers, which was far more pronounced in the US than elsewhere.

- The unemployment rate in the US continued to drop toward its pre-pandemic low. However, labor force participation remained low, due to a wave of early retirements and younger workers having government provided resources to abstain from the job market.

- The small pool of available workers was coupled with a record number of job openings. Unsurprisingly, the result was wage inflation, although many workers were still left worse off because their wage gains were lower than consumer price inflation.

- Covid cases spiked in many countries as the more-infectious Omicron variant spread rapidly. However, most countries refrained from re-imposing lockdowns and restrictions, as this variant caused less severe symptoms and many governments were unwilling to repeat the economic costs of broad lockdowns.

Stairway Partners is an SEC-registered Investment Advisor providing comprehensive investment advice and industry-leading portfolio management solutions. Our firm was created to provide institutions and individual investors with transparent and cost-effective stewardship of their assets. Our sophisticated investment capabilities and a steadfast commitment to the industry’s best practices have allowed us to serve as a valued advisor and trusted fiduciary to clients throughout the United States. For more information, please call (630) 371-2626 or email us at stairwaypartners@stairwaypartners.com.

Global Equity and Currency Commentary

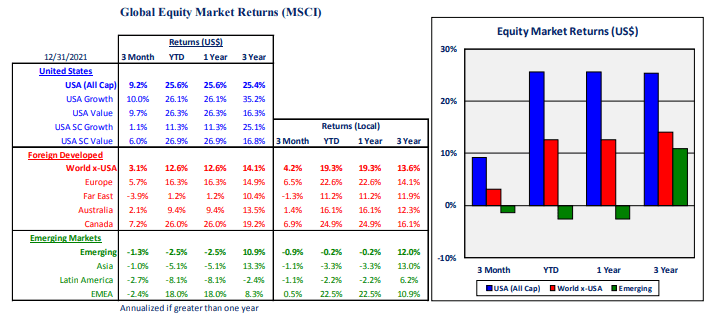

- US equities produced another strong performance in the fourth quarter. Investors remained optimistic about the earnings picture, despite continuing supply-chain problems and the resurgence in inflation.

- In the last few years, the large tech companies in the US have outpaced many other names. As a result, at the end of 2021, the ten largest companies – mostly technology-related – accounted for close to 30% of the market value of the S&P 500 index.

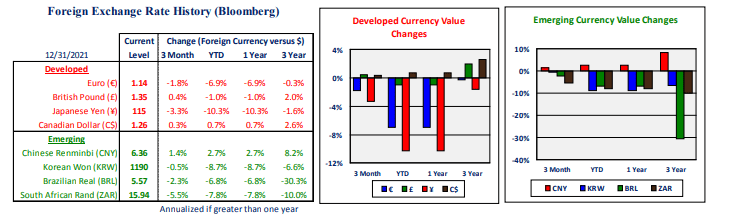

- In the first three quarters of 2021, returns in non-US developed equity markets were very close to the US equity return, although US dollar strength detracted from performance for US-based investors. In the fourth quarter, developed non-US equities produced positive returns, but lagged the US market and were weighed down by a modest further strengthening of the dollar. Emerging markets equities had negative returns for the quarter, given weakness in a number of the larger markets such as China and Brazil.

- Many European and Asian goods-producing firms faced the same supply chain headwinds the US experienced. In addition, China stuck with its Covid “zero tolerance” policy, which led to imposition of a few new lockdowns as the Omicron variant appeared in several cities.

US Fixed Income and Fed Commentary

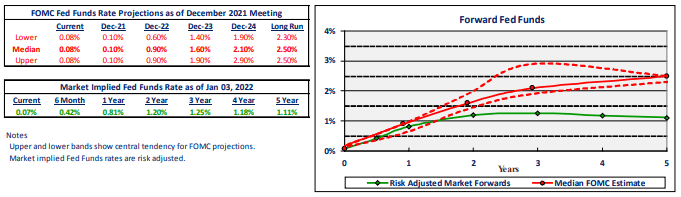

- During the fourth quarter of 2021, expectations for the future path of short-term interest rates rose significantly. The sharp rise in inflation led Chairman Powell and the Federal Reserve to eliminate their previous language that any inflation spike would be “transitory” and not a cause for concern.

- In the three months between the September FOMC meeting and the December meeting, the Fed governors raised their forecasts by 60 basis points for the Fed Funds policy interest rate at December 2022 and December 2023, from 0.30% to 0.90% and from 1.00% to 1.60% respectively. Over this same time period, market-implied expectations also rose substantially – by 75 basis points – but remained below the Fed’s projections.

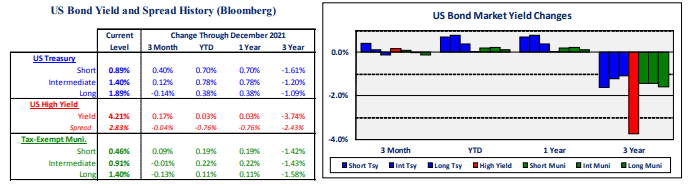

- Overall, bond market performance was mixed for the quarter, with a near-zero return to the Bloomberg Barclays US Aggregate index. Returns on short-term and intermediate-term bonds were negative due to the rise in yields at the shorter end of the yield curve. However, yields on long-term bonds fell somewhat, resulting in modestly positive returns on longer-maturity securities.

- Credit-sensitive fixed income produced modest positive returns for the fourth quarter. Investment grade corporate and non-investment-grade high yield bonds benefitted from strength in the equity market. The narrowing of credit spreads more than compensated for any increase in yields.

Stairway Partners, LLC © 2022

This material is based upon information that we believe to be reliable, but no representation is being made that it is accurate or complete, and it should not be relied upon as such. This material is based upon our assumptions, opinions and estimates as of the date the material was prepared. Changes to assumptions, opinions and estimates are subject to change without notice. Past performance is not indicative of future results, and no representation is being made that any returns indicated will be achieved. This material has been prepared for information purposes and does not constitute investment advice. This material does not take into account particular investment objectives or financial situations. Strategies and financial instruments described in this material may not be suitable for all investors. Readers should not act upon the information without seeking professional advice. This material is not a recommendation or an offer or solicitation for the purchase or sale of any security or other financial instrument.

You must be logged in to post a comment.