Global Market and Economic Perspective

Global Economic Commentary

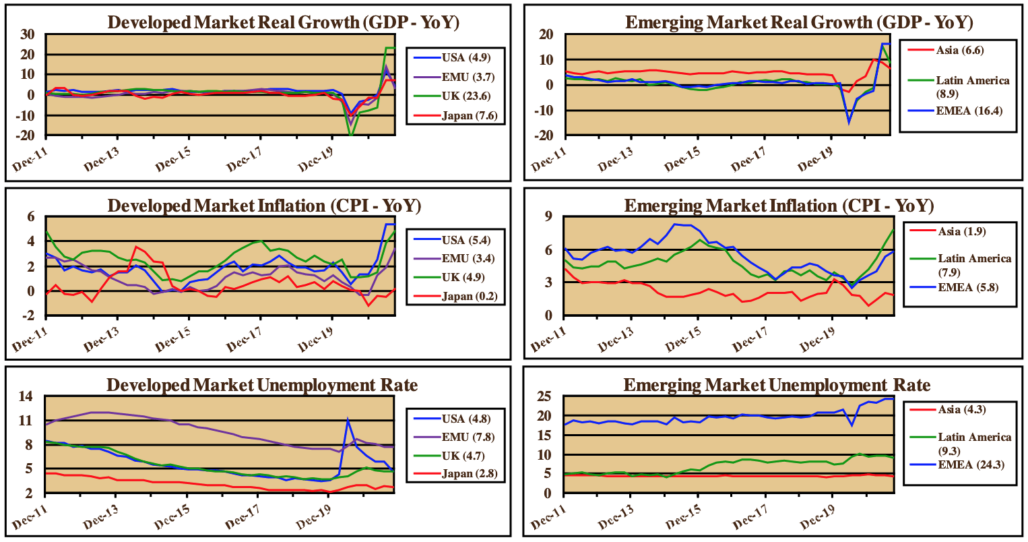

- During the third quarter, both the US and the European Union saw growth of real GDP slow sharply from the second quarter’s rapid rate. The slowing of the recovery after the Covid shutdowns can be at least partially attributed to another wave of infections over the summer. Perhaps more important was the continued supply chain disruptions, particularly in industries such as automobile production, which was hampered by a shortage of the chips necessary to control vehicles’ increasingly automated systems.

- The supply problems, coupled in many countries with substantial government support of consumers’ incomes, resulted in the highest inflation in decades. In the US, both the Consumer Price Index and the PCE Deflator (the Federal Reserve’s preferred measure) hit 30-year highs at the end of the third quarter.

- Despite the strength in economic output growth, the employment situation in many countries has not recovered in line with the rebound in GDP. In the US, the number of people in work remains well below pre-pandemic levels, as labor force participation has fallen even in the face of a record number of job openings and the strongest growth in wages in many years.

Stairway Partners is an SEC-registered Investment Advisor providing comprehensive investment advice and industry-leading portfolio management solutions. Our firm was created to provide institutions and individual investors with transparent and cost-effective stewardship of their assets. Our sophisticated investment capabilities and a steadfast commitment to the industry’s best practices have allowed us to serve as a valued advisor and trusted fiduciary to clients throughout the United States. For more information, please call (630) 371-2626 or email us at stairwaypartners@stairwaypartners.com.

Global Equity and Currency Commentary

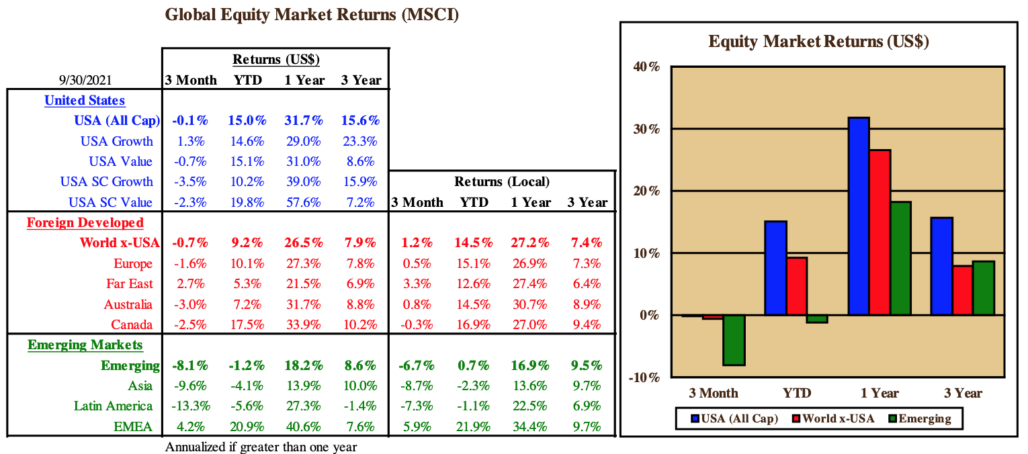

- Although the broad US equity market produced positive returns in July and August, September’s negative return resulted in a loss for the quarter. In addition to inflation fears and supply disruptions, some of September’s damage seemed to be a result of the political situation in Washington. As happens every few years, Democrats and Republicans refused to cooperate in extending the debt limit. Eventually, there was enough agreement to suspend the limit from mid-October to early December. As a result, fiscal uncertainty could produce similar pressure on financial markets in the fourth quarter.

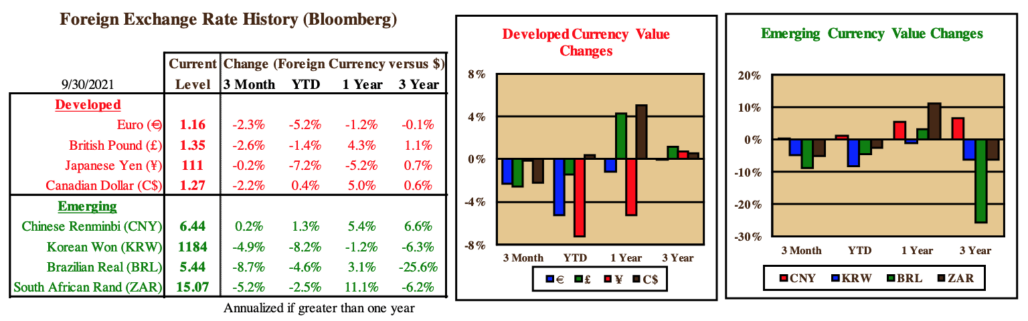

- In developed non-US markets, returns were mostly positive during the quarter, as economies and earnings continued their recovery from the Covid downturn. However, US dollar strength more than offset the equity market gains. As a result, US investments in non-US developed equities saw losses.

- Emerging markets contrasted sharply with the developed markets. Many of the emerging equity markets suffered sharp losses during the quarter. China was a particularly poor performer, as Evergrande and other real estate development-related firms faced severe financial difficulties that could result in default. Compounding the equity market losses, the US dollar strengthened against many emerging market currencies.

US Fixed Income and Fed Commentary

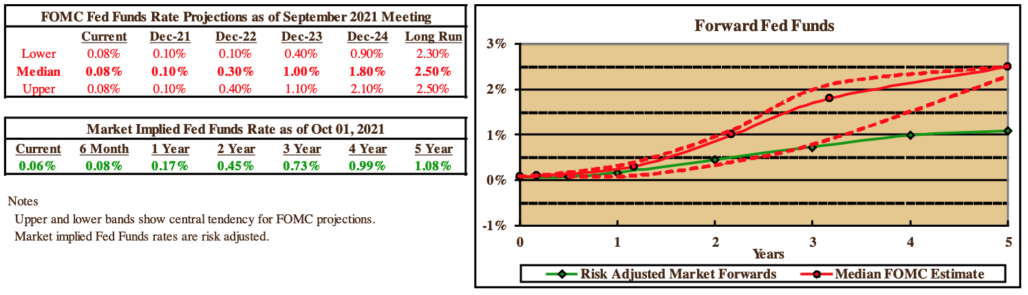

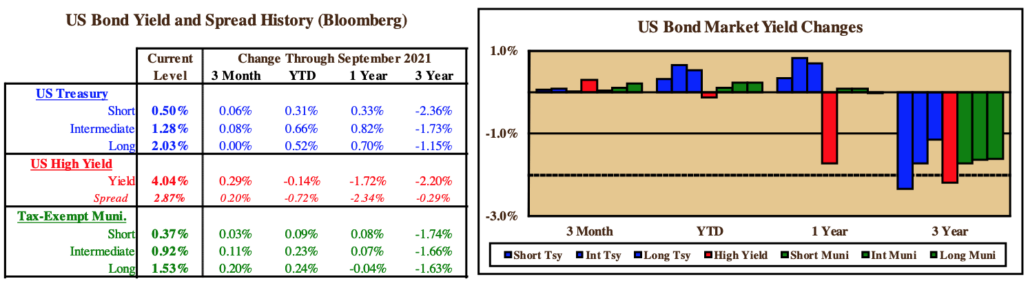

- Fixed income investors reacted to the surge in inflation, pushing yields higher on investment-grade and high yield securities. As a result, returns were negative for the quarter in almost all fixed income sectors, with the exception of the shortest-duration paper (which are least sensitive to yield increases) and TIPS (which have returns tied to CPI inflation).

- For many months, Federal Reserve chairman Powell had been assuring investors that any rise in inflation would be transitory and not a concern. However, market expectations for inflation began to shift dramatically during the quarter as inflation data came in much higher than expected. Chairman Powell has shifted his message, and now admits that inflation may be above the Fed’s projections by more and for longer than originally thought. As a result, the Fed’s projections for the Fed Funds Rate now indicates the first increase in 2022 rather than 2023.

- Unfortunately, the Fed has made the Treasury yield curve far less useful than in the past as an indicator of the future path of short-term interest rates and inflation. That is because the Fed has essentially purchased all of the net debt issued by the Treasury this year. As a result, financial markets now play a greatly diminished role in setting relative bond prices and interest rates.

Stairway Partners, LLC © 2021

This material is based upon information that we believe to be reliable, but no representation is being made that it is accurate or complete, and it should not be relied upon as such. This material is based upon our assumptions, opinions and estimates as of the date the material was prepared. Changes to assumptions, opinions and estimates are subject to change without notice. Past performance is not indicative of future results, and no representation is being made that any returns indicated will be achieved. This material has been prepared for information purposes and does not constitute investment advice. This material does not take into account particular investment objectives or financial situations. Strategies and financial instruments described in this material may not be suitable for all investors. Readers should not act upon the information without seeking professional advice. This material is not a recommendation or an offer or solicitation for the purchase or sale of any security or other financial instrument.

You must be logged in to post a comment.