Global Market and Economic Perspective

Global Economic Commentary

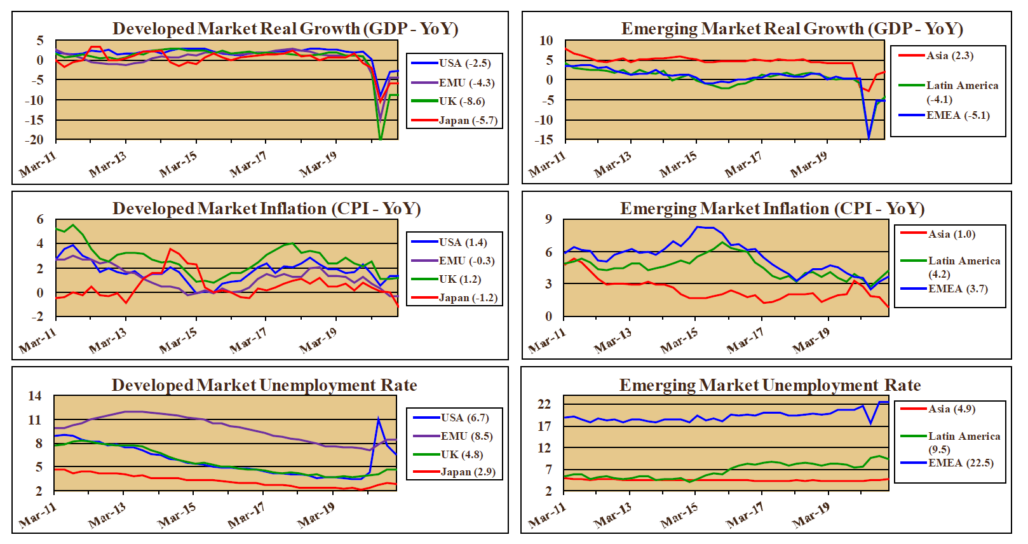

- Resurgent Covid-19 infections led to another round of lockdowns in a number of locations, including parts of Europe and the UK. This weighed on economic activity and raised the specter of a second recession. China bucked this trend by reporting relatively strong fourth quarter GDP growth.

- In the US, the fourth quarter saw a continuation of many trends that were underway earlier in 2020. Home sales and housing starts remained very strong, as many people looked for additional space for distancing and working from home. Manufacturing activity was also strong, but the bricks and mortar retail and service sectors were weak.

- Despite massive increases in the money supply, inflationary pressures remained subdued in most places. This can be attributed, in part, to lockdowns and travel restrictions limiting people’s ability to purchase many services and products. Additionally, in the US, many citizens chose to save a large portion of their first federal stimulus payment. An estimated 70% of recipients from the first stimulus package saved the money (or equivalently used it to pay down debt). Therefore, it is likely that the latest package will also fall short of the government’s goal of boosting consumption.

Stairway Partners is an SEC-registered Investment Advisor providing comprehensive investment advice and industry-leading portfolio management solutions. Our firm was created to provide institutions and individual investors with transparent and cost-effective stewardship of their assets. Our sophisticated investment capabilities and a steadfast commitment to the industry’s best practices have allowed us to serve as a valued advisor and trusted fiduciary to clients throughout the United States. For more information, please call (630) 371-2626 or email us at stairwaypartners@stairwaypartners.com.

Global Equity and Currency Commentary

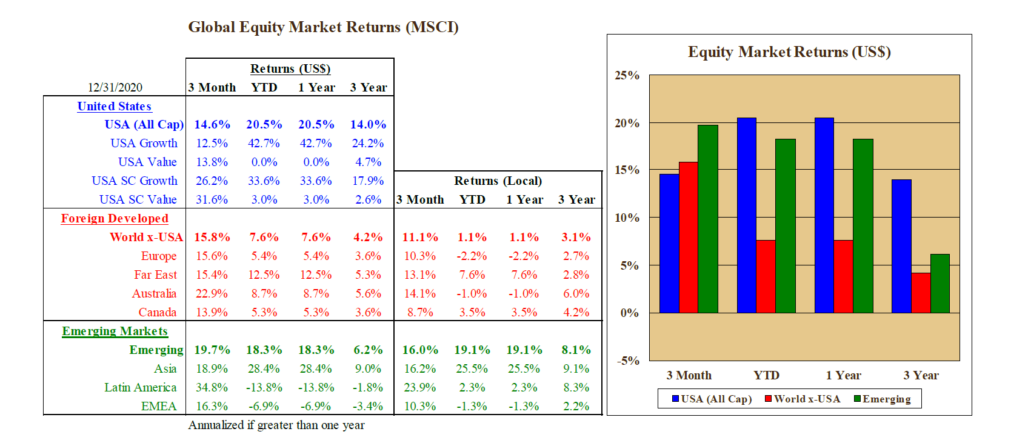

- Positive news on the vaccine-development front caused equity markets around the globe to climb sharply during the fourth quarter. In addition to the Chinese and Russian vaccines that were already being administered in those countries, Pfizer and Moderna in December began distributing Covid vaccines in the US and several other countries. Markets appeared to take these developments as signaling the light at the end of the tunnel – that economic activity would soon begin returning back to a more normal state. Although revenues and profitability remained depressed in industries such as restaurants, hotels, and airlines, widespread vaccination would benefit from pent-up demand for face-to-face interaction.

- Most stock markets produced double-digit returns for the quarter. In the US, small cap equities substantially outperformed large stocks, which was a reversal of a trend that had been in place for several years.

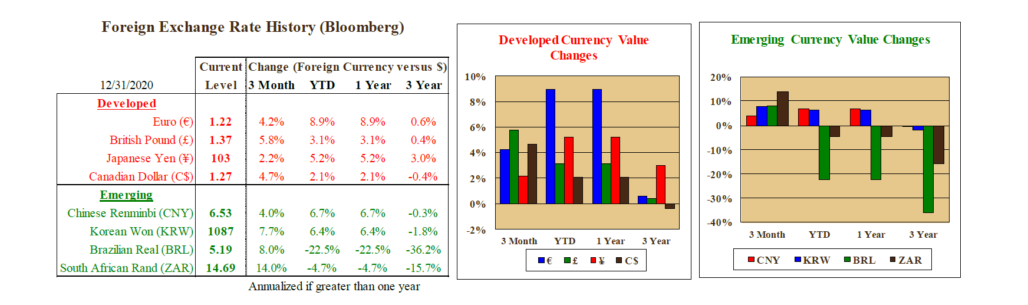

- For US-based investors, non-US equities produced even better returns than did US equities. Good returns in these equity markets were boosted further by US dollar weakness. Currency strength in developed markets added almost 5% to underlying equity returns. In emerging markets, currency appreciation added nearly 4% to local market returns.

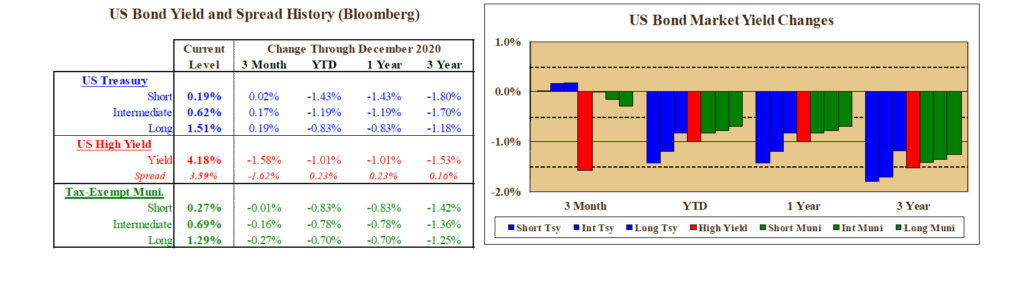

US Fixed Income and Fed Commentary

- Yields on nominal Treasury bonds rose during the fourth quarter, leading to losses on intermediate and long-term securities. After seeming to ignore the massive increases in federal government borrowing earlier during the Covid crisis, investors appeared in the fourth quarter to become concerned about the sustainability of the fiscal situation and its potential inflationary impact. Inflation-linked Treasury bonds (TIPS) produced strong performance, as yields declined further into negative territory.

- In sharp contrast to nominal Treasuries, bonds with credit risk exposure performed well in the fourth quarter. As the equity market rose strongly, credit spreads narrowed substantially which resulted in good returns in the investment-grade corporate bond market and very high returns in high yield bonds.

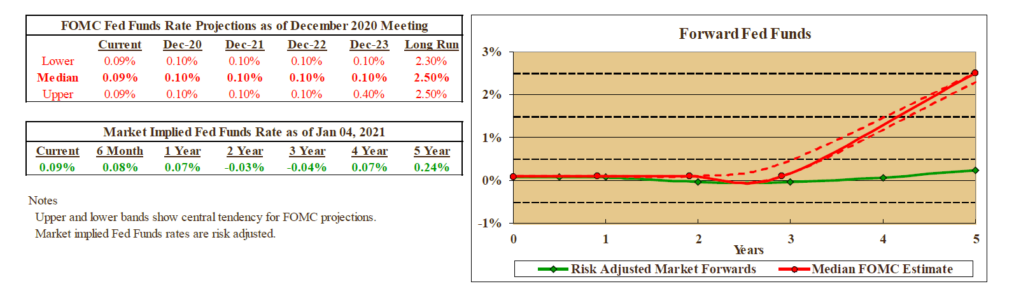

- Federal Reserve policy remained very accommodative. Federal Reserve officials reiterated their commitment to not raise rates until inflation exceeds 2% for at least one full year. The Fed also continued to expand their already massive balance sheet in the fourth quarter. Purchases of Treasury bonds and other securities increased the Fed’s holdings of securities from $6.3 trillion at the end of the third quarter to $6.7 trillion at year end.

Stairway Partners, LLC © 2021

This material is based upon information that we believe to be reliable, but no representation is being made that it is accurate or complete, and it should not be relied upon as such. This material is based upon our assumptions, opinions and estimates as of the date the material was prepared. Changes to assumptions, opinions and estimates are subject to change without notice. Past performance is not indicative of future results, and no representation is being made that any returns indicated will be achieved. This material has been prepared for information purposes and does not constitute investment advice. This material does not take into account particular investment objectives or financial situations. Strategies and financial instruments described in this material may not be suitable for all investors. Readers should not act upon the information without seeking professional advice. This material is not a recommendation or an offer or solicitation for the purchase or sale of any security or other financial instrument.

You must be logged in to post a comment.