Global Market and Economic Perspective

Global Economic Commentary

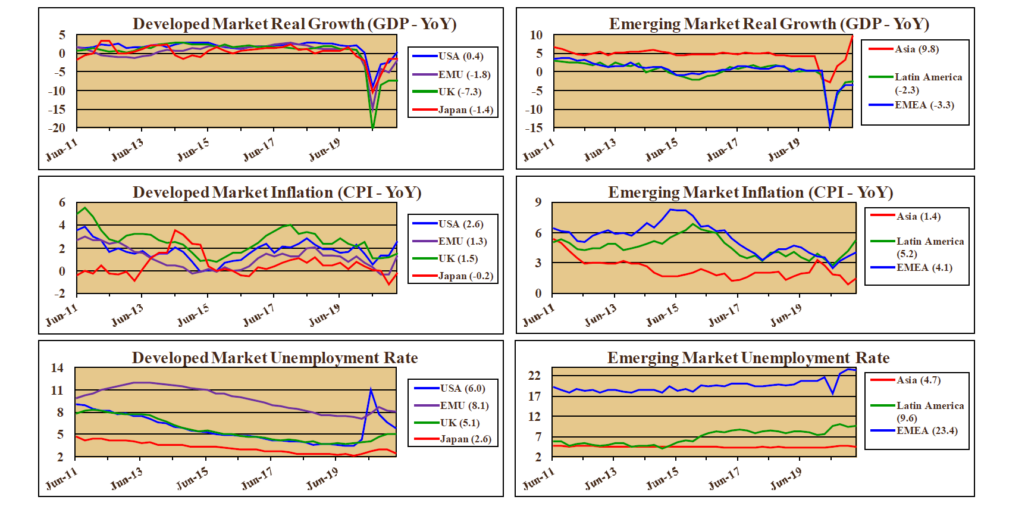

- The first quarter of 2021 marked one year since the COVID-induced lockdowns from last March. In the US, first quarter economic growth continued its recovery from the sharp declines of the first half of 2020. Personal consumption expenditures were buoyed by the massive stimulus payments to individuals, in the form of both direct payments and enhanced unemployment benefits. Housing was particularly strong, driven by the desire for more space by work-from-home employees.

- Chinese GDP growth was particularly strong in the first quarter, due to continued demand both domestically and from exports to the US and other developed countries. In Europe, economic growth was held back in a number of countries, most notably Germany and the UK, as another round of lockdowns were put in place to combat rising coronavirus infection numbers.

- Unemployment patterns largely mirrored GDP growth, with less-open countries witnessing continued softness in their labor markets. In the US in the first quarter, increasing numbers of employers began to complain of an inability to hire new workers and rehire furloughed workers, despite the still-elevated unemployment rate. This has been attributed to the ongoing, generous level of unemployment benefits.

- The US experienced a modest resurgence in core inflation due to supply bottlenecks and strong demand.

Stairway Partners is an SEC-registered Investment Advisor providing comprehensive investment advice and industry-leading portfolio management solutions. Our firm was created to provide institutions and individual investors with transparent and cost-effective stewardship of their assets. Our sophisticated investment capabilities and a steadfast commitment to the industry’s best practices have allowed us to serve as a valued advisor and trusted fiduciary to clients throughout the United States. For more information, please call (630) 371-2626 or email us at stairwaypartners@stairwaypartners.com.

Global Equity and Currency Commentary

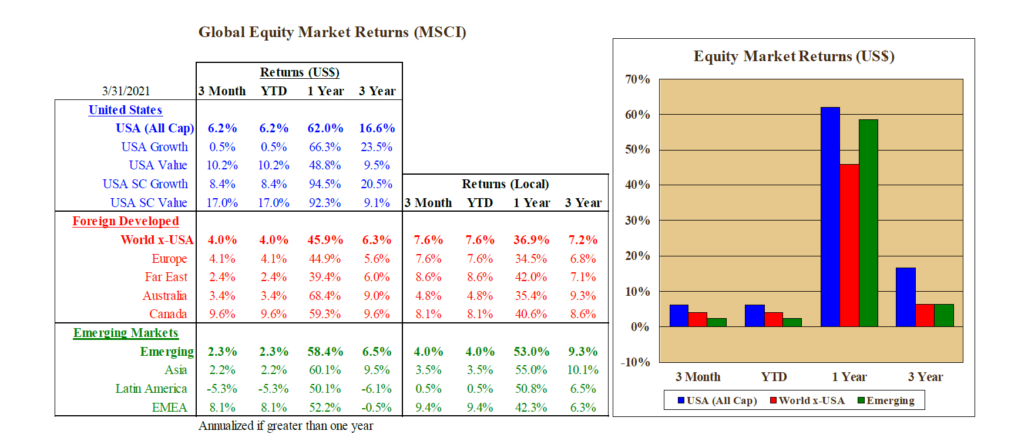

- Developed equity markets produced strong returns in the first quarter, despite a rise in interest rates which has the effect of increasing the equity discount rates, which in turn puts downward pressure on prices. This discount rate effect was more than offset by a number of positive factors including; the recovery in earnings from their depressed levels in the first half of 2020, extraordinary financial support from national governments, and investors’ optimism that vaccinations will lead to the lifting of lockdowns.

- Returns in emerging markets were good, but not quite as high as in developed markets. Despite its smaller magnitude, first quarter performance boosted the 1-year return to nearly 60%.

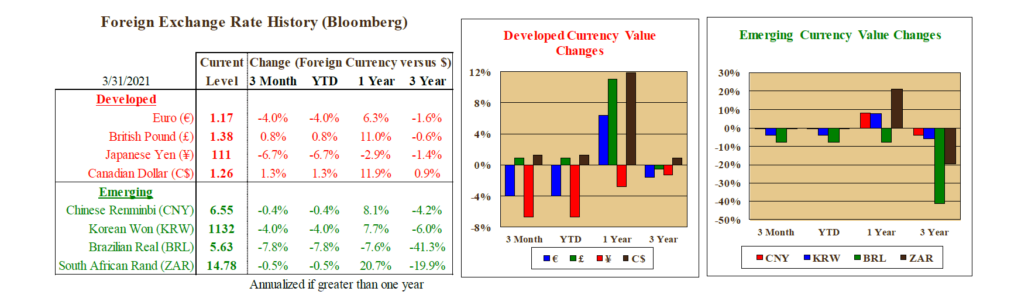

- In contrast to the past several quarters where foreign currencies gained in value, the US dollar experienced a modest reversal and appreciated in the first quarter, as economic strength and higher interest rates attracted foreign investors.

US Fixed Income and Fed Commentary

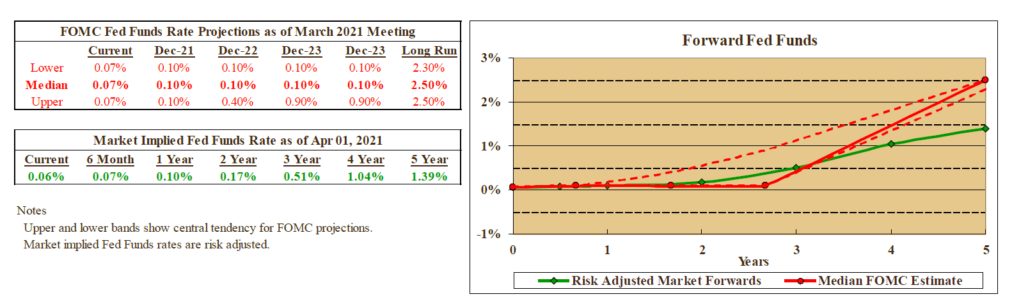

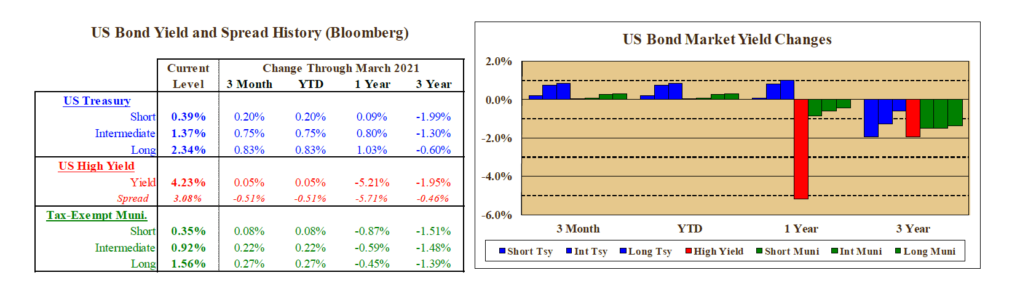

- As GDP growth continued to recover and inflationary pressures reappeared, bond investors drove Treasury yields higher in the first quarter, especially for intermediate and long-term bonds. This resulted in some of the weakest returns for US Treasuries in decades.

- The Federal Reserve maintained its long-standing posture, despite the concerns expressed by investors in pushing yields higher. The Fed continued to state that inflation expectations are “well anchored” and that they are not concerned with inflation running somewhat above their 2% target for a while. In addition, they believe that the upward trend in the first quarter is transitory, resulting from price index softness a year earlier.

- Equity market strength supported pricing in credit-sensitive bonds, particularly in the high yield market, where the decline in credit spreads offset nearly all of the increase in underlying Treasury yields.

Stairway Partners, LLC © 2021

This material is based upon information that we believe to be reliable, but no representation is being made that it is accurate or complete, and it should not be relied upon as such. This material is based upon our assumptions, opinions and estimates as of the date the material was prepared. Changes to assumptions, opinions and estimates are subject to change without notice. Past performance is not indicative of future results, and no representation is being made that any returns indicated will be achieved. This material has been prepared for information purposes and does not constitute investment advice. This material does not take into account particular investment objectives or financial situations. Strategies and financial instruments described in this material may not be suitable for all investors. Readers should not act upon the information without seeking professional advice. This material is not a recommendation or an offer or solicitation for the purchase or sale of any security or other financial instrument.

You must be logged in to post a comment.