Global Market and Economic Perspective

Global Economic Commentary

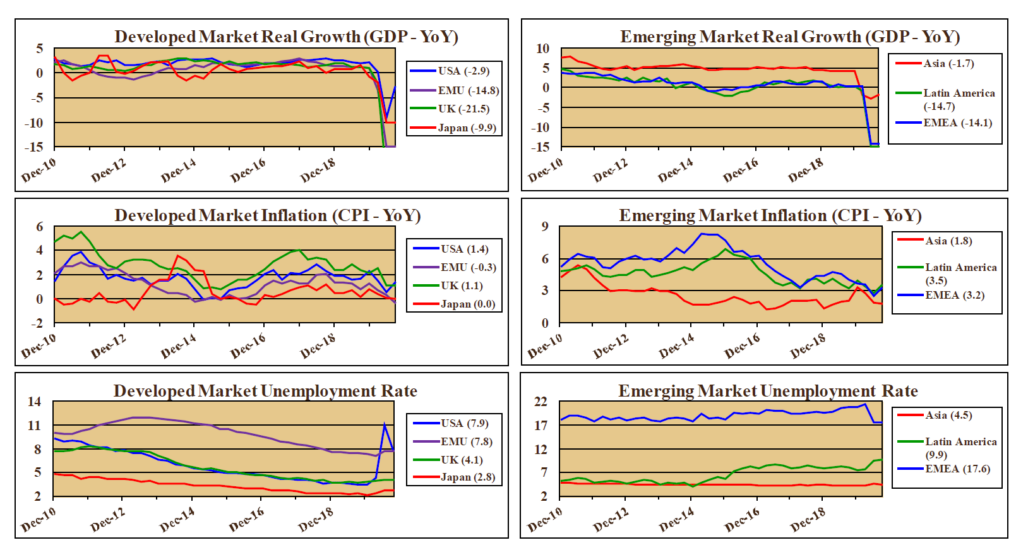

- After the sharpest downturn on record in this year’s second quarter, the US economy rebounded fairly strongly in the third quarter. Despite the rapid growth in GDP during the third quarter, output was still 3.5% below its peak level in the fourth quarter of 2019.

- Because the recession and recovery have not been V-shaped, the unemployment rate had fallen only to 7.9% at the end of September, from its April peak of 14.7%. It remains quite far from its pre-pandemic low of 3.5%. The large pick-up in hiring after the recession trough was not sustained, and it is likely that many job losses will be long-lasting or even permanent. Although employment in September was up 10.6% from its April low, it remained more than 7% below the pre-recession level.

- Economic activity and employment have been hampered by the persistence of lockdowns throughout the world. In a number of European countries, such as France and Germany, accelerating coronavirus infections have led to a second round of restrictions and lockdowns.

- The economic recovery has been much stronger in Asia, which was the site of the first wave of infection and lockdowns. China is the only major economy expected to record positive real growth in 2020.

Stairway Partners is an SEC-registered Investment Advisor providing comprehensive investment advice and industry-leading portfolio management solutions. Our firm was created to provide institutions and individual investors with transparent and cost-effective stewardship of their assets. Our sophisticated investment capabilities and a steadfast commitment to the industry’s best practices have allowed us to serve as a valued advisor and trusted fiduciary to clients throughout the United States. For more information, please call (630) 371-2626 or email us at stairwaypartners@stairwaypartners.com.

Global Equity and Currency Commentary

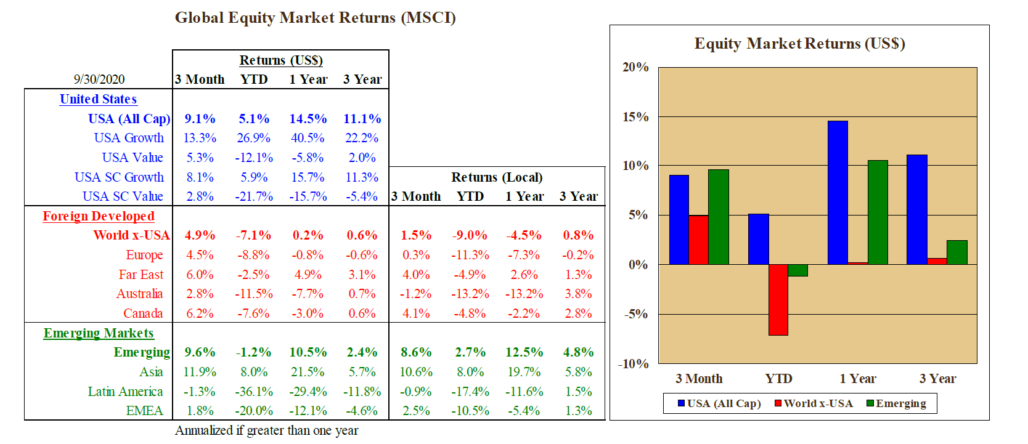

- In the third quarter, equity markets largely continued the rebound that began in the second quarter, although the gains were not nearly as large. In the US, third quarter appreciation resulted in the equity market finishing September with a positive year-to-date return. Growth stocks, specifically some of the large-cap technology names, performed particularly well. Firms such as Amazon, Netflix, and Microsoft continued to benefit from the work-from-home and stay-at-home environment.

- Outside the US, both developed and emerging markets experienced strong performance, particularly in the Asian emerging markets.

- Several countries experienced poor performance in Q3, including the UK, where the lack of substantial progress toward a final Brexit agreement with the European Union increased the likelihood of a no-deal withdrawal at year-end. Several resource-heavy emerging market countries, such as Brazil and Russia, also lagged in the third quarter.

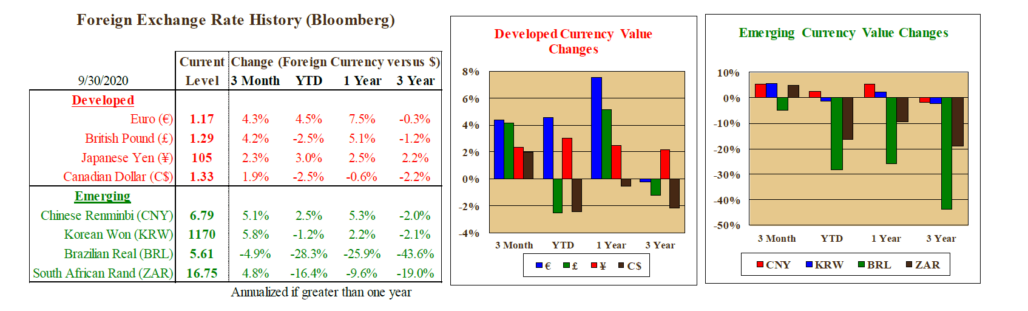

- US dollar weakness in the third quarter boosted returns on non-US equity investments, by over 3.5% in the MSCI EAFE developed markets index and nearly 1.0% in the MSCI Emerging Markets index.

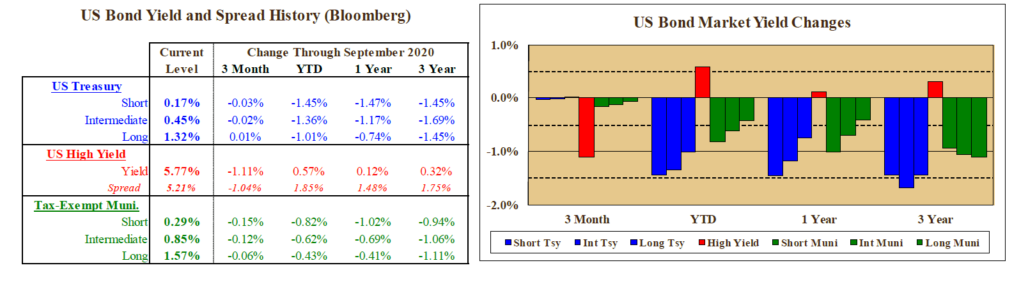

US Fixed Income and Fed Commentary

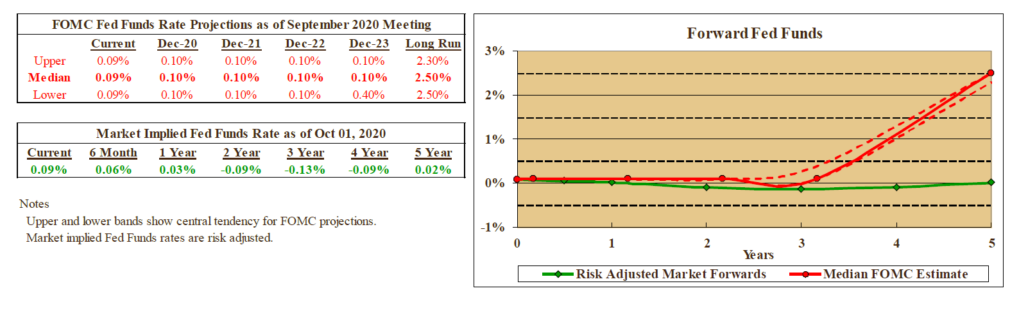

- The Federal Reserve did not change its zero-rate policy during the third quarter, resulting in yields on US Treasury securities remaining low across the entire range of maturities. A small increase in yields on long-term bonds resulted in a minor decrease in values due to their sensitivity to interest rate changes. However, the decline in value was not large enough to completely offset the yield, so Treasury bonds finished the quarter with positive returns.

- Corporate bonds performed well, given both their yield advantage over Treasuries and their sensitivity to stock prices and the improving economic environment. Those same factors drove even stronger performance in high yield bonds, where the sensitivity to default risk is considerably higher.

- The Fed’s Open Market Committee, which is responsible for setting monetary policy, maintained its expectation that the short-term policy interest rate will be held at or near zero for several more years. This is due to the absence of inflation pressures currently and an explicit willingness on the part of the FOMC to allow above-target inflation while the economy returns to a more normal state. All but the most distressed bonds are expected to benefit from the Fed’s ongoing purchase program, which is likely to last beyond the end of 2021.

Stairway Partners, LLC © 2021

This material is based upon information that we believe to be reliable, but no representation is being made that it is accurate or complete, and it should not be relied upon as such. This material is based upon our assumptions, opinions and estimates as of the date the material was prepared. Changes to assumptions, opinions and estimates are subject to change without notice. Past performance is not indicative of future results, and no representation is being made that any returns indicated will be achieved. This material has been prepared for information purposes and does not constitute investment advice. This material does not take into account particular investment objectives or financial situations. Strategies and financial instruments described in this material may not be suitable for all investors. Readers should not act upon the information without seeking professional advice. This material is not a recommendation or an offer or solicitation for the purchase or sale of any security or other financial instrument.

You must be logged in to post a comment.