At Stairway Partners, we emphasize transparent reporting of investment performance. Accurate and timely performance reporting allows an investor to understand how well their portfolio has done in terms of meeting their objectives.

Introduction

At Stairway Partners, we emphasize transparent reporting of investment performance. Accurate and timely performance reporting allows an investor to understand how well their portfolio has done in terms of meeting their overall return objective.

Stairway Partners also provides performance attribution, which includes information on how decisions on the portfolio’s exposures have contributed to the portfolio’s return. In other words, we examine how the returns in the various investments, in different asset classes, sum to create the overall portfolio return. This information allows the investor to understand whether performance was in line with expectations, and also what the sources of this performance were. Just as importantly, attribution also permits Stairway Partners to evaluate the impact of our advice and decisions.

Portfolio Objectives

If one purpose behind reporting is to evaluate how the portfolio is doing in meeting objectives, a logical follow-up question is “Where do these objectives come from?” An investor’s return objective and tolerance for accepting risk are embedded in the investment policy. A higher return objective generally points toward a larger share of equities and a smaller allocation to bonds.

The return objective should be based on the future liability the portfolio is designed to satisfy. For example, a pension fund will need to earn a return sufficient to make the retirement payments that have been promised to participants. An endowment fund will have a stream of desired payments, such as funding a portion of the operating budget of an educational institution. An individual’s return objective could be a function of how much that person’s portfolio needs to grow in order to support anticipated future outlays, such as retirement spending, a home purchase, or desired bequests to children.

It is important to recognize that striving for a higher return entails taking greater risk. This means the investor needs to have a greater willingness to endure fluctuations in the value of their portfolio.

“An investor’s return objective and tolerance for accepting risk are embedded in the investment policy”

Investment Policy

The investment policy for a client’s portfolio is specified at the outset of the relationship, when Stairway Partners is hired to manage the investor’s assets. This policy explicitly defines the asset allocation guidelines – the asset classes and their “normal” allocations. As numerous studies have shown, a portfolio’s overall risk and return over time are determined largely by the portfolio’s asset allocation – what percentage is allocated to stocks and how much to bonds. This vein of research was triggered by the ground-breaking study by Brinson, Hood, and Beebower (Financial Analysts Journal, 1986). The authors found that over 90% of a portfolio’s return variability could be attributed to asset allocation, with only very small amounts attributable to active decisions such as security selection.

For example, a portfolio with a moderate level of risk might have a policy asset mix that specifies a normal weight of 60% in equities and 40% in bonds, with ranges around those amounts to allow for active asset allocation strategies. This policy could have, for performance measurement, a benchmark that is as simple as a blend of two indexes: 60% MSCI All-Country World (the equity index) + 40% Bloomberg Barclays Global Aggregate (the bond index). This 60/40 two-index blend can serve as a reasonably good proxy or benchmark for moderate-risk global balanced portfolios.

However, these two indexes are extremely broad and encompass what we (and most others) consider to be separate and distinct asset classes, such as both US and non-US equities. When developing policy benchmarks, we specify separate allocations to: US equities, non-US developed equities, emerging equities, core US bonds (either taxable investment grade or municipal, depending on the client’s tax situation), high yield bonds, emerging markets bonds, and cash.

Specifying these asset classes and assigning them allocations individually in the policy provides a number of advantages over the simple two-index benchmark. Importantly, this disaggregated or higher-resolution benchmark allows Stairway the ability to construct portfolios with more precisely targeted characteristics. It also provides the ability to set a higher-than-market capitalization weight on the US assets. This “home bias” reduces the risk that arises from currency exposures inherent in holding non-US assets. Both of these factors should provide for an increased likelihood of achieving better returns over time, while also allowing for a more insightful analysis of performance.

Stairway Partners Reporting

The way in which we analyze and report performance is based on the seminal methodology described by Brinson and Fachler over 30 years ago (Measuring Non-US Equity Portfolio Performance, Journal of Portfolio Management, 1985). The methodology deconstructs returns into “contributors” to performance – either absolute or relative to a benchmark.

“Our performance reporting reinforces Stairway Partners’ commitment to transparency.”

The approach uses weights and returns to calculate contributions to performance. For example, if a portfolio had a 20% allocation to an asset class that experienced a return of 10%, the contribution of that asset class to the overall portfolio return would have been 20% × 10% = 2%.

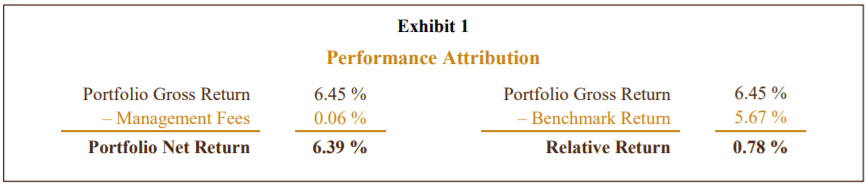

Exhibit 1 shows the summary returns in Stairway Partners’ performance attribution report. The report is composed of several different sections, which we explain below.

Summary Returns

In Exhibit 1, we start with showing the total return, for the selected time period, for both the portfolio and its policy benchmark. Portfolio returns are shown both gross and net of Stairway Partners’ management fees. Note however that the portfolio’s gross return reflects the impact of all underlying ETF and mutual fund expenses, as well as any trading expenses incurred during the period.

All returns are calculated monthly, and for periods longer than 12 months the returns are annualized. This means that, if a performance measurement period of more than a year is selected, the return numbers are average annual returns.

The policy benchmark return is the hypothetical return that would have been earned if one were able to invest directly in the underlying indexes that comprise the policy benchmark. This is hypothetical because indexes by themselves are not “investible” and benchmark returns do not reflect the expenses related to investing in the underlying funds that are designed to track the indexes. Furthermore, because we calculate performance on a monthly basis, the calculation of benchmark returns assumes that the fixed policy weights are reset each month. While there is an implicit cost to this rebalancing, any transaction costs associated with rebalancing are not reflected in the benchmark returns.

The relative return is the difference between the gross portfolio return and the benchmark return. This shows how the portfolio’s return – before management fees, but after all fund expenses and trading expenses – compares to the policy benchmark return over the relevant time period. Stairway Partners uses gross returns rather than net returns for calculating performance attribution, which is consistent with industry practice. The primary reason for using gross returns is to allow the asset management decisions to be isolated from the other factors that affect portfolio returns.

Return Attribution

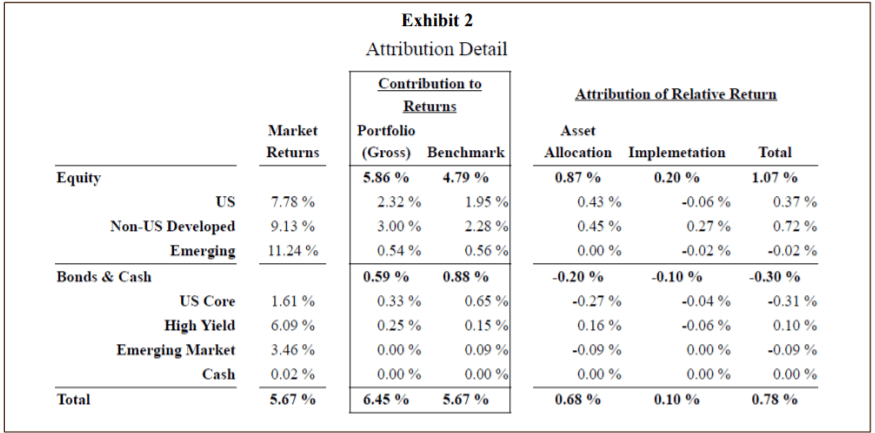

Next, we turn to the performance attribution, which explains how the total returns were generated. The first column of numbers in Exhibit 2 simply shows, for the period, the returns for each asset class benchmark index: US equity, non-US developed equity, emerging equity, core bonds (municipal or investment-grade taxable), high yield bonds, emerging market bonds, and cash.

The next two columns of numbers (in box, labeled as “Contribution to Returns”) show the contribution that each asset class made to the total returns of the benchmark and the portfolio. The total return of the policy benchmark in each month is the sum of: the index return in each asset class multiplied by the asset class’ weight in the overall benchmark. For example, in Exhibit 2 the 1.95% US Equity contribution to the 5.67% total benchmark return is calculated as the US equity index return of 7.78% multiplied by the policy weight of 25%.

Total return of the portfolio is analogous. It is the sum of: the return of the investments in each asset class multiplied by the actual weight of the asset class in the portfolio. Note that the total returns in the bottom row match the total returns in Exhibit 1, which simply means that the individual contributions do indeed sum to the total.

For periods longer than one month, the various components of the contributions are aggregated to a full-period contribution. This is because the weights can change, sometimes substantially, over time. So using an average weight and the average annual full-period return could produce a meaningless result.

Due to Stairway Partners’ asset allocation and investment fund selection decisions, both the asset class weights and their returns in the portfolio can, and typically will, differ from the policy weights and the returns to the benchmark indexes. These management decisions are evaluated in the last three columns, which show the attribution detail (labeled as “Attribution of Relative Return”). The relative return is broken down into two main categories: Asset Allocation and Implementation.

Asset Allocation

Asset Allocation captures the effect of top-level asset class weighting decisions – in other words, the effect of the portfolio holding an allocation that differs from the weight in the investment policy. Ideally, our strategies will allocate more of a portfolio to asset classes that perform well and less to asset classes that perform poorly. The total Asset Allocation figure shows how much our asset class decisions contributed to or detracted from performance.

Mathematically, the Asset Allocation component in each asset class is the passive benchmark return for a given segment multiplied by the active weight (which is the overweight or underweight relative to the benchmark weight). For example, if high yield bonds had a negative return during the measurement period, and our strategy had been to underweight that asset class, the Asset Allocation amount would be positive. Value was added to the portfolio by avoiding a loss.

Implementation

Implementation is also fairly straightforward: it shows whether the portfolio’s investments in a given asset class performed better or worse than that asset class’ index return. Implementation captures several different effects.

The first effect relates to mutual fund and ETF expenses. Even if the portfolio’s exposure in an asset class is “identical” to the benchmark index, actual performance would be expected to fall short of the index due to fund expenses within the ETF or mutual fund. For example, in US equity, where the benchmark is the Russell 3000 index, the portfolio’s US equity exposure might be held entirely in a Russell 3000 ETF. But the Russell 3000 ETF has an annual expense ratio of 0.20%.

Second, we could have an explicit strategy within an asset class that differs somewhat from the benchmark index exposure. For example, if we consider small-capitalization stocks to be more attractive than large cap, some of the US equity exposure might be held in a small-cap ETF rather than in the Russell 3000 ETF. Therefore, to the extent that small-cap performance differs from broad market performance as measured by the Russell 3000, the Implementation figure will show how much the performance of the actual investments added to or subtracted from the benchmark index’s performance.

In a few asset classes, such as High Yield Bonds, liquid passive investment vehicles do not exist that track the indexes we use for performance-measurement purposes. In this case, the investment vehicle’s pricing can deviate from the index level day to day, which will cause Implementation to reflect a positive or negative value.

The Implementation numbers also include effects that result from intra-month asset allocation changes. For example, consider a hypothetical situation in which the US equity market declines 5% from the start of a month until mid-month, then recovers fully by the end of the month. Further assume that we increased the US equity allocation in portfolios at the mid-month low. The benchmark US equity return for the month would be zero, with the index beginning and ending the month at the same level. However, there would be value added from the strategy change because of the increased exposure at a point that was 5% below the end-of-month index level. In our attribution, this added value appears as part of Implementation.

Finally, Implementation includes some unavoidable distortions. For instance, to the extent that portfolios include non-US equity exposure, there will frequently be a disconnect between the closing price of the ETFs that are held in those asset classes and the benchmark indexes against which we measure performance. For example, the Japanese equity market is a fairly large share of the MSCI EAFE (developed non-US equity) index. Trading on the Tokyo Stock Exchange closes at 3:00 p.m. local time, which is 1:00 a.m. (Standard time) in New York. So, the index pricing level for Japan is set more than half a day before the ETF stops trading in New York. If the last business day of the month sees a substantial movement in the US equity market – upward or downward – that does not get reflected in the Japanese market until the next trading day. As a result, the Implementation performance can show a fairly large negative or positive number.

Conclusion

We believe that our performance reporting strikes a good balance between simplicity and providing substantial useful information. Each of the components of the report provides an easy-to-comprehend piece of information, from an overall return to a return contribution to benchmark-relative performance. This provides our clients with the information they need to understand the progress they are making toward achieving their objectives. Our performance reporting reinforces Stairway Partners’ commitment to transparency. It also provides us with information that we use to evaluate and improve our investment decisions and processes.

Stairway Partners, LLC © 2020

This material is based upon information that we believe to be reliable, but no representation is being made that it is accurate or complete, and it should not be relied upon as such. This material is based upon our assumptions, opinions and estimates as of the date the material was prepared. Changes to assumptions, opinions and estimates are subject to change without notice. Past performance is not indicative of future results, and no representation is being made that any returns indicated will be achieved. This material has been prepared for information purposes and does not constitute investment advice. This material does not take into account particular investment objectives or financial situations. Strategies and financial instruments described in this material may not be suitable for all investors. Readers should not act upon the information without seeking professional advice. This material is not a recommendation or an offer or solicitation for the purchase or sale of any security or other financial instrument.

You must be logged in to post a comment.