Global Market and Economic Perspective

Global Economic Commentary

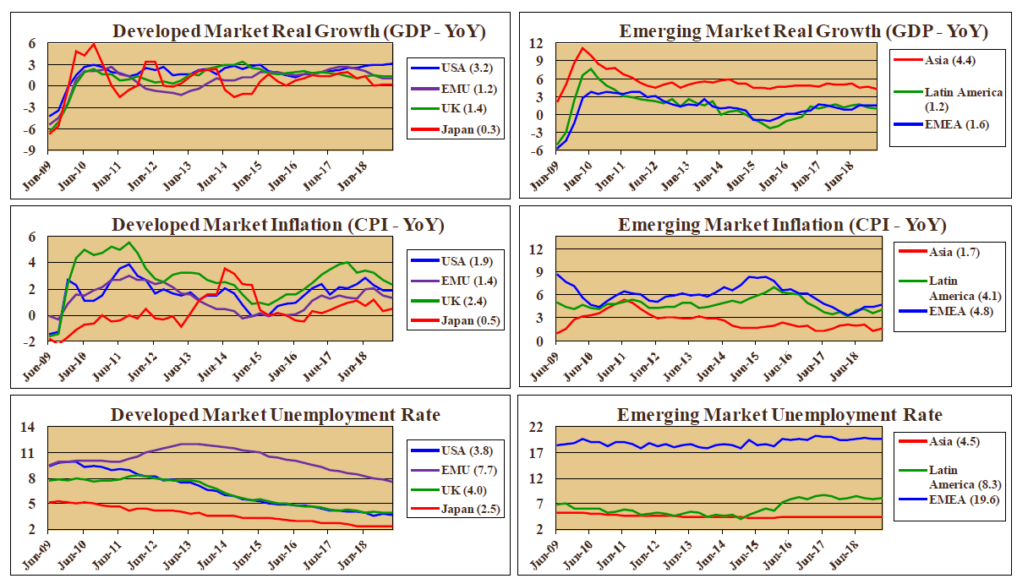

- GDP growth in the US remained at a healthy level of 3.0% or better during both the fourth quarter of 2018 (data release was delayed due to the government shutdown) and the first quarter of 2019. As a result, the unemployment rate has stayed below 4.0% thus far in 2019. Despite this economic strength, inflation has yet to emerge as a threat, with the consumer price index rising at an annualized rate of only 1.9%.

- Developed market economies outside the US are experiencing more sluggish growth. The UK economy continues to suffer from Brexit-related weakness in corporate investment spending, and many countries, such as Japan and Italy, have fiscal and structural problems (e.g. high debt levels and aging populations) that are suppressing growth.

- In emerging economies, the economic picture continued to be better than in developed economies. Growth in Asia, in particular, remained healthy, although somewhat softer than in years past. For example, China’s GDP has been closer to 6% in recent quarters, rather than the 8%-9% range of 5 years ago.

Stairway Partners is an SEC-registered Investment Advisor providing comprehensive investment advice and industry-leading portfolio management solutions. Our firm was created to provide institutions and individual investors with transparent and cost-effective stewardship of their assets. Our sophisticated investment capabilities and a steadfast commitment to the industry’s best practices have allowed us to serve as a valued advisor and trusted fiduciary to clients throughout the United States. For more information, please call (630) 371-2626 or email us at stairwaypartners@stairwaypartners.com.

Global Equity and Currency Commentary

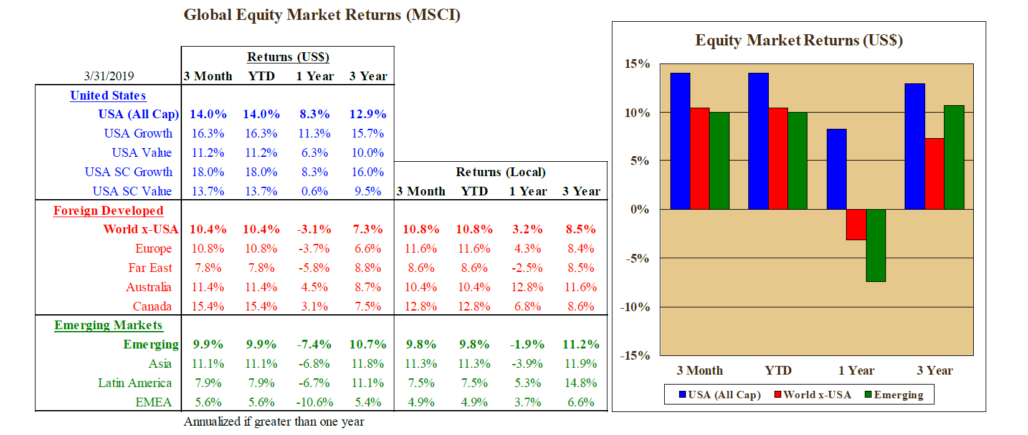

- The first quarter of 2019 saw equity markets largely erase the steep losses they produced in the fourth quarter of last year. This recovery did not seem to come as the result of substantive positive news, but rather from investors becoming less pessimistic and more willing to buy riskier assets.

- In the US, stock market gains were particularly strong. Interestingly, this was despite the fact that profit growth expectations for 2019 turned negative, with first quarter S&P 500 earnings appearing as though they will show a year-on-year decline for the first time since 2016.

- Both in the US and in other markets, some of the buoyancy in equities can be attributed to expectations that central banks will not raise rates in 2019. Likewise, concerns around growth in China have diminished, which led to strong performance in Asian emerging markets.

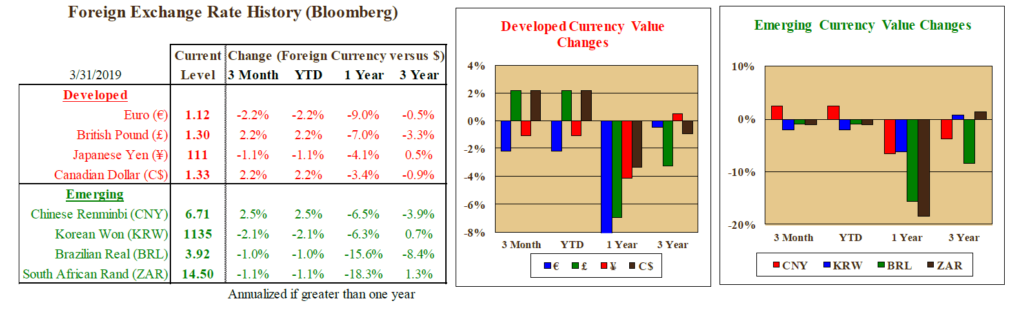

- The US dollar showed only a small gain during the quarter against a broad basket of currencies, which detracted a bit from non-US equity returns.

US Fixed Income and Fed Commentary

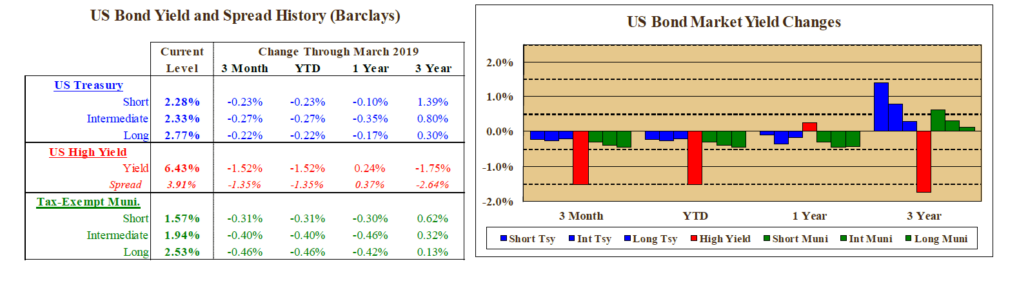

- The US Treasury yield curve inverted for a short time during the first quarter, which means that yields on longer-term Treasury bonds were lower than yields on short-term T-bills. This unusual situation raised some concerns, as historically an inverted yield curve has presaged an economic downturn. Most observers were not overly worried, however, because the inversion was short-lived and was also not reflected in other yield curves, such as corporate bonds.

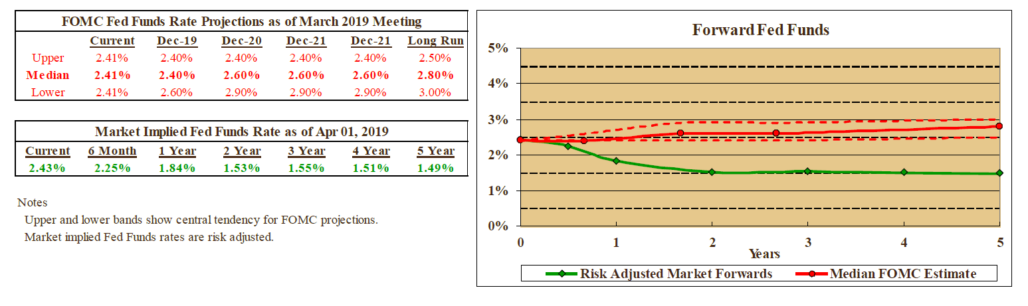

- Long-term interest rates declined due to investors’ belief that the Fed is unlikely to raise short-term interest rates further, and might reduce rates in 2019. We continue to believe that these market expectations are inaccurate, and the next interest rate move from the Fed is more likely to be an increase rather than a decrease. Although the Fed has softened the language in their policy pronouncements, they have only stated that they are pausing in the timetable – not reversing course and planning cuts.

- Given the decline in Treasury yields during the quarter, longer-term bonds performed very well, and short- and intermediate-term Treasury notes also produced good returns. Yields in credit-sensitive sectors, such as emerging markets bonds and US high yield bonds, generated large gains, as their yields fell due to both the decline in the underlying Treasury yield curve and a narrowing in credit spreads.

Stairway Partners, LLC © 2021

This material is based upon information that we believe to be reliable, but no representation is being made that it is accurate or complete, and it should not be relied upon as such. This material is based upon our assumptions, opinions and estimates as of the date the material was prepared. Changes to assumptions, opinions and estimates are subject to change without notice. Past performance is not indicative of future results, and no representation is being made that any returns indicated will be achieved. This material has been prepared for information purposes and does not constitute investment advice. This material does not take into account particular investment objectives or financial situations. Strategies and financial instruments described in this material may not be suitable for all investors. Readers should not act upon the information without seeking professional advice. This material is not a recommendation or an offer or solicitation for the purchase or sale of any security or other financial instrument.

You must be logged in to post a comment.