Global Market and Economic Perspective

Global Economic Commentary

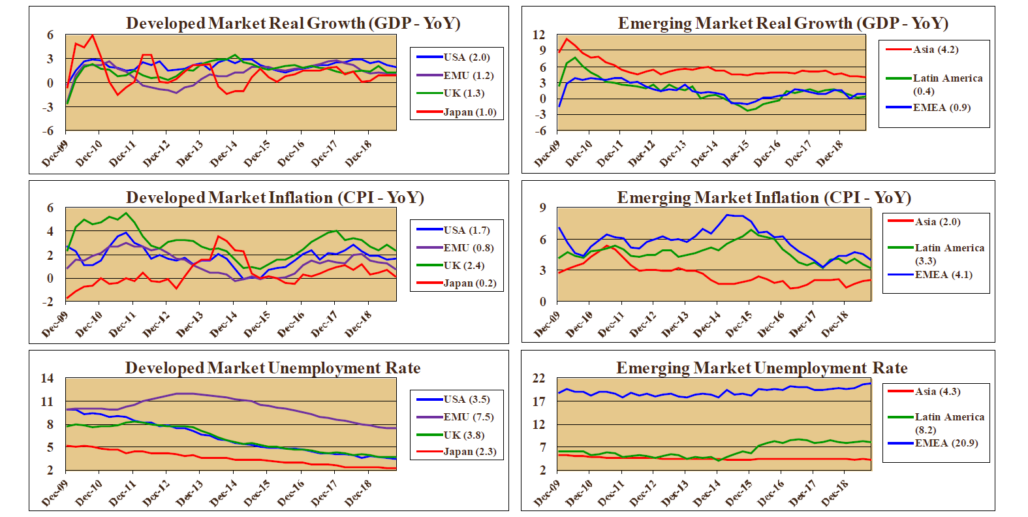

- Real GDP growth in the US slowed again in the third quarter, falling to just below 2.0%. This slowing can be at least partially attributed to the disappearance of the one-off tax cut stimulus. In addition, agriculture and manufacturing suffered from a lack of progress in settling the trade and tariff conflicts. The labor market continued to show strength, with the unemployment rate around 50-year lows and unfilled job openings running at a high level.

- The slowdown is global in nature, with the German economy – a main driver of European growth – weakening and perhaps even entering a recession. Manufacturing has been particularly weak, as international trade continued to suffer the effects of tariff disputes. For example, industrial production in the US peaked in December 2018 and in Germany it has been declining throughout most of 2019 also.

- Emerging markets were not immune. GDP growth in China continued to trend slowly down, with third quarter growth figure reported at 6.0% over the previous year. This was the smallest increase in over 25 years. Indications point to India also suffering economic weakness.

- Slower growth has helped keep inflationary pressures largely in check. Interestingly, although headline CPI inflation in the US during 2019 has been in a narrow range between 1.5% and 2.0%, core CPI (ex food and energy) rose from 2.0% in May to 2.4% in August.

Stairway Partners is an SEC-registered Investment Advisor providing comprehensive investment advice and industry-leading portfolio management solutions. Our firm was created to provide institutions and individual investors with transparent and cost-effective stewardship of their assets. Our sophisticated investment capabilities and a steadfast commitment to the industry’s best practices have allowed us to serve as a valued advisor and trusted fiduciary to clients throughout the United States. For more information, please call (630) 371-2626 or email us at stairwaypartners@stairwaypartners.com.

Global Equity and Currency Commentary

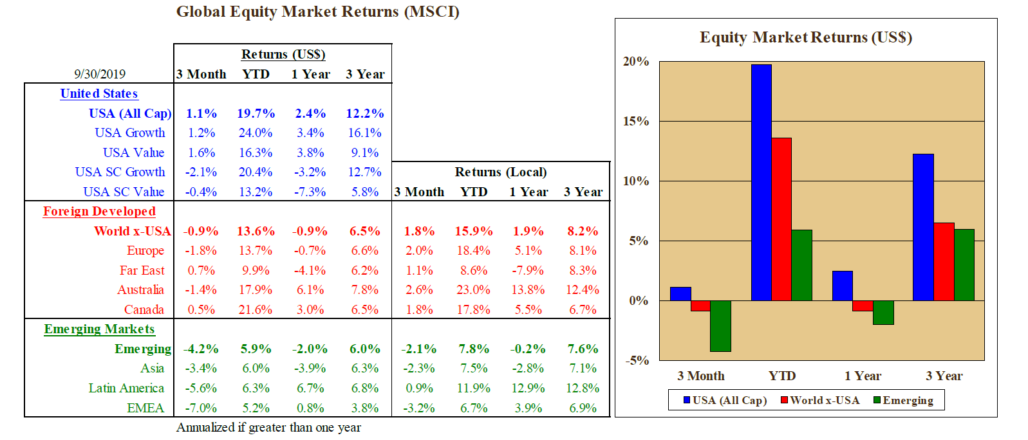

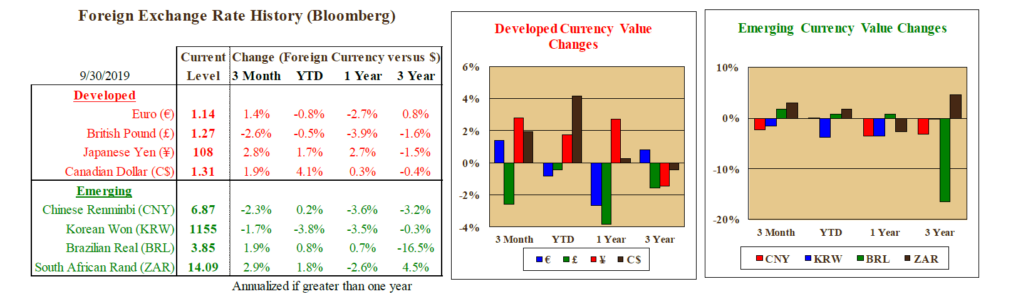

- During the third quarter, equities in foreign developed and emerging markets produced negative returns, as the trade and tariff conflict, coupled with weakening growth, led to both stock market declines and weaker currencies relative to the US dollar. In non-US developed equity markets, positive local-currency returns were offset by a stronger dollar.

- In both non-US developed markets and emerging markets, earnings have been flat or weakening during much of 2019, including the third quarter.

- Returns in the US equity market were positive during the quarter, despite several headwinds. In addition to trade disputes weighing on the manufacturing sector, profits growth was developing as a negative. According to FactSet, a data provider, earnings of S&P 500 companies are estimated to decline around 3% for the quarter. Earnings for firms with over 50% of their revenues sourced outside the US are estimated to be under greater pressure, with a decline of around 10%. This should mean that profits at smaller capitalization domestically oriented firms hold up better.

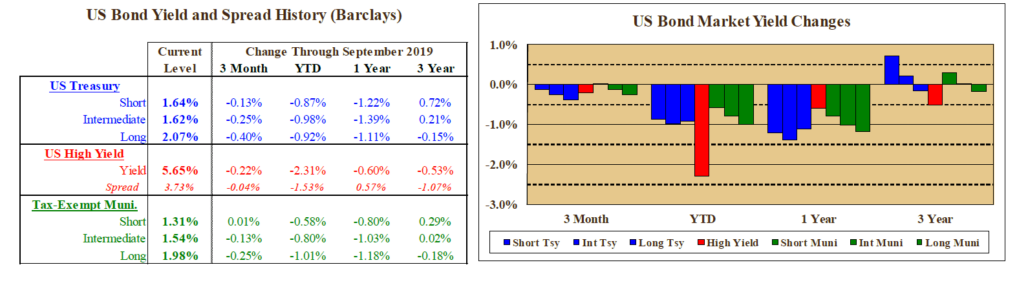

US Fixed Income and Fed Commentary

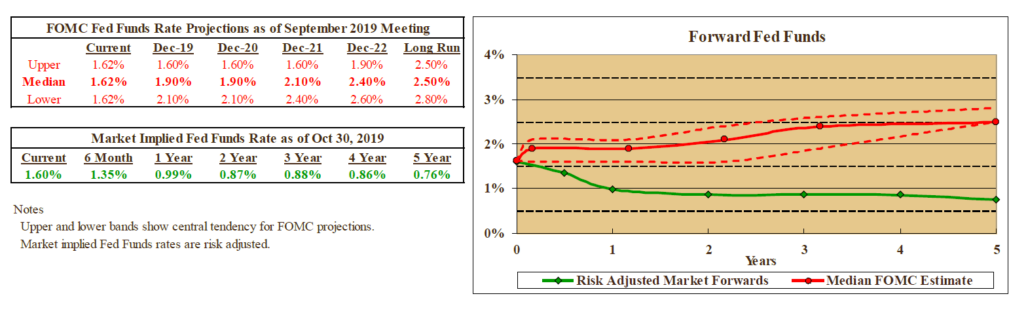

- The Federal Reserve cut its policy interest rate by one-quarter of a percentage point twice during the third quarter, and an additional time at the end of October. Although the economy continued to perform well, with unemployment at historic lows and GDP growth remaining modestly positive, Chairman Powell portrayed these cuts as “insurance” against a potential downturn. In addition, inflation has not risen sharply, and financial market participants had very strong expectations of rate cuts, which might have played into the Fed Board’s deliberations.

- Longer-term interest rates declined along with the decreasing short-term rates in the third quarter. These falling yields produced good returns across the US bond market, particularly in the longest-maturity bonds.

- High yield bonds and emerging markets debt also performed well, but did not match the returns produced by investment-grade sectors.

- Negative policy rates outside the US have dragged corporate yields into unprecedented territory. Over 25% of the bonds in the Bloomberg Barclays Non-US Aggregate Bond Index had negative yields at the end of the quarter, guaranteeing investors who hold those bonds to maturity a negative return.

Stairway Partners, LLC © 2021

This material is based upon information that we believe to be reliable, but no representation is being made that it is accurate or complete, and it should not be relied upon as such. This material is based upon our assumptions, opinions and estimates as of the date the material was prepared. Changes to assumptions, opinions and estimates are subject to change without notice. Past performance is not indicative of future results, and no representation is being made that any returns indicated will be achieved. This material has been prepared for information purposes and does not constitute investment advice. This material does not take into account particular investment objectives or financial situations. Strategies and financial instruments described in this material may not be suitable for all investors. Readers should not act upon the information without seeking professional advice. This material is not a recommendation or an offer or solicitation for the purchase or sale of any security or other financial instrument.

You must be logged in to post a comment.