Global Market and Economic Perspective

Global Economic Commentary

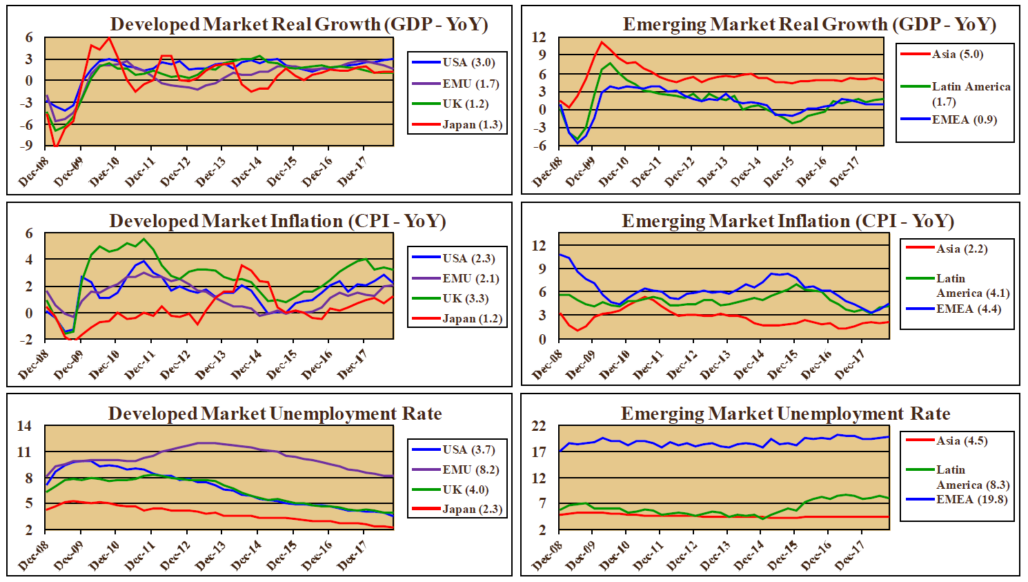

- Third-quarter GDP growth in the US continued its strong pace seen earlier in the year. However, the good headline number masked some potentially troubling underlying data points. While increased government spending was a big contributor and consumption was relatively good, there was weakness in home building (new home sales have been falling during most of 2018), exports, and investment spending. In addition, one of the larger contributors was the build-up by businesses of unsold inventories. Other indicators though pointed to further economic strength: small business optimism remained high, unfilled positions were at a record level, and initial claims for unemployment insurance hit a record low.

- Economic growth outside the US softened a bit in a number of markets, including the Eurozone. China saw its growth rate slow from the rapid pace of previous years, seemingly as the result of the US trade and tariff actions. Now that nearly a decade has elapsed since the end of the financial crisis, economic growth and low unemployment rates appear finally to be producing wage gains.

- Low unemployment and good growth are feeding into some mild increases in prices. Headline inflation rates rose during the quarter in a number of the emerging markets, the Eurozone, and Japan. In the US, core inflation (excluding energy and food) hit a post-crisis high.

Stairway Partners is an SEC-registered Investment Advisor providing comprehensive investment advice and industry-leading portfolio management solutions. Our firm was created to provide institutions and individual investors with transparent and cost-effective stewardship of their assets. Our sophisticated investment capabilities and a steadfast commitment to the industry’s best practices have allowed us to serve as a valued advisor and trusted fiduciary to clients throughout the United States. For more information, please call (630) 371-2626 or email us at stairwaypartners@stairwaypartners.com.

Global Equity and Currency Commentary

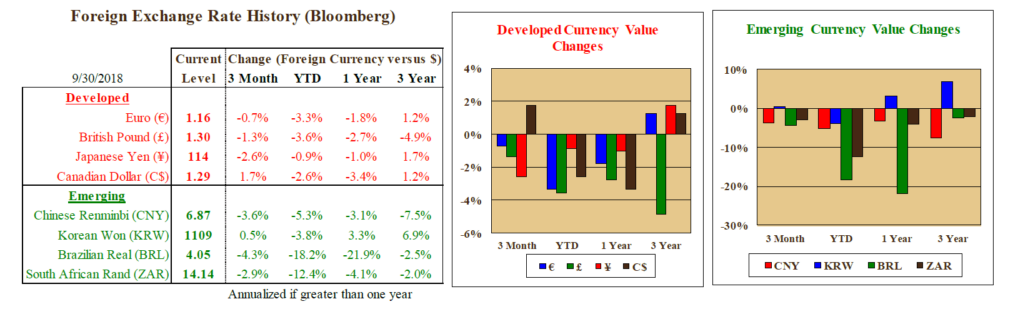

- The US dollar continued on its strengthening trend, which detracted from returns in non-US equity and fixed income investments. While the Federal Reserve has been increasing interest rates and signaling further rate increases over the coming quarters, other central banks have largely been on hold. The more-attractive dollar yields have caused weakness in other currencies.

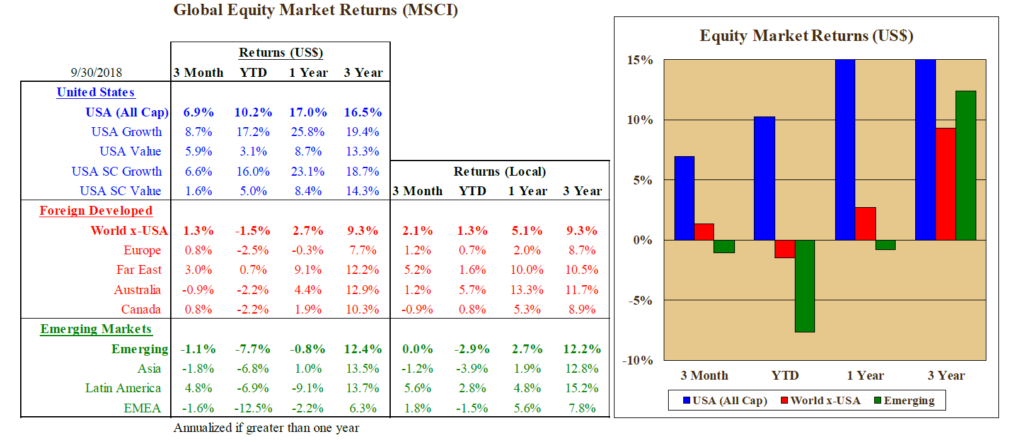

- US equities again outpaced other markets – both developed and emerging- during the third quarter, although the small-cap and value sectors began to weaken during September. The S&P 500 index hit a record high during the quarter as optimism over earnings continued.

- Outside the US, the picture was mixed. Overall, returns in developed markets were positive, despite dollar strength subtracting around a percentage point of gain. In the UK, the stock market suffered yet another poor quarter, as fears of a “no deal” Brexit appeared to gain ground. A small positive return in emerging market equities was turned into a loss by dollar strength. Brazilian equities performed well, due in part to the increasing likelihood of the potentially business-friendly Bolsonaro winning the presidential election.

US Fixed Income and Fed Commentary

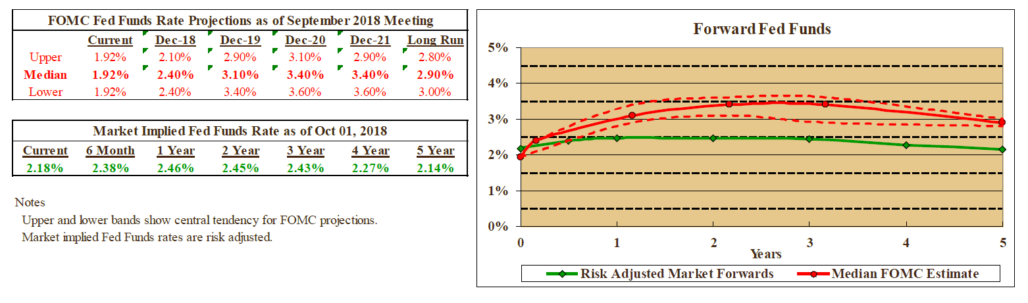

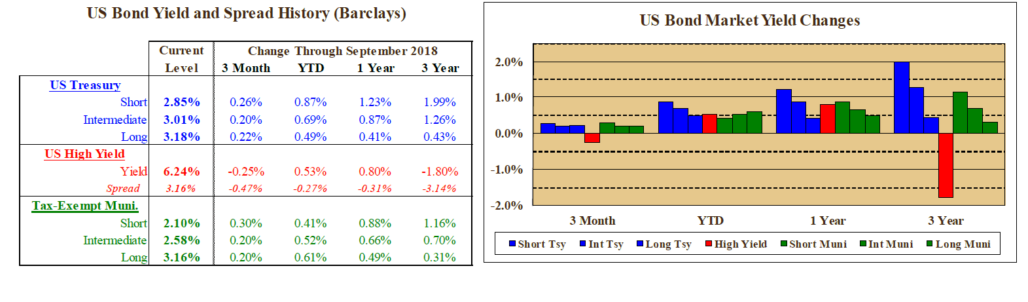

- Poor performance in the US bond market in September wiped out almost all of the decent returns in the first two months of the quarter. During the month, apart from high yield which benefitted from equity market strength, yields rose and returns were negative in essentially every sector and all along the maturity spectrum.

- At their meeting in late September, the Fed raised the policy interest rate another quarter point. This was expected; the surprises were the increase in their “forecast” (from the dot plot) of the policy rate to 3.45% in 2020 and the removal of the “policy remains accommodative” language from their post-meeting statement.

- Emerging markets debt produced good performance during the quarter, although the gains were insufficient to offset the damage experienced earlier in 2018. Investors have seemingly turned less negative on Latin American bonds, as new regimes in Brazil and Mexico could provide a better financial environment than has been in place the last few years.

Stairway Partners, LLC © 2021

This material is based upon information that we believe to be reliable, but no representation is being made that it is accurate or complete, and it should not be relied upon as such. This material is based upon our assumptions, opinions and estimates as of the date the material was prepared. Changes to assumptions, opinions and estimates are subject to change without notice. Past performance is not indicative of future results, and no representation is being made that any returns indicated will be achieved. This material has been prepared for information purposes and does not constitute investment advice. This material does not take into account particular investment objectives or financial situations. Strategies and financial instruments described in this material may not be suitable for all investors. Readers should not act upon the information without seeking professional advice. This material is not a recommendation or an offer or solicitation for the purchase or sale of any security or other financial instrument.

You must be logged in to post a comment.