Global Market and Economic Perspective

Global Economic Commentary

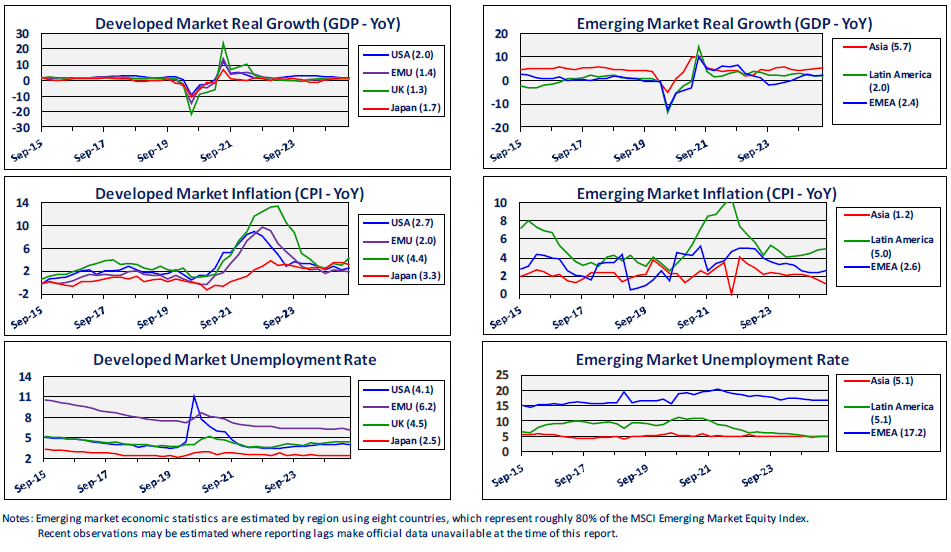

- U.S. real economic growth accelerated in the second quarter, consistent with expectations as the surge in imports in the first quarter was followed by a resumption in domestic production in the second. While negotiations around trade remain ongoing, policy uncertainty has lessened with aggregate U.S.-imposed tariff rates settling into a 15-20% range and tax policy legislation now enacted. Growth above 5% in China also exceeded expectations as Chinese exports remained strong worldwide. All other major economies grew around 1%.

- Inflation remained particularly subdued in Asia emerging markets with central banks cutting policy rates across the region, including China’s central bank reducing both the loan prime rates and reserve requirements in May. The European Central Bank also continued along a steady path of lowering policy rates, cutting twice in the second quarter. In contrast, the U.S. and Japan both left policy rates unchanged, while Brazil hiked multiple times during the quarter.

- Unemployment during the second quarter remained at or near its recent lows in most countries. While the unemployment rate remains just above 4% in the U.S., overall labor market activity (hiring and separations) has been slowing somewhat.

Stairway Partners is an SEC-registered Investment Advisor providing comprehensive investment advice and industry-leading portfolio management solutions. Our firm was created to provide institutions and individual investors with transparent and cost-effective stewardship of their assets. Our sophisticated investment capabilities and a steadfast commitment to the industry’s best practices have allowed us to serve as a valued advisor and trusted fiduciary to clients throughout the United States. For more information, please call (630) 371-2626 or email us at stairwaypartners@stairwaypartners.com.

Global Equity and Currency Commentary

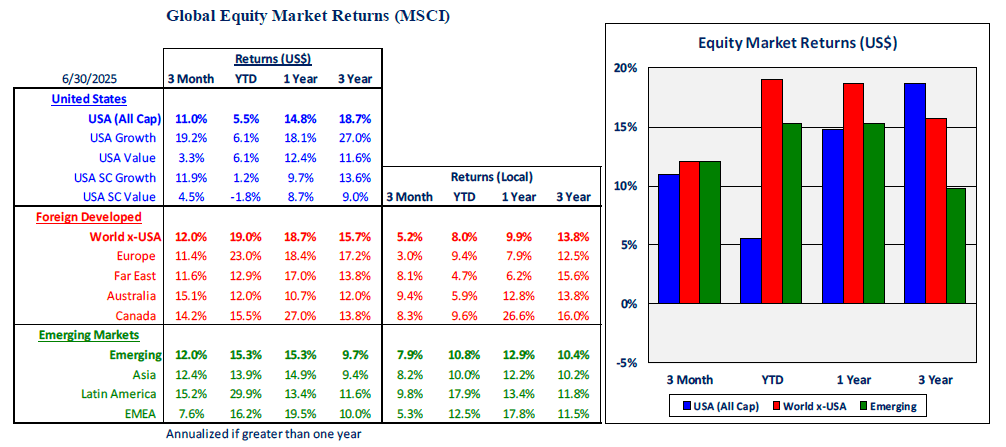

- In the second quarter, global equity markets were marked by a strong, broad-based rally. Within the U.S., growth stocks were led again by a handful of the very largest names that strongly outperformed, bringing first-half performance back in line with value stocks. Small caps continued to modestly underperform on a relative basis as they have for quite some time now.

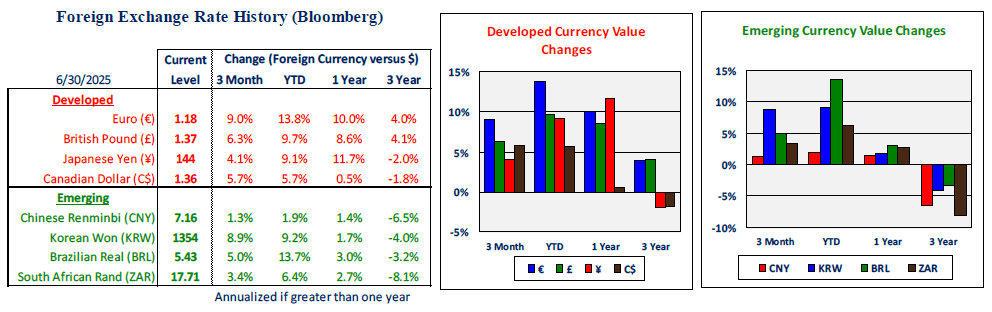

- Non-U.S. equity markets, both developed and emerging, outperformed the U.S. for consecutive quarters. In the second quarter, the outperformance was slight and remained a result of positive local market results coupled with notable dollar weakness across the board relative to foreign currencies.

- The broad-based dollar weakness relative to foreign currencies in the second quarter was accompanied by expectations shifting toward forthcoming lower policy rates in the U.S. into 2026 and lingering uncertainty around future inflation and growth impacts from tariff policy changes.

US Fixed Income and Fed Commentary

- In the second quarter, the yield curve steepened as short-term rates continued to decline while longer term rates increased. The FOMC left the current level of short-term interest rates unchanged as expectations increased for the board to take on a slightly more dovish posture into 2026. At the same time, the passage of the OBBB Act was met with expectations that the trajectory of debt/GDP would increase even further.

- The FOMC’s forecasts shifted toward slower growth and increased inflation after recent tariff and tax policy changes. Thus far, the impact of these changes is not clear and to the extent they have begun to play out so far it has appeared very mild. The Fed projects reducing policy rates toward a neutral posture over the coming 12-24 months and, after holding rates steady in Q2, a cut in Q3 currently appears to be a toss-up.

- While a preponderance of the Treasury yield curve shifted lower leading to gains in high-quality fixed income, tax-exempt municipals performed relatively worse across the maturity spectrum. Credit spreads narrowed meaningfully for the quarter, bringing them back to flat on the year and producing strong returns in corporate bonds.

Stairway Partners, LLC © 2024

This material is based upon information that we believe to be reliable, but no representation is being made that it is accurate or complete, and it should not be relied upon as such. This material is based upon our assumptions, opinions and estimates as of the date the material was prepared. Changes to assumptions, opinions and estimates are subject to change without notice. Past performance is not indicative of future results, and no representation is being made that any returns indicated will be achieved. This material has been prepared for information purposes and does not constitute investment advice. This material does not take into account particular investment objectives or financial situations. Strategies and financial instruments described in this material may not be suitable for all investors. Readers should not act upon the information without seeking professional advice. This material is not a recommendation or an offer or solicitation for the purchase or sale of any security or other financial instrument.

You must be logged in to post a comment.