Global Market and Economic Perspective

Global Economic Commentary

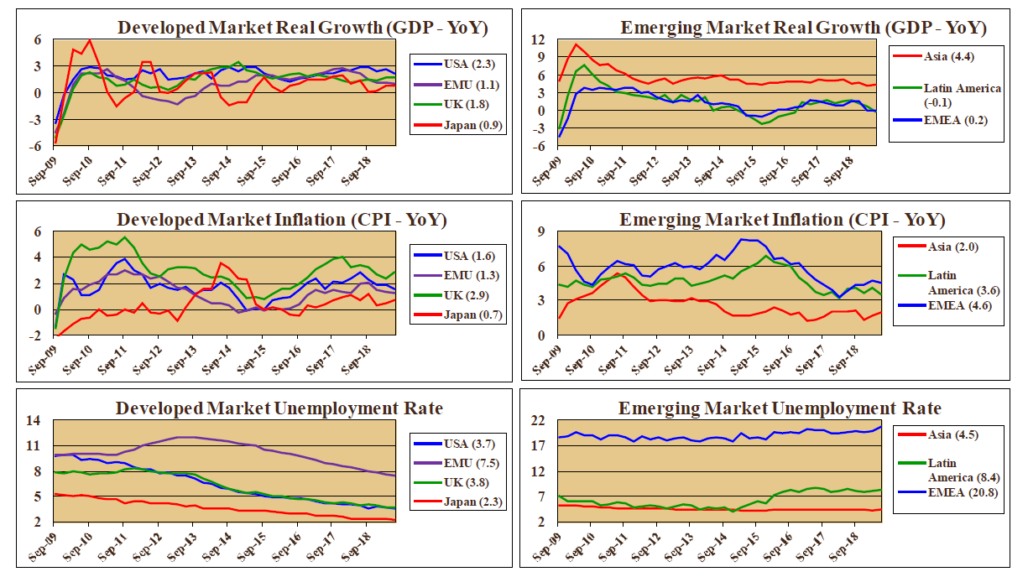

- GDP growth in the US slowed again in the second quarter, although it remained above 2.0%. This slowing can be at least partially attributed to the disappearance of the one-off tax cut stimulus. In addition, agriculture and manufacturing suffered from a lack of progress in settling the trade and tariff conflicts. The labor market continued to show strength, with the unemployment rate around 50-year lows and unfilled job openings running at a high level.

- Growth in other developed countries continued to underperform the US. Europe and Japan seem unable to get their economies growing strongly. And in the UK, Brexit woes worsened, as Boris Johnson was set to take over as Prime Minister on a platform of leaving the EU with or without a deal.

- Emerging market economies also remained soft. The slowdown in trade has had an adverse impact on many countries’ exports, although China’s domestic consumption has picked up.

- Inflation in most countries was subdued. Consumer price inflation in the US, which had been above 2.0% last year, was closer to 1.5% in the second quarter.

Stairway Partners is an SEC-registered Investment Advisor providing comprehensive investment advice and industry-leading portfolio management solutions. Our firm was created to provide institutions and individual investors with transparent and cost-effective stewardship of their assets. Our sophisticated investment capabilities and a steadfast commitment to the industry’s best practices have allowed us to serve as a valued advisor and trusted fiduciary to clients throughout the United States. For more information, please call (630) 371-2626 or email us at stairwaypartners@stairwaypartners.com.

Global Equity and Currency Commentary

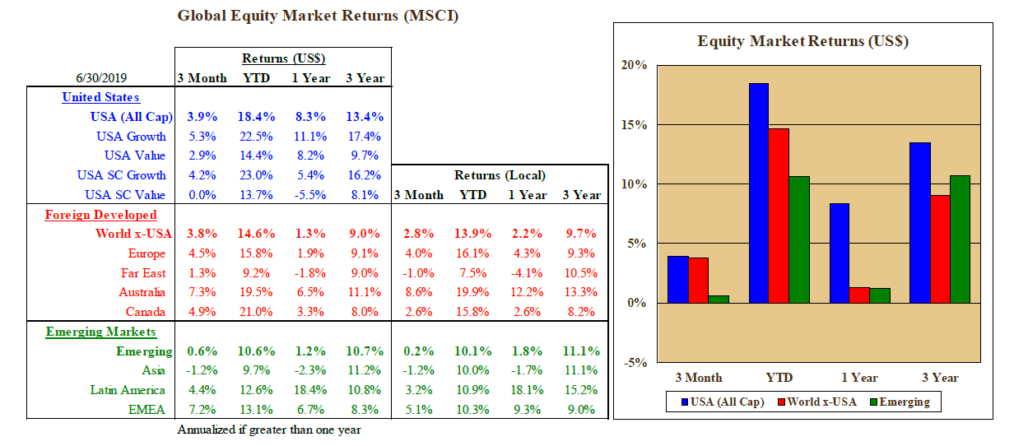

- The second quarter saw US equity market indexes sustain the momentum of the first quarter, leading them to hit all-time highs. This occurred despite signs that the earnings picture was turning weak, particularly for companies generating much of their revenue outside the US. In fact, quarterly earnings growth is expected to turn negative, although we will only know in hindsight if this is correct.

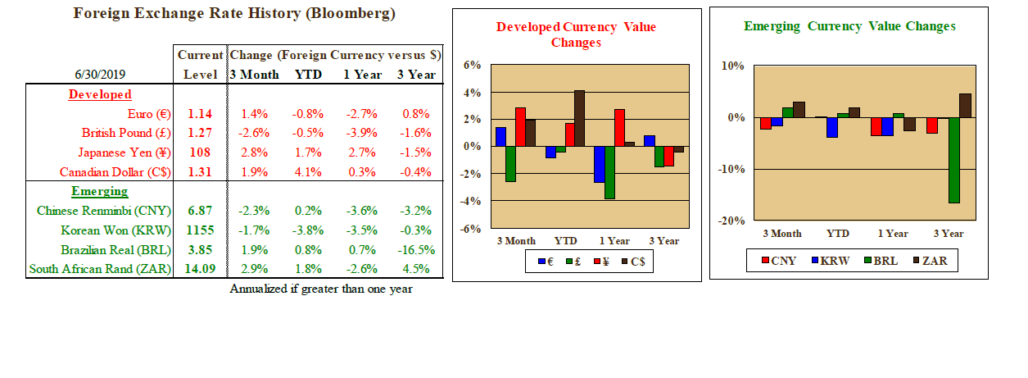

- Given the small amount of weakness in the US dollar against a number of foreign developed-market currencies, the return to US investors in the second quarter from holding developed equities was almost identical to the US market return.

- Equities in Asian emerging markets lagged returns in other emerging markets, as the US-China trade dispute seemed to finally be taking a toll on investor optimism. Non-Asian emerging market currencies strengthened against the US dollar, mirroring developed-market currencies, which modestly improved returns to US investors.

US Fixed Income and Fed Commentary

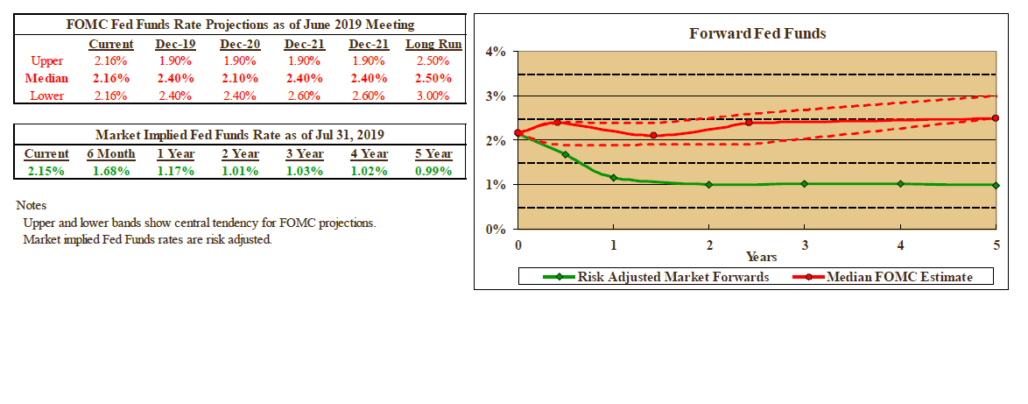

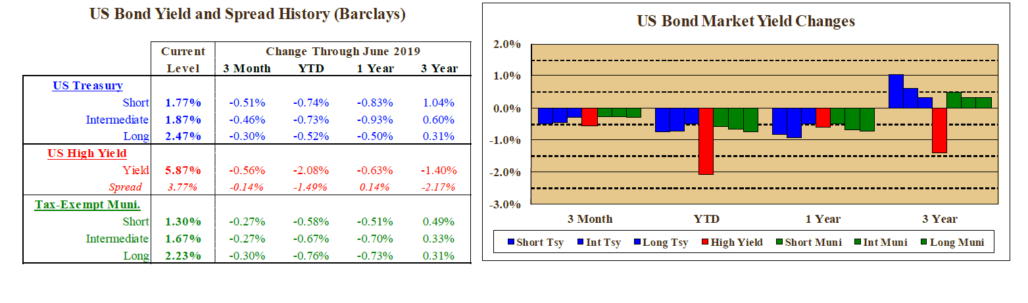

- Despite the fact that economic growth remained moderately positive, inflation was closer to 2.0% than zero, and labor market tightness continued, the Fed signaled that a cut in interest rates could be expected in the second half of 2019. Market participants initially reacted by pricing in a decline in the short-term policy rate by three-quarters of a percentage point (75 basis points). At their end-of-July meeting, the Fed did indeed lower the Fed funds rate by one-quarter of a point.

- As expectations of future interest rate decreases developed, longer-term interest rates fell in tandem. Falling yields resulted in strong returns to fixed income investments, particularly in longer-term bonds.

- With the equity market making new highs, high yield and other credit-sensitive bonds produced good returns. They benefitted from both the decline in the Treasury yield curve and the narrowing of spreads over Treasuries.

Stairway Partners, LLC © 2021

This material is based upon information that we believe to be reliable, but no representation is being made that it is accurate or complete, and it should not be relied upon as such. This material is based upon our assumptions, opinions and estimates as of the date the material was prepared. Changes to assumptions, opinions and estimates are subject to change without notice. Past performance is not indicative of future results, and no representation is being made that any returns indicated will be achieved. This material has been prepared for information purposes and does not constitute investment advice. This material does not take into account particular investment objectives or financial situations. Strategies and financial instruments described in this material may not be suitable for all investors. Readers should not act upon the information without seeking professional advice. This material is not a recommendation or an offer or solicitation for the purchase or sale of any security or other financial instrument.

You must be logged in to post a comment.