Global Market and Economic Perspective

Global Economic Commentary

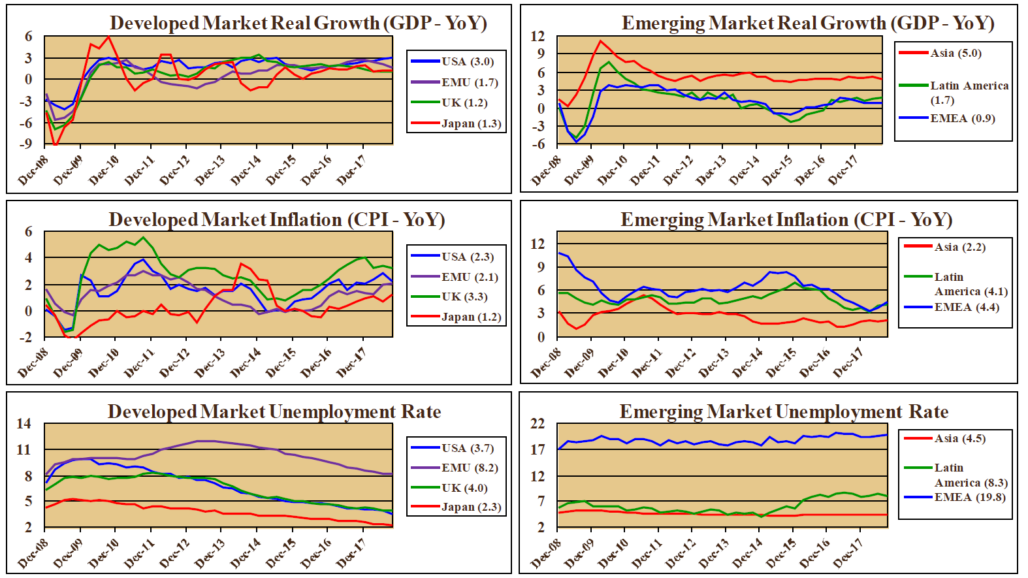

- Normally, we would have the fourth quarter GDP numbers for the US when issuing this report. However, these have not been normal times. The lengthy US government shutdown that began a few days before Christmas has meant delays in releasing economic reports and data, including GDP. Although indications point to continued good economic growth, one dissonant note has been the continued widening trade deficit with China, which may contribute to a moderate slowdown in the coming quarters.

- Outside the US, the continuing uncertainty surrounding Brexit in Britain has led to weak investment spending, slower economic growth, and weakness in the British Pound. Brexit has also weighed on European Union economies, where growth has softened, particularly in Germany. Other conditions in the Euro area, such as unemployment and inflation, remain good.

- In China, the slowing of exports and constrained credit conditions in the shadow banking industry resulted in 2018 showing the lowest full-year GDP growth in nearly 30 years.

Stairway Partners is an SEC-registered Investment Advisor providing comprehensive investment advice and industry-leading portfolio management solutions. Our firm was created to provide institutions and individual investors with transparent and cost-effective stewardship of their assets. Our sophisticated investment capabilities and a steadfast commitment to the industry’s best practices have allowed us to serve as a valued advisor and trusted fiduciary to clients throughout the United States. For more information, please call (630) 371-2626 or email us at stairwaypartners@stairwaypartners.com.

Global Equity and Currency Commentary

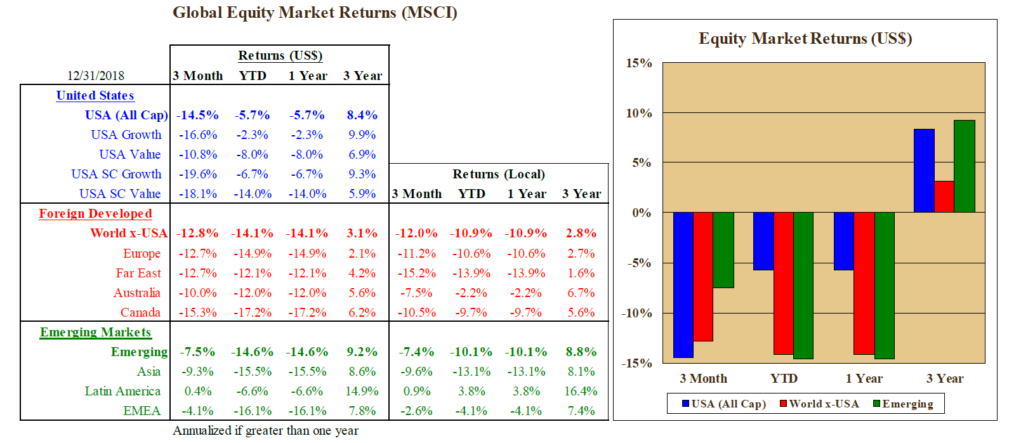

- Most equity markets experienced sharp declines during the fourth quarter. Only a few markets bucked this trend, such as Brazil where the election of business-friendly Jair Bolsonaro as president produced a strong upward move in the stock market. The declines in many Asian stock markets reflected the signs of slowing growth and increased financial difficulty in China.

- US equities had double-digit losses, as investors appeared to become increasingly concerned over the outlook for earnings growth. Expectations for positive earnings growth in 2019 remain; however, the expected growth rate fell due to the effect of the 2018 tax cuts rolling off and to expectations that revenue growth will slow in line with softer economic growth.

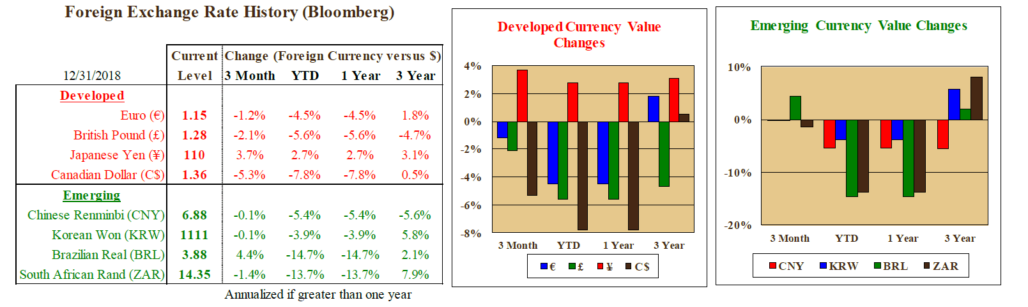

- The fourth quarter saw the US dollar strengthen further against most currencies. As a result, returns in non-US equities were reduced by adverse currency movements.

US Fixed Income and Fed Commentary

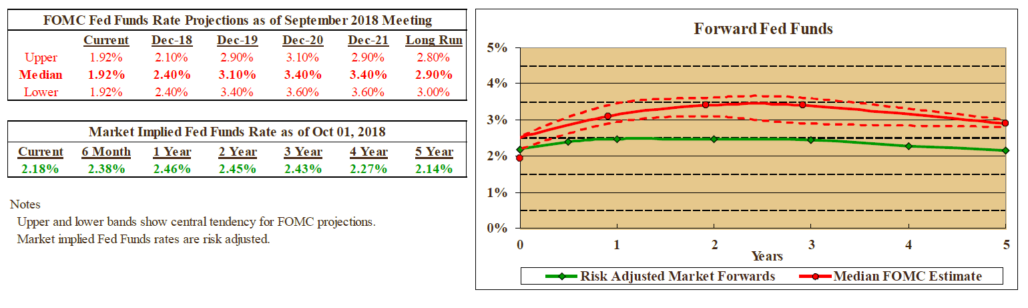

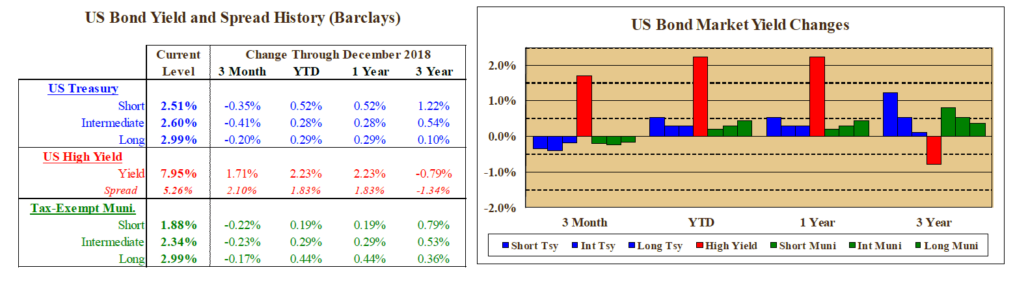

- Treasury bond yields fell in the fourth quarter, as bond market investors became increasingly convinced that the Federal Reserve was turning more dovish and would not be raising interest rates as aggressively as they had expected previously. The change in sentiment hinged on the difference in the Fed’s language from October – when Chairman Powell stated that the policy interest rate was “a long way from neutral…” – to the end of November – when the statement said the rate, at 2.25% to 2.50%, was “just below the broad range of estimates” of their neutral level of 2.50% to 3.50%.

- Contrary to much of the year prior to the quarter, the Treasury yield curve actually steepened. The flattening curve had been raising concerns earlier of an increased probability of recession, because past instances in which long-term yields fell below short-term yields were typically followed by an economic contraction. As a result, when short and intermediate-term rates fell more than long-term rates, this concern was somewhat alleviated.

- Yields in emerging markets bonds and in US high yield bonds rose during the quarter, which meant that these bond markets saw their spreads over Treasury bonds widen substantially. Because these bonds carry a significant credit-risk component, they tend to be sensitive to movements in the equity market. The weakness in equities and concerns over slower earnings growth thus led to credit concerns and higher yields.

Stairway Partners, LLC © 2021

This material is based upon information that we believe to be reliable, but no representation is being made that it is accurate or complete, and it should not be relied upon as such. This material is based upon our assumptions, opinions and estimates as of the date the material was prepared. Changes to assumptions, opinions and estimates are subject to change without notice. Past performance is not indicative of future results, and no representation is being made that any returns indicated will be achieved. This material has been prepared for information purposes and does not constitute investment advice. This material does not take into account particular investment objectives or financial situations. Strategies and financial instruments described in this material may not be suitable for all investors. Readers should not act upon the information without seeking professional advice. This material is not a recommendation or an offer or solicitation for the purchase or sale of any security or other financial instrument.

You must be logged in to post a comment.