Global Market and Economic Perspective

Global Economic Commentary

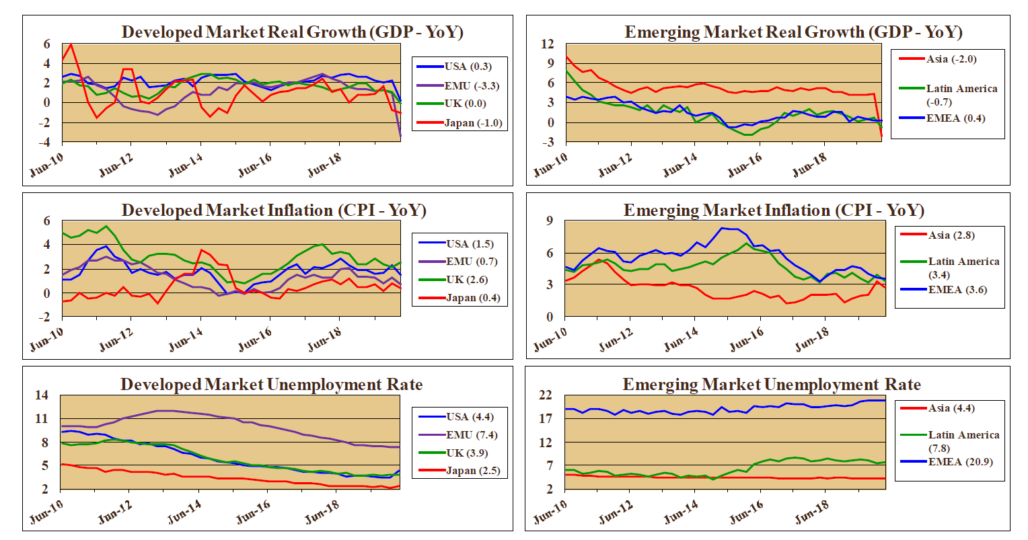

- Although the Coronavirus (COVID-19) began in China in late 2019, its rapid spread and the resulting government lock-down measures to combat the virus did not materially affect the global economy until the end of the first quarter. The true economic impact of COVID-19 will not be seen until second quarter data is available.

- The pandemic caused sharp drops in consumer sentiment and spending. Oil prices also fell substantially due both to severely dampened demand, from the decline in travel, and to a supply glut, from Saudi Arabia’s ill-timed output “war” with Russia.

- In the US, what had been the strongest labor market in 50 years turned quickly into near-depression levels of unemployment. The last two weeks of March saw over 10 million initial claims for unemployment insurance (with another 20+ million initial claims in April).

- To control the virus’ spread and potential for accelerating death rates, many countries (Italy, Spain, UK, US) shut down a wide range of businesses and restricted movement of people. These measures had the biggest effect on travel-related firms (airlines, hotels), group gatherings (sporting events, business meetings, parties/weddings), and “non-essential” service industries that rely on face-to-face interaction (retail, restaurants).

Stairway Partners is an SEC-registered Investment Advisor providing comprehensive investment advice and industry-leading portfolio management solutions. Our firm was created to provide institutions and individual investors with transparent and cost-effective stewardship of their assets. Our sophisticated investment capabilities and a steadfast commitment to the industry’s best practices have allowed us to serve as a valued advisor and trusted fiduciary to clients throughout the United States. For more information, please call (630) 371-2626 or email us at stairwaypartners@stairwaypartners.com.

Global Equity and Currency Commentary

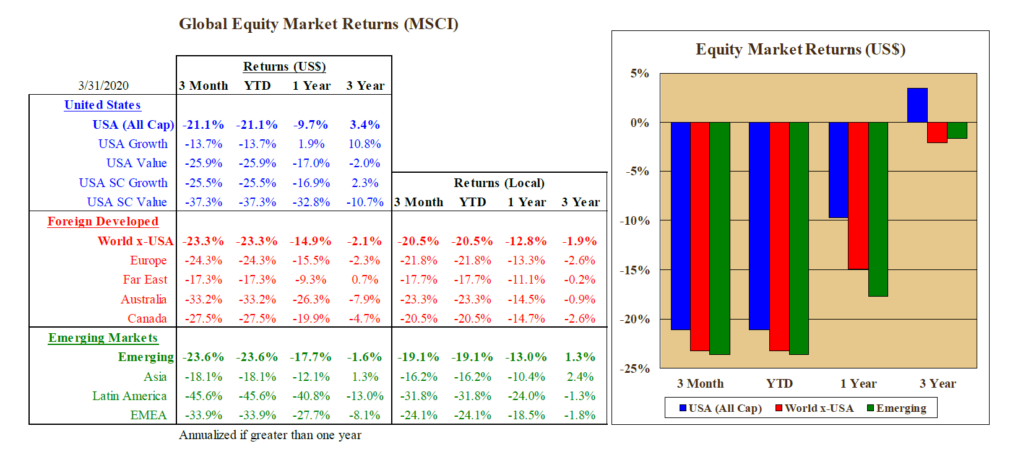

- The rapid darkening of the economic and profits outlook caused equity prices to suffer sharp declines in February and March. Sectors that were hit hard included energy (due to the slump in demand) and financials (as repayments on many loans looked increasingly uncertain).

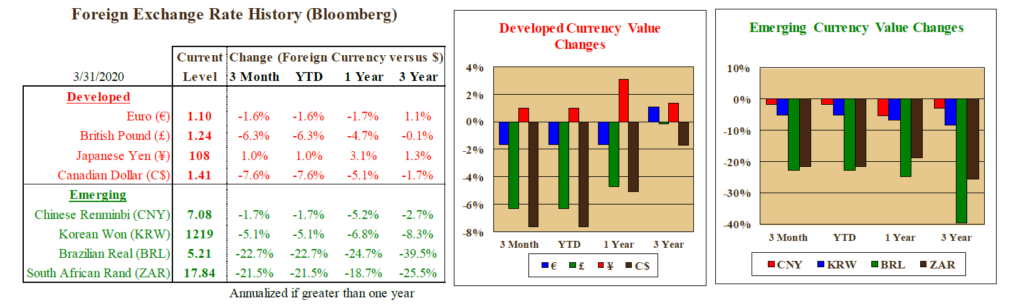

- Outside the US, equity index returns in both developed and emerging markets in their own local currencies were similar to the broad US equity market’s return. However, US dollar strength against other currencies detracted further from non-US equity returns.

- The currencies of commodity exporting countries were especially weak, given the expected declines in industrial production and international trade.

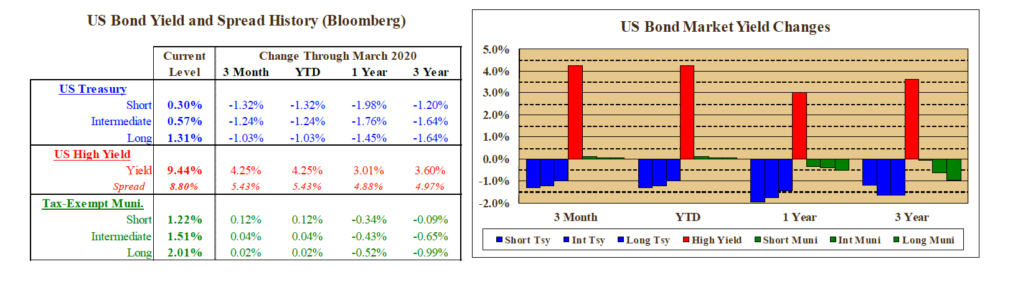

US Fixed Income and Fed Commentary

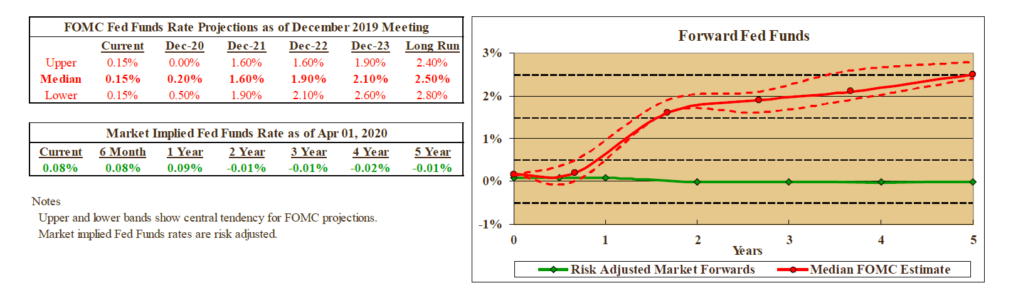

- In response to the developing coronavirus-induced economic calamity, the Federal Reserve cut its policy interest rate target by 1.5% in two unscheduled March meetings. In addition to the historically large and abrupt rate cuts, the Fed also expanded its balance sheet by over $2 trillion by purchasing a wide variety of bonds, in an effort to provide liquidity to public debt markets. Again, the speed and magnitude of the Fed’s purchase program was historically significant. Before the financial crisis in 2008, the Fed’s balance sheet never exceeded $1 trillion. As of the end of April, the total value of the Fed’s balance sheet had grown to over $6.5 trillion.

- Although yields had fallen and prices had risen on Treasury bonds in January and February, the Fed rate cuts were met with a rise in yields in March. Pundits offered several explanations for this abnormal relationship, including fear related to the explosion of federal government borrowing, and selling by leveraged investors and corporations to meet margin calls and raise cash.

- In addition to the rise in Treasury yields, March saw a dramatic widening of credit spreads on both investment-grade and high yield corporate bonds. The equity market decline and expected weakness in profits in many industries drove bond prices and returns sharply lower.

Stairway Partners, LLC © 2021

This material is based upon information that we believe to be reliable, but no representation is being made that it is accurate or complete, and it should not be relied upon as such. This material is based upon our assumptions, opinions and estimates as of the date the material was prepared. Changes to assumptions, opinions and estimates are subject to change without notice. Past performance is not indicative of future results, and no representation is being made that any returns indicated will be achieved. This material has been prepared for information purposes and does not constitute investment advice. This material does not take into account particular investment objectives or financial situations. Strategies and financial instruments described in this material may not be suitable for all investors. Readers should not act upon the information without seeking professional advice. This material is not a recommendation or an offer or solicitation for the purchase or sale of any security or other financial instrument.

You must be logged in to post a comment.