Global Market and Economic Perspective

Global Economic Commentary

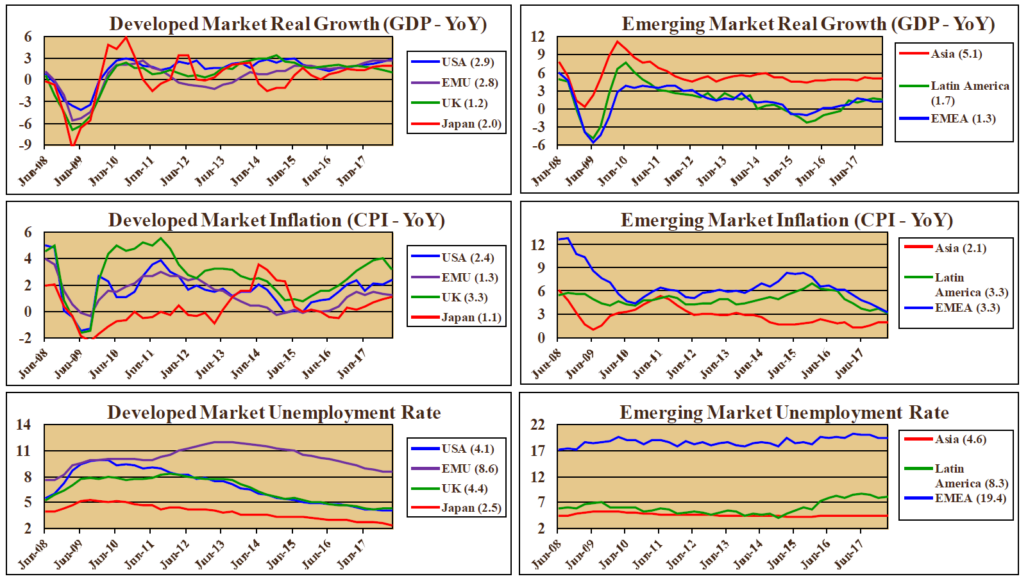

- In the first quarter of 2018, real GDP growth in the US picked up further – to an annual rate of 2.9%. The economic expansion since the recession of ‘08-‘09 is on track to become the second longest in history. Only the 10-year growth span from 1991 to 2001 is longer. Growth in much of Europe has followed a path similar to the US. However, the UK has seen deceleration in its real GDP growth rate, from around 2% for several quarters after the Brexit vote, to 1.2% most recently. Growth in the emerging economies has been good but not great, averaging around 4% for the latest four quarters. Emerging Asian countries had the best real growth in recent quarters.

- The unemployment rate in the US was at its lowest in well over 15 years. The story is similar in Japan, where an aging workforce and negligible immigration have put pressure on the labor market.

- Inflation in the US picked up in the first quarter, driven by the strengthening economy, a weaker dollar, and higher oil prices. Elsewhere, the picture was different, as consumer price inflation mostly remained largely subdued.

Stairway Partners is an SEC-registered Investment Advisor providing comprehensive investment advice and industry-leading portfolio management solutions. Our firm was created to provide institutions and individual investors with transparent and cost-effective stewardship of their assets. Our sophisticated investment capabilities and a steadfast commitment to the industry’s best practices have allowed us to serve as a valued advisor and trusted fiduciary to clients throughout the United States. For more information, please call (630) 371-2626 or email us at stairwaypartners@stairwaypartners.com.

Global Equity and Currency Commentary

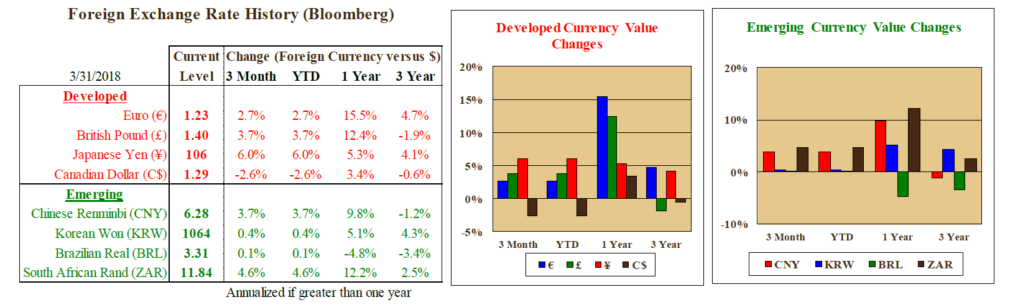

- The US dollar weakened again in the first quarter of 2018. This decline contributed further to the substantial weakening over the latest four quarters against both developed and emerging currencies.

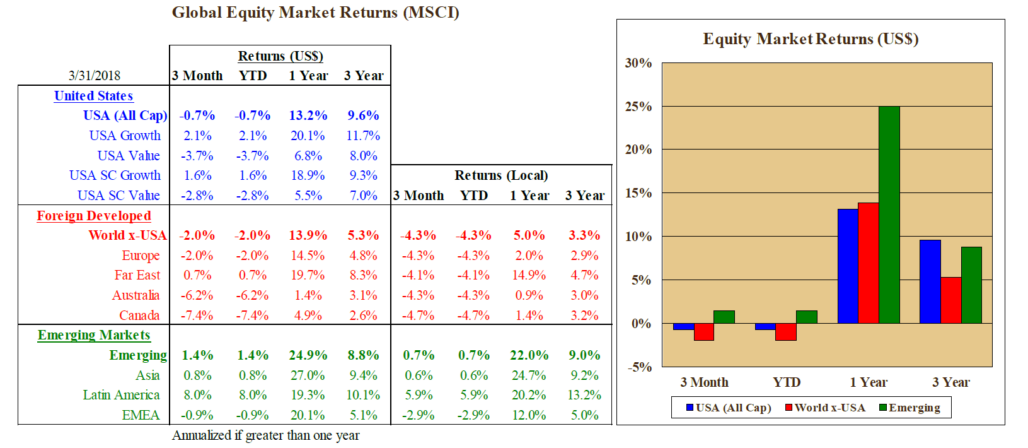

- Developed equity markets, including the US, turned in negative total returns for the first quarter, although the weaker dollar meant that the loss was reduced for US investors. The declines in equity markets were driven largely by investors returning to a more normal assessment of risk. In contrast to the record low levels of volatility in 2017, equity market risk rose toward a more typical range. Earnings in most markets continued to be strong.

- Whereas developed equity markets produced losses, emerging equities provided a small gain in the first quarter. For US investors, this was enhanced further by the weakness in the dollar. Over the last four quarters, emerging markets equities generated a return that was nearly double the return of US equities.

US Fixed Income and Fed Commentary

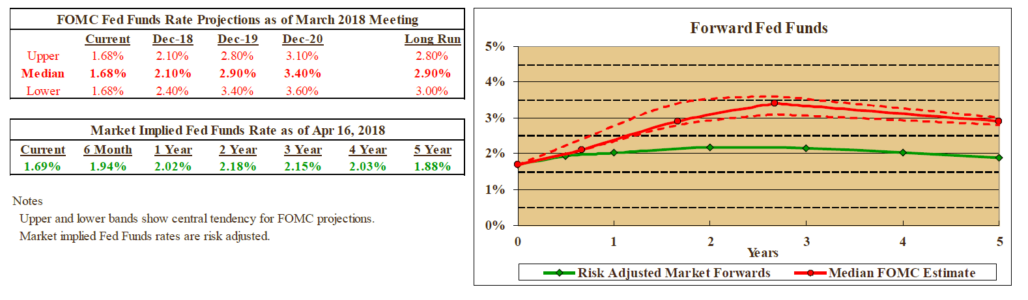

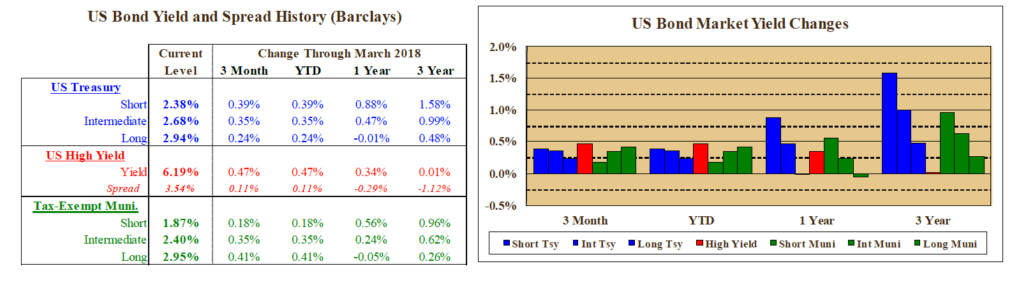

- The US Treasury yield curve continued to flatten in the first quarter. Short rates rose nearly 40 basis points (bps) during the quarter, which brought the one-year increase to nearly 90 bps. This continued rise in short-term interest rates has been driven by the Federal Reserve’s increases in the Fed funds rate. The Fed’s latest hike of 25 bps occurred on March 22.

- Whereas yields on long-term Treasuries actually declined in 2017, this year rates have risen along the entire yield curve. Long Treasury rates ended the first quarter at nearly 3%, and the spread between short-term and long-term rates narrowed to a little more than half of a percentage point.

- We believe that market participants continue to underestimate future Fed rate hikes. This behavior – discounting the Fed’s own published forecasts of what they foresee doing – has been exhibited for several years now. The Fed funds rate that is implied by futures contracts has been consistently below the Fed’s forecast (and Stairway Partners’ forecast), which has driven much of the yield curve flattening.

Stairway Partners, LLC © 2021

This material is based upon information that we believe to be reliable, but no representation is being made that it is accurate or complete, and it should not be relied upon as such. This material is based upon our assumptions, opinions and estimates as of the date the material was prepared. Changes to assumptions, opinions and estimates are subject to change without notice. Past performance is not indicative of future results, and no representation is being made that any returns indicated will be achieved. This material has been prepared for information purposes and does not constitute investment advice. This material does not take into account particular investment objectives or financial situations. Strategies and financial instruments described in this material may not be suitable for all investors. Readers should not act upon the information without seeking professional advice. This material is not a recommendation or an offer or solicitation for the purchase or sale of any security or other financial instrument.

You must be logged in to post a comment.